- China

- /

- Auto Components

- /

- SHSE:603178

What You Can Learn From Ningbo Shenglong Automotive Powertrain System Co.,Ltd.'s (SHSE:603178) P/SAfter Its 30% Share Price Crash

Ningbo Shenglong Automotive Powertrain System Co.,Ltd. (SHSE:603178) shareholders that were waiting for something to happen have been dealt a blow with a 30% share price drop in the last month. The good news is that in the last year, the stock has shone bright like a diamond, gaining 164%.

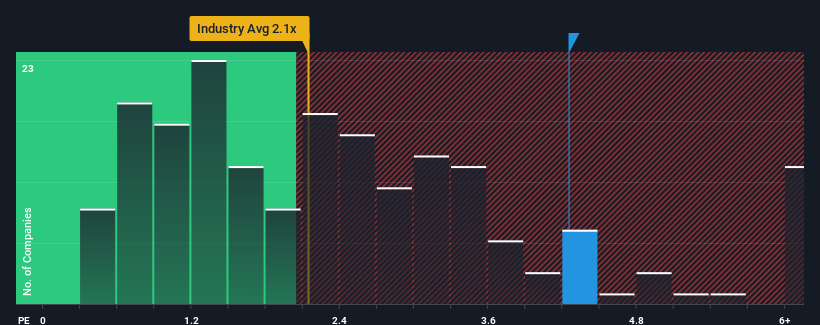

In spite of the heavy fall in price, you could still be forgiven for thinking Ningbo Shenglong Automotive Powertrain SystemLtd is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 4.3x, considering almost half the companies in China's Auto Components industry have P/S ratios below 2.1x. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Ningbo Shenglong Automotive Powertrain SystemLtd

What Does Ningbo Shenglong Automotive Powertrain SystemLtd's Recent Performance Look Like?

Ningbo Shenglong Automotive Powertrain SystemLtd could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. Perhaps the market is expecting the poor revenue to reverse, justifying it's current high P/S.. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Keen to find out how analysts think Ningbo Shenglong Automotive Powertrain SystemLtd's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The High P/S?

In order to justify its P/S ratio, Ningbo Shenglong Automotive Powertrain SystemLtd would need to produce outstanding growth that's well in excess of the industry.

Retrospectively, the last year delivered a frustrating 6.5% decrease to the company's top line. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 17% in total. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Looking ahead now, revenue is anticipated to climb by 38% during the coming year according to the one analyst following the company. With the industry only predicted to deliver 25%, the company is positioned for a stronger revenue result.

With this in mind, it's not hard to understand why Ningbo Shenglong Automotive Powertrain SystemLtd's P/S is high relative to its industry peers. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Final Word

A significant share price dive has done very little to deflate Ningbo Shenglong Automotive Powertrain SystemLtd's very lofty P/S. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our look into Ningbo Shenglong Automotive Powertrain SystemLtd shows that its P/S ratio remains high on the merit of its strong future revenues. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. It's hard to see the share price falling strongly in the near future under these circumstances.

And what about other risks? Every company has them, and we've spotted 2 warning signs for Ningbo Shenglong Automotive Powertrain SystemLtd you should know about.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Ningbo Shenglong Automotive Powertrain SystemLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603178

Ningbo Shenglong Automotive Powertrain SystemLtd

Ningbo Shenglong Automotive Powertrain System Co.,Ltd.

Adequate balance sheet and slightly overvalued.

Market Insights

Community Narratives