- China

- /

- Auto Components

- /

- SHSE:600609

Risks Still Elevated At These Prices As Shenyang Jinbei Automotive Company Limited (SHSE:600609) Shares Dive 28%

Shenyang Jinbei Automotive Company Limited (SHSE:600609) shares have retraced a considerable 28% in the last month, reversing a fair amount of their solid recent performance. Still, a bad month hasn't completely ruined the past year with the stock gaining 29%, which is great even in a bull market.

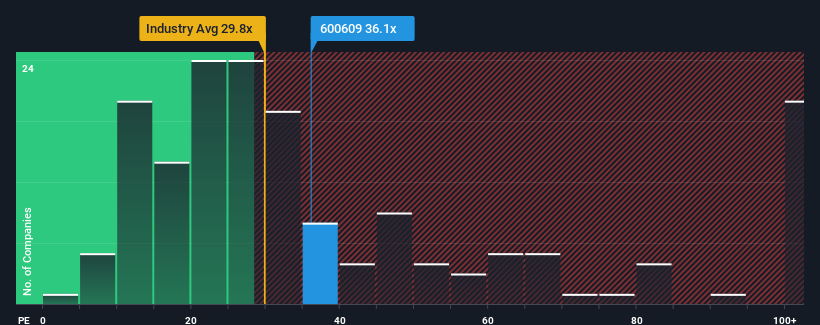

Although its price has dipped substantially, there still wouldn't be many who think Shenyang Jinbei Automotive's price-to-earnings (or "P/E") ratio of 36.1x is worth a mention when the median P/E in China is similar at about 34x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Earnings have risen at a steady rate over the last year for Shenyang Jinbei Automotive, which is generally not a bad outcome. It might be that many expect the respectable earnings performance to only match most other companies over the coming period, which has kept the P/E from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

See our latest analysis for Shenyang Jinbei Automotive

What Are Growth Metrics Telling Us About The P/E?

In order to justify its P/E ratio, Shenyang Jinbei Automotive would need to produce growth that's similar to the market.

If we review the last year of earnings growth, the company posted a worthy increase of 7.0%. However, due to its less than impressive performance prior to this period, EPS growth is practically non-existent over the last three years overall. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

This is in contrast to the rest of the market, which is expected to grow by 38% over the next year, materially higher than the company's recent medium-term annualised growth rates.

In light of this, it's curious that Shenyang Jinbei Automotive's P/E sits in line with the majority of other companies. It seems most investors are ignoring the fairly limited recent growth rates and are willing to pay up for exposure to the stock. They may be setting themselves up for future disappointment if the P/E falls to levels more in line with recent growth rates.

The Bottom Line On Shenyang Jinbei Automotive's P/E

Shenyang Jinbei Automotive's plummeting stock price has brought its P/E right back to the rest of the market. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Shenyang Jinbei Automotive currently trades on a higher than expected P/E since its recent three-year growth is lower than the wider market forecast. When we see weak earnings with slower than market growth, we suspect the share price is at risk of declining, sending the moderate P/E lower. Unless the recent medium-term conditions improve, it's challenging to accept these prices as being reasonable.

Plus, you should also learn about this 1 warning sign we've spotted with Shenyang Jinbei Automotive.

Of course, you might also be able to find a better stock than Shenyang Jinbei Automotive. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600609

Shenyang Jinbei Automotive

Engages in the design, production, and sale of auto parts in China.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives