- China

- /

- Auto Components

- /

- SHSE:600741

HUAYU Automotive Systems Company Limited's (SHSE:600741) Low P/E No Reason For Excitement

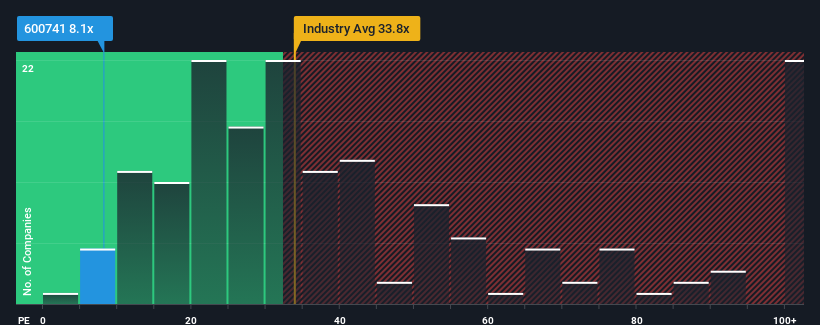

When close to half the companies in China have price-to-earnings ratios (or "P/E's") above 36x, you may consider HUAYU Automotive Systems Company Limited (SHSE:600741) as a highly attractive investment with its 8.1x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

The recently shrinking earnings for HUAYU Automotive Systems have been in line with the market. One possibility is that the P/E is low because investors think the company's earnings may begin to slide even faster. If you still like the company, you'd want its earnings trajectory to turn around before making any decisions. In saying that, existing shareholders may feel hopeful about the share price if the company's earnings continue tracking the market.

See our latest analysis for HUAYU Automotive Systems

Is There Any Growth For HUAYU Automotive Systems?

There's an inherent assumption that a company should far underperform the market for P/E ratios like HUAYU Automotive Systems' to be considered reasonable.

Retrospectively, the last year delivered a frustrating 1.7% decrease to the company's bottom line. At least EPS has managed not to go completely backwards from three years ago in aggregate, thanks to the earlier period of growth. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

Shifting to the future, estimates from the analysts covering the company suggest earnings growth is heading into negative territory, declining 14% per annum over the next three years. That's not great when the rest of the market is expected to grow by 20% per annum.

With this information, we are not surprised that HUAYU Automotive Systems is trading at a P/E lower than the market. However, shrinking earnings are unlikely to lead to a stable P/E over the longer term. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

The Bottom Line On HUAYU Automotive Systems' P/E

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

As we suspected, our examination of HUAYU Automotive Systems' analyst forecasts revealed that its outlook for shrinking earnings is contributing to its low P/E. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for HUAYU Automotive Systems that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if HUAYU Automotive Systems might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600741

HUAYU Automotive Systems

Researches and develops, manufactures, and sells automotive parts worldwide.

Flawless balance sheet 6 star dividend payer.

Similar Companies

Market Insights

Community Narratives