- China

- /

- Auto Components

- /

- SHSE:601689

After Leaping 37% Ningbo Tuopu Group Co.,Ltd. (SHSE:601689) Shares Are Not Flying Under The Radar

Ningbo Tuopu Group Co.,Ltd. (SHSE:601689) shareholders would be excited to see that the share price has had a great month, posting a 37% gain and recovering from prior weakness. But the gains over the last month weren't enough to make shareholders whole, as the share price is still down 9.5% in the last twelve months.

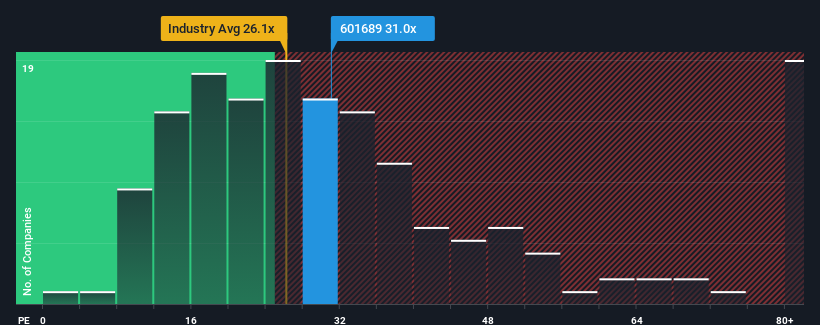

In spite of the firm bounce in price, you could still be forgiven for feeling indifferent about Ningbo Tuopu GroupLtd's P/E ratio of 31x, since the median price-to-earnings (or "P/E") ratio in China is also close to 30x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

With its earnings growth in positive territory compared to the declining earnings of most other companies, Ningbo Tuopu GroupLtd has been doing quite well of late. It might be that many expect the strong earnings performance to deteriorate like the rest, which has kept the P/E from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

View our latest analysis for Ningbo Tuopu GroupLtd

How Is Ningbo Tuopu GroupLtd's Growth Trending?

There's an inherent assumption that a company should be matching the market for P/E ratios like Ningbo Tuopu GroupLtd's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 21% gain to the company's bottom line. The strong recent performance means it was also able to grow EPS by 161% in total over the last three years. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to climb by 21% each year during the coming three years according to the analysts following the company. That's shaping up to be similar to the 19% per annum growth forecast for the broader market.

In light of this, it's understandable that Ningbo Tuopu GroupLtd's P/E sits in line with the majority of other companies. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

What We Can Learn From Ningbo Tuopu GroupLtd's P/E?

Ningbo Tuopu GroupLtd appears to be back in favour with a solid price jump getting its P/E back in line with most other companies. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Ningbo Tuopu GroupLtd maintains its moderate P/E off the back of its forecast growth being in line with the wider market, as expected. Right now shareholders are comfortable with the P/E as they are quite confident future earnings won't throw up any surprises. It's hard to see the share price moving strongly in either direction in the near future under these circumstances.

Having said that, be aware Ningbo Tuopu GroupLtd is showing 2 warning signs in our investment analysis, you should know about.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Ningbo Tuopu GroupLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:601689

Ningbo Tuopu GroupLtd

Engages in the research and development, production, and sale of auto parts in China and internationally.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives