- China

- /

- Electronic Equipment and Components

- /

- SZSE:002979

Three Undiscovered Gems In Asia To Enhance Your Portfolio

Reviewed by Simply Wall St

As global markets experience fluctuations, with key indices like the S&P 500 and Nasdaq Composite reaching record highs amid easing trade tensions, investors are increasingly looking towards Asia for potential opportunities. In this dynamic environment, small-cap stocks in Asia offer intriguing possibilities for portfolio enhancement, characterized by their growth potential and ability to capitalize on regional economic developments.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Argosy Research | NA | 6.09% | 11.72% | ★★★★★★ |

| Sinopower Semiconductor | NA | 1.45% | -4.33% | ★★★★★★ |

| Zhejiang Sling Automobile Bearing | NA | 6.76% | 24.26% | ★★★★★★ |

| Yibin City Commercial Bank | 136.61% | 11.29% | 20.39% | ★★★★★★ |

| ShenZhen Click TechnologyLTD | 4.03% | 31.94% | 12.56% | ★★★★★☆ |

| Guangdong Transtek Medical Electronics | 18.14% | -7.58% | -3.26% | ★★★★★☆ |

| Daoming Optics&ChemicalLtd | 33.83% | 1.38% | 5.82% | ★★★★★☆ |

| DorightLtd | 5.31% | 15.47% | 9.44% | ★★★★★☆ |

| Uniplus Electronics | 32.17% | 46.30% | 75.33% | ★★★★★☆ |

| Palasino Holdings | 9.75% | 10.88% | -14.54% | ★★★★★☆ |

Underneath we present a selection of stocks filtered out by our screen.

Shanghai Beite Technology (SHSE:603009)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Shanghai Beite Technology Co., Ltd. operates in the chassis parts, lightweight aluminum alloy, and air-conditioning compressor sectors in China, with a market capitalization of CN¥14.12 billion.

Operations: Shanghai Beite Technology derives its revenue primarily from the chassis parts, lightweight aluminum alloy, and air-conditioning compressor sectors in China. The company has a market capitalization of CN¥14.12 billion.

Shanghai Beite Technology has shown promising growth, with earnings jumping 26.9% last year, outpacing the Auto Components industry's 4.7%. Despite a high net debt to equity ratio of 41.1%, its interest payments are comfortably covered by EBIT at 4.3 times coverage, reflecting solid financial management. The company reported Q1 sales of CNY 542 million and net income of CNY 23 million, up from CNY 490 million and CNY 16 million respectively a year ago. While its share price has been volatile recently, the forecasted annual earnings growth rate of over 42% suggests strong potential ahead.

Shanghai Haoyuan Chemexpress (SHSE:688131)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Shanghai Haoyuan Chemexpress Co., Ltd. engages in the research, development, and manufacturing of pharmaceutical intermediates and small molecule drugs with a market capitalization of CN¥10.20 billion.

Operations: The company generates revenue primarily from the sale of pharmaceutical intermediates and small molecule drugs. A notable financial metric is its gross profit margin, which stands at 42.5%.

Shanghai Haoyuan Chemexpress, a nimble player in the life sciences sector, has shown impressive financial strides with earnings surging 152% over the last year. Despite a debt to equity ratio climbing from 8.6% to 60.4% over five years, its interest payments are well covered by EBIT at 9.4 times coverage, indicating robust financial health. The company's revenue for Q1 2025 hit CNY 606 million versus CNY 505 million previously, while net income soared to CNY 62 million from CNY 17 million a year prior. With a P/E ratio of 41x below industry average and high-quality earnings, it's poised for continued growth amidst market volatility.

China Leadshine Technology (SZSE:002979)

Simply Wall St Value Rating: ★★★★★☆

Overview: China Leadshine Technology Co., Ltd. specializes in designing, manufacturing, and selling motion control equipment and components in China, with a market cap of CN¥13.84 billion.

Operations: Leadshine generates revenue primarily from the sale of motion control equipment and components. The company's cost structure includes expenses related to manufacturing and distribution, which influence its financial performance.

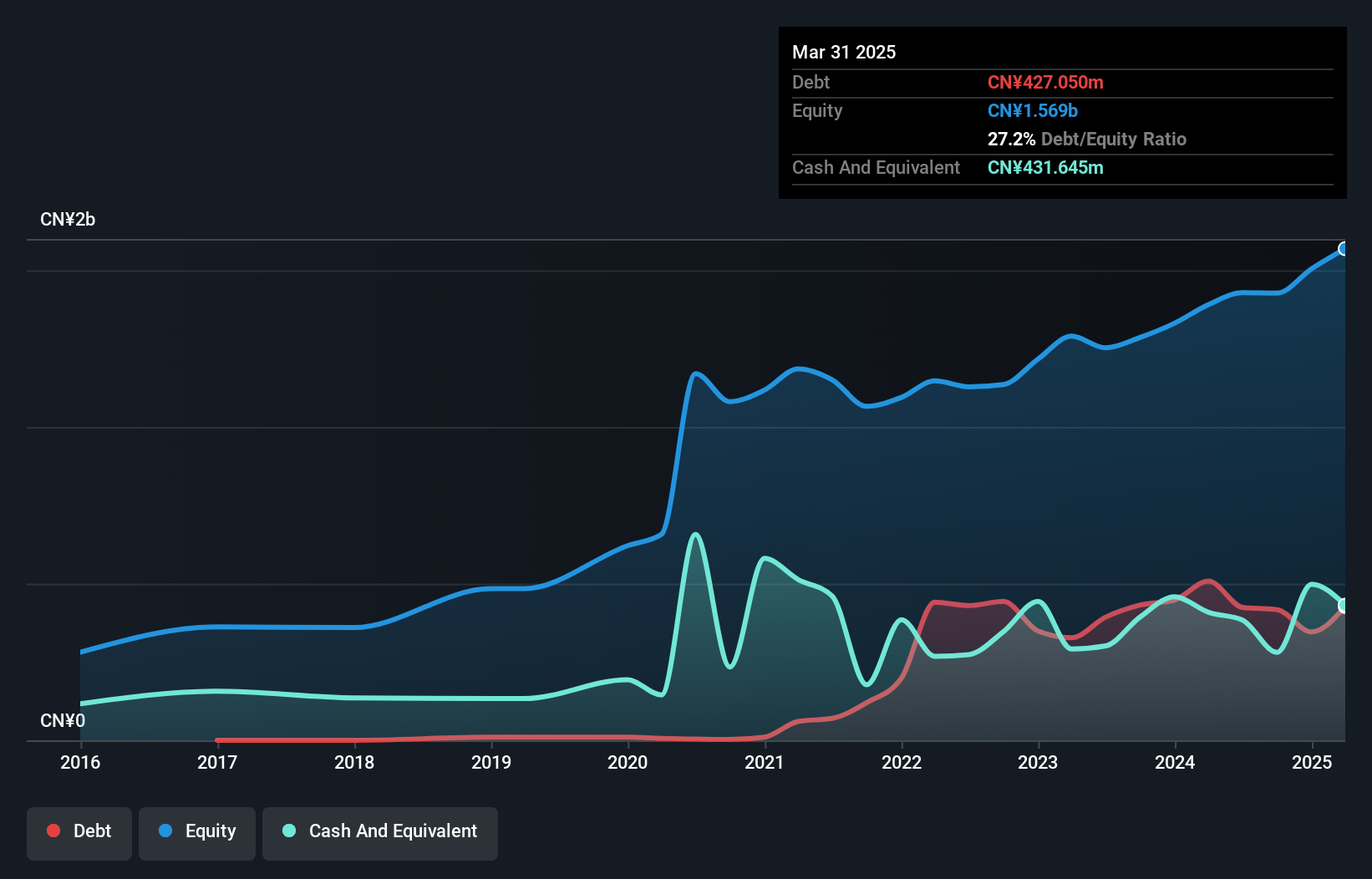

Leadshine Technology, a promising player in the electronics sector, has demonstrated robust financial health with earnings growing 28% over the past year, outpacing the industry average of 2.8%. The company reported net income of CNY 200 million for 2024, a notable increase from CNY 139 million in the previous year. Despite an increased debt-to-equity ratio from 0.9% to 27.2% over five years, it maintains more cash than total debt and trades at a considerable discount to its estimated fair value by about 77%. Recent strategic moves include dividend increases and consideration of stock incentive plans for future growth initiatives.

- Take a closer look at China Leadshine Technology's potential here in our health report.

Learn about China Leadshine Technology's historical performance.

Turning Ideas Into Actions

- Reveal the 2614 hidden gems among our Asian Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002979

China Leadshine Technology

Designs, manufactures, and sells motion control equipment and components in China.

High growth potential with solid track record.

Market Insights

Community Narratives