- China

- /

- Auto Components

- /

- SHSE:603085

Shareholders Will Be Pleased With The Quality of Zhejiang Tiancheng Controls' (SHSE:603085) Earnings

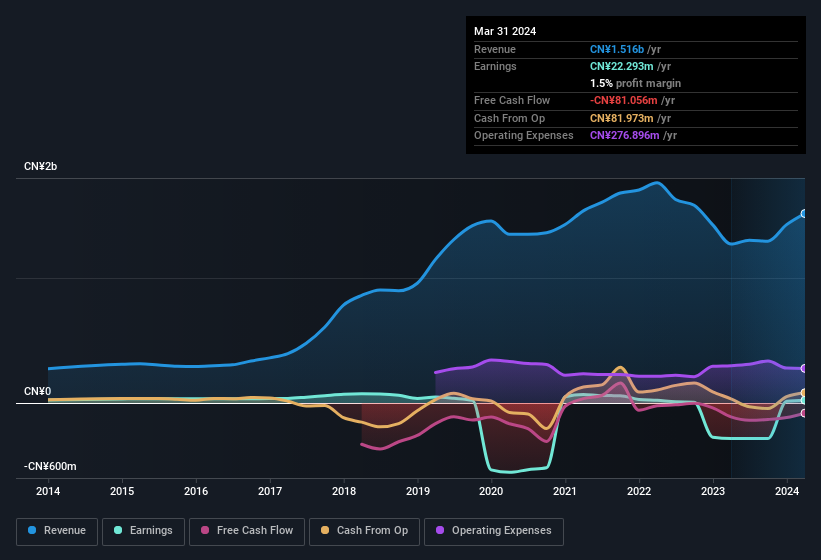

The subdued stock price reaction suggests that Zhejiang Tiancheng Controls Co., Ltd.'s (SHSE:603085) strong earnings didn't offer any surprises. Investors are probably missing some underlying factors which are encouraging for the future of the company.

View our latest analysis for Zhejiang Tiancheng Controls

The Impact Of Unusual Items On Profit

For anyone who wants to understand Zhejiang Tiancheng Controls' profit beyond the statutory numbers, it's important to note that during the last twelve months statutory profit was reduced by CN¥19m due to unusual items. While deductions due to unusual items are disappointing in the first instance, there is a silver lining. We looked at thousands of listed companies and found that unusual items are very often one-off in nature. And, after all, that's exactly what the accounting terminology implies. In the twelve months to March 2024, Zhejiang Tiancheng Controls had a big unusual items expense. All else being equal, this would likely have the effect of making the statutory profit look worse than its underlying earnings power.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Zhejiang Tiancheng Controls.

An Unusual Tax Situation

Having already discussed the impact of the unusual items, we should also note that Zhejiang Tiancheng Controls received a tax benefit of CN¥4.3m. It's always a bit noteworthy when a company is paid by the tax man, rather than paying the tax man. Of course, prima facie it's great to receive a tax benefit. And since it previously lost money, it may well simply indicate the realisation of past tax losses. However, our data indicates that tax benefits can temporarily boost statutory profit in the year it is booked, but subsequently profit may fall back. In the likely event the tax benefit is not repeated, we'd expect to see its statutory profit levels drop, at least in the absence of strong growth.

Our Take On Zhejiang Tiancheng Controls' Profit Performance

In the last year Zhejiang Tiancheng Controls received a tax benefit, which boosted its profit in a way that might not be much more sustainable than turning prime farmland into gas fields. But on the other hand, it also saw an unusual item depress its profit. Considering all the aforementioned, we'd venture that Zhejiang Tiancheng Controls' profit result is a pretty good guide to its true profitability, albeit a bit on the conservative side. In light of this, if you'd like to do more analysis on the company, it's vital to be informed of the risks involved. Every company has risks, and we've spotted 2 warning signs for Zhejiang Tiancheng Controls you should know about.

In this article we've looked at a number of factors that can impair the utility of profit numbers, as a guide to a business. But there is always more to discover if you are capable of focussing your mind on minutiae. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Zhejiang Tenchen Controls might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603085

Zhejiang Tenchen Controls

Engages in the research, development, production, sale, and service of automobile seats in China, the United Kingdom, and internationally.

Undervalued with high growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Automotive Electronics Manufacturer Consistent and Stable

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion