Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We note that Ling Yun Industrial Corporation Limited (SHSE:600480) does have debt on its balance sheet. But the more important question is: how much risk is that debt creating?

When Is Debt Dangerous?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

View our latest analysis for Ling Yun Industrial

What Is Ling Yun Industrial's Net Debt?

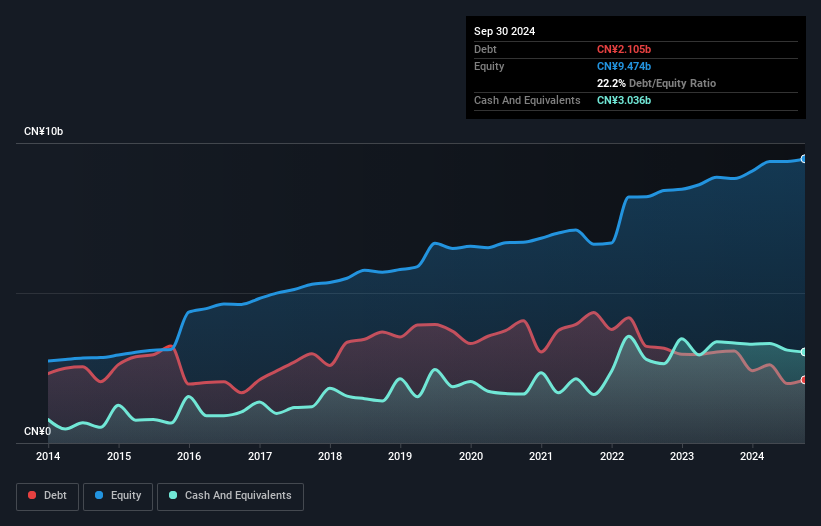

As you can see below, Ling Yun Industrial had CN¥2.10b of debt at September 2024, down from CN¥3.06b a year prior. But it also has CN¥3.04b in cash to offset that, meaning it has CN¥931.3m net cash.

A Look At Ling Yun Industrial's Liabilities

The latest balance sheet data shows that Ling Yun Industrial had liabilities of CN¥9.00b due within a year, and liabilities of CN¥550.7m falling due after that. On the other hand, it had cash of CN¥3.04b and CN¥6.46b worth of receivables due within a year. So these liquid assets roughly match the total liabilities.

This state of affairs indicates that Ling Yun Industrial's balance sheet looks quite solid, as its total liabilities are just about equal to its liquid assets. So while it's hard to imagine that the CN¥10.7b company is struggling for cash, we still think it's worth monitoring its balance sheet. While it does have liabilities worth noting, Ling Yun Industrial also has more cash than debt, so we're pretty confident it can manage its debt safely.

In addition to that, we're happy to report that Ling Yun Industrial has boosted its EBIT by 31%, thus reducing the spectre of future debt repayments. When analysing debt levels, the balance sheet is the obvious place to start. But it is future earnings, more than anything, that will determine Ling Yun Industrial's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. While Ling Yun Industrial has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. Happily for any shareholders, Ling Yun Industrial actually produced more free cash flow than EBIT over the last three years. That sort of strong cash conversion gets us as excited as the crowd when the beat drops at a Daft Punk concert.

Summing Up

We could understand if investors are concerned about Ling Yun Industrial's liabilities, but we can be reassured by the fact it has has net cash of CN¥931.3m. And it impressed us with free cash flow of CN¥1.2b, being 122% of its EBIT. So we don't think Ling Yun Industrial's use of debt is risky. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. Case in point: We've spotted 1 warning sign for Ling Yun Industrial you should be aware of.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600480

Ling Yun Industrial

Engages in the production and sale of automotive plastic, and plastic piping systems in China.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026