- China

- /

- Auto Components

- /

- SHSE:603085

Despite lower earnings than three years ago, Zhejiang Tiancheng Controls (SHSE:603085) investors are up 22% since then

One simple way to benefit from the stock market is to buy an index fund. But many of us dare to dream of bigger returns, and build a portfolio ourselves. For example, Zhejiang Tiancheng Controls Co., Ltd. (SHSE:603085) shareholders have seen the share price rise 22% over three years, well in excess of the market decline (19%, not including dividends).

While this past week has detracted from the company's three-year return, let's look at the recent trends of the underlying business and see if the gains have been in alignment.

Check out our latest analysis for Zhejiang Tiancheng Controls

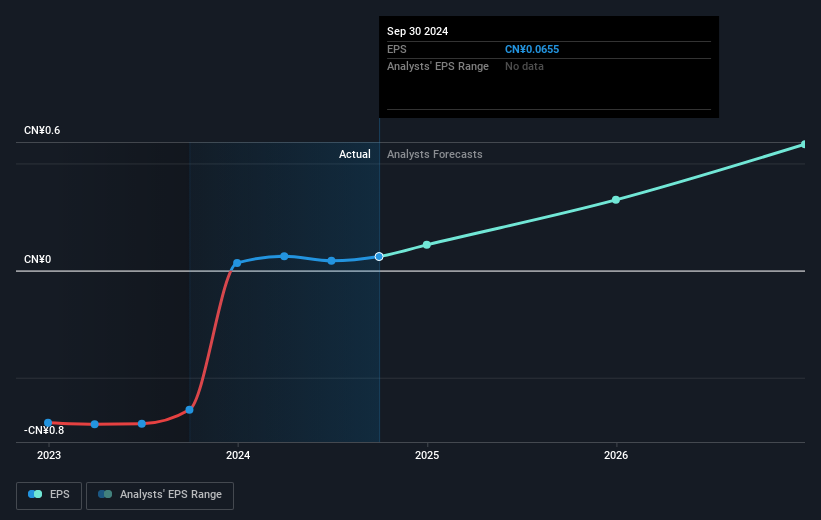

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Zhejiang Tiancheng Controls became profitable within the last three years. So we would expect a higher share price over the period.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

We know that Zhejiang Tiancheng Controls has improved its bottom line lately, but is it going to grow revenue? You could check out this free report showing analyst revenue forecasts.

A Different Perspective

While the broader market gained around 12% in the last year, Zhejiang Tiancheng Controls shareholders lost 2.8%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. On the bright side, long term shareholders have made money, with a gain of 3% per year over half a decade. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. It's always interesting to track share price performance over the longer term. But to understand Zhejiang Tiancheng Controls better, we need to consider many other factors. Consider risks, for instance. Every company has them, and we've spotted 1 warning sign for Zhejiang Tiancheng Controls you should know about.

For those who like to find winning investments this free list of undervalued companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Tiancheng Controls might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603085

Zhejiang Tiancheng Controls

Engages in the research, development, production, sale, and service of automobile seats in China and internationally.

Undervalued with high growth potential.

Similar Companies

Market Insights

Community Narratives