- Japan

- /

- Specialty Stores

- /

- TSE:8214

Undiscovered Gems In Asia To Explore This May 2025

Reviewed by Simply Wall St

As global markets navigate a landscape marked by easing trade tensions and mixed economic signals, small-cap stocks in Asia present intriguing opportunities for investors seeking growth potential amid a backdrop of cautious optimism. With the S&P MidCap 400 and Russell 2000 indices showing resilience, identifying stocks with strong fundamentals and strategic positioning could be key to uncovering hidden gems in this dynamic region.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Standard Foods | 3.13% | -4.13% | -23.84% | ★★★★★★ |

| Imuraya Group | 11.51% | 3.86% | 33.46% | ★★★★★★ |

| Shanghai Chlor-Alkali Chemical | 4.84% | 8.02% | -0.91% | ★★★★★★ |

| Shenzhen iN-Cube Automation | NA | 1.75% | -15.44% | ★★★★★★ |

| Pan Asian Microvent Tech (Jiangsu) | 23.44% | 15.19% | 13.48% | ★★★★★★ |

| CMC | 1.28% | 2.43% | 10.81% | ★★★★★☆ |

| AJIS | 0.78% | 2.14% | -13.06% | ★★★★★☆ |

| Guangdong Transtek Medical Electronics | 18.69% | -7.58% | -3.26% | ★★★★★☆ |

| Qingdao CHOHO IndustrialLtd | 39.70% | 14.43% | 7.86% | ★★★★★☆ |

| Suzhou Sepax Technologies | 4.44% | 21.44% | 34.83% | ★★★★★☆ |

Here we highlight a subset of our preferred stocks from the screener.

Hunan Tyen MachineryLtd (SHSE:600698)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Hunan Tyen Machinery Co., Ltd specializes in the development, design, production, and sales of engine parts in China with a market capitalization of CN¥5.74 billion.

Operations: Hunan Tyen Machinery generates revenue primarily from the sale of engine parts. The company's net profit margin stands at 3.5%, reflecting its ability to convert sales into actual profit after accounting for all expenses.

Hunan Tyen, a relatively small player in the auto components sector, has shown impressive earnings growth of 55.3% over the past year, outpacing the industry's 6.4%. The company's debt to equity ratio significantly improved from 4.1 to 0.1 over five years, indicating better financial health. However, recent results revealed a net income of CN¥0.88 million for Q1 2025 on sales of CN¥110.69 million, with basic earnings per share at CN¥0.0008—an improvement from last year's figures but still modest overall due to large one-off gains impacting results by CN¥25.5 million in March 2025.

- Unlock comprehensive insights into our analysis of Hunan Tyen MachineryLtd stock in this health report.

Evaluate Hunan Tyen MachineryLtd's historical performance by accessing our past performance report.

Xiamen Kingdomway Group (SZSE:002626)

Simply Wall St Value Rating: ★★★★★★

Overview: Xiamen Kingdomway Group Company focuses on the manufacturing and sale of nutrition and health products both in China and internationally, with a market cap of CN¥10.45 billion.

Operations: The company generates revenue primarily from the manufacturing and sale of nutrition and health products. It operates both in domestic and international markets.

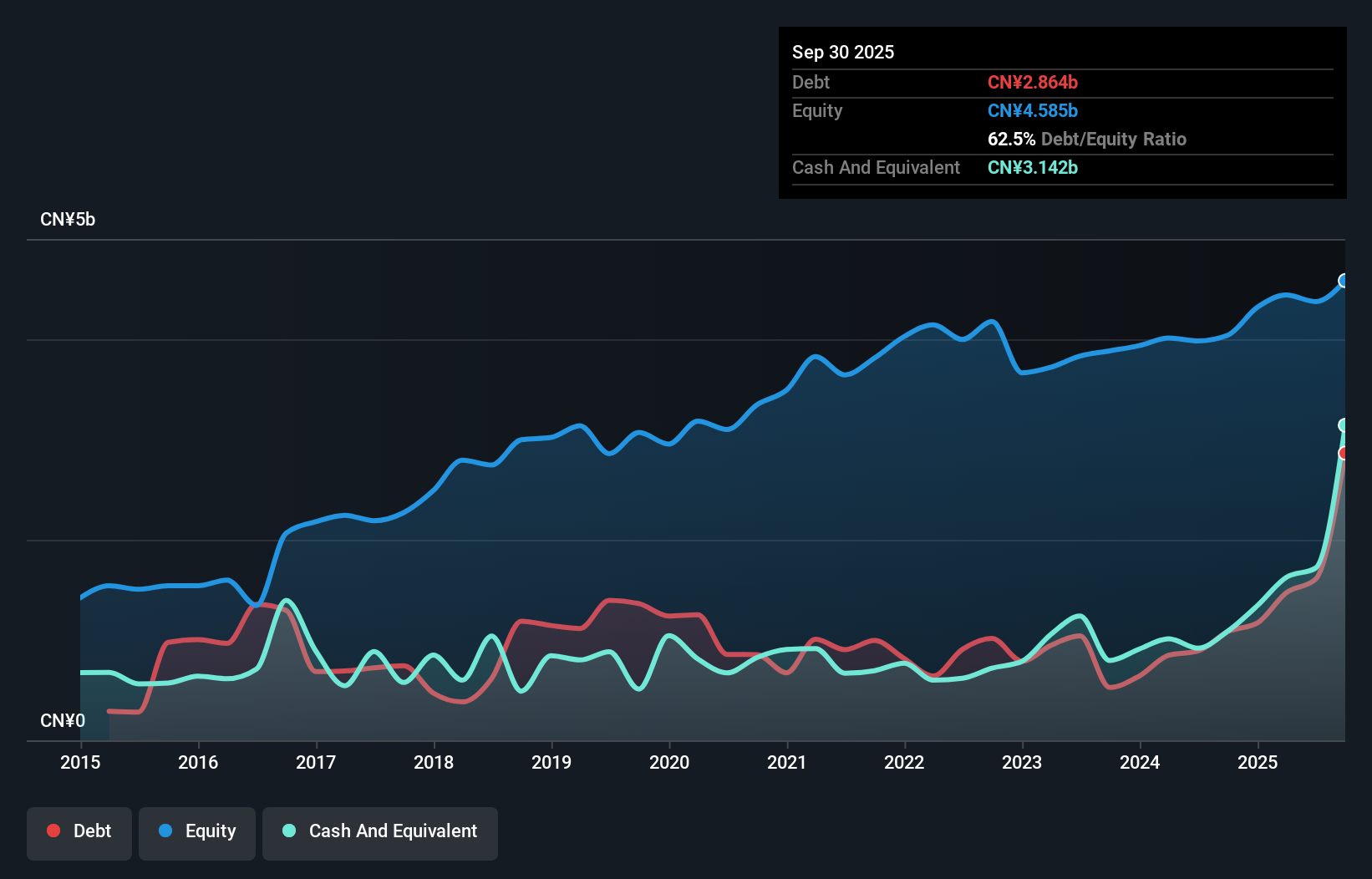

Xiamen Kingdomway Group, a smaller player in the industry, has shown impressive growth with earnings rising by 50.8% last year, outpacing its peers. The company reported first-quarter sales of CNY 827.24 million and net income of CNY 121.74 million, marking a significant improvement from the previous year. With a price-to-earnings ratio of 26.6x below the CN market average of 37.6x, it trades at an attractive valuation relative to its sector peers. The debt-to-equity ratio decreased from 39.3% to 33.1% over five years, indicating prudent financial management and positioning it well for future growth prospects in the pharmaceutical industry.

- Dive into the specifics of Xiamen Kingdomway Group here with our thorough health report.

Assess Xiamen Kingdomway Group's past performance with our detailed historical performance reports.

AOKI Holdings (TSE:8214)

Simply Wall St Value Rating: ★★★★★★

Overview: AOKI Holdings Inc. operates in the fashion, anniversary and bridal, entertainment, and real estate rental sectors in Japan with a market cap of ¥121.77 billion.

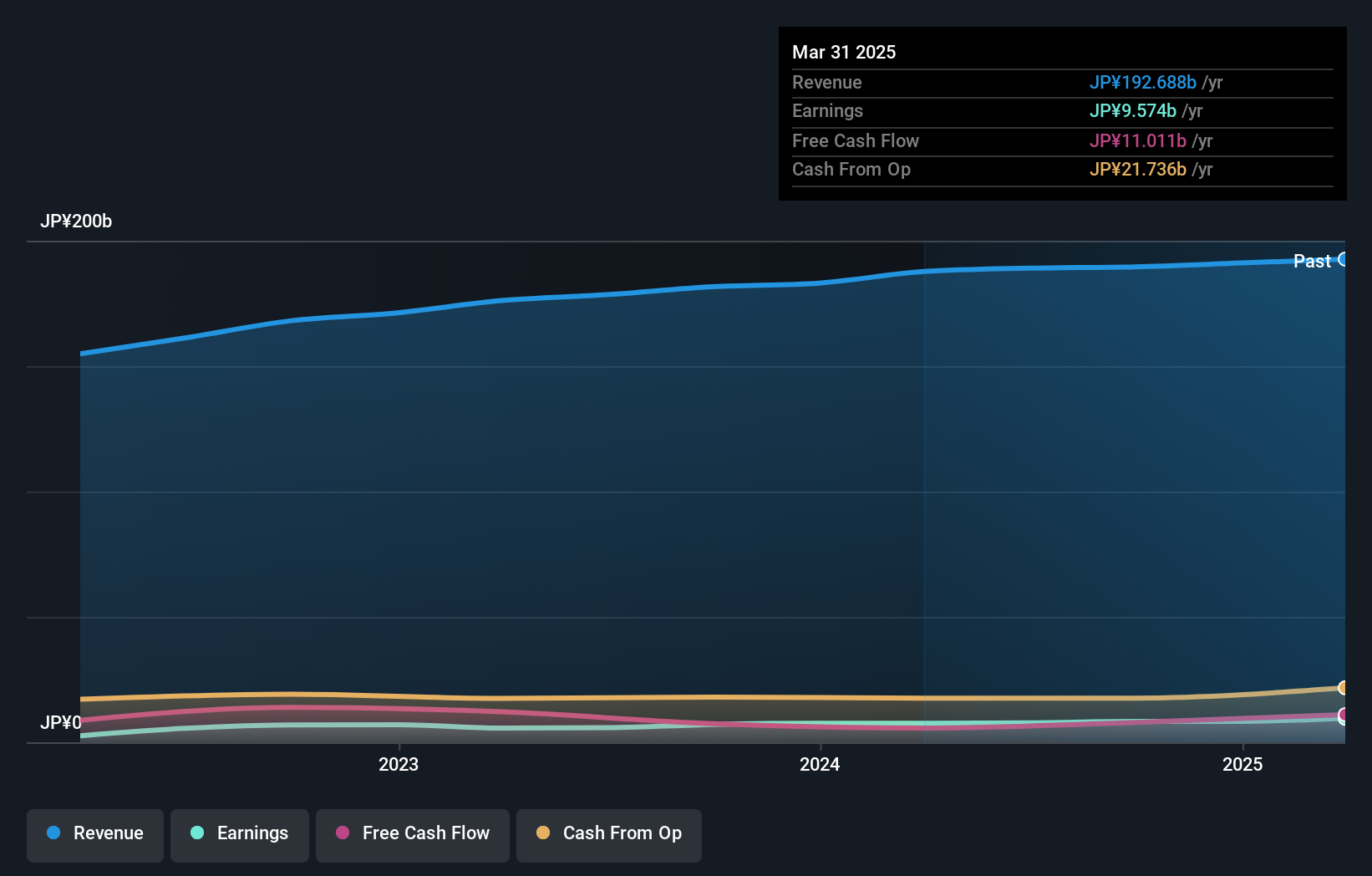

Operations: AOKI Holdings generates revenue primarily from its fashion business, which contributes ¥101.20 billion, followed by the entertainment segment at ¥76.47 billion. The anniversary and bridal segment adds ¥11.28 billion to the revenue, while real estate leasing brings in ¥6.79 billion.

AOKI Holdings, a small cap in the specialty retail sector, is trading at 21.2% below its estimated fair value, suggesting potential undervaluation. Over the past five years, earnings have grown robustly by 52.5% annually, indicating strong operational performance. The company's debt management is commendable with a reduction in its debt to equity ratio from 33.6% to 27.1%, and interest payments are well covered by EBIT at an impressive 88 times coverage. Recent guidance revisions highlight expected net sales of ¥192.6 billion and a dividend increase to ¥60 per share for the year ending March 2025 reflecting solid financial health and shareholder focus.

- Click to explore a detailed breakdown of our findings in AOKI Holdings' health report.

Explore historical data to track AOKI Holdings' performance over time in our Past section.

Taking Advantage

- Unlock more gems! Our Asian Undiscovered Gems With Strong Fundamentals screener has unearthed 2676 more companies for you to explore.Click here to unveil our expertly curated list of 2679 Asian Undiscovered Gems With Strong Fundamentals.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade AOKI Holdings, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8214

AOKI Holdings

Engages in the fashion, anniversary and bridal, entertainment, and real estate rental businesses in Japan.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives