- South Korea

- /

- Professional Services

- /

- KOSE:A030190

Exploring Undiscovered Gems In November 2024

Reviewed by Simply Wall St

As global markets navigate the complexities of shifting political landscapes and economic indicators, investors are keenly observing the impact of potential deregulation and policy changes on various sectors. With small-cap indices like the Russell 2000 experiencing notable fluctuations, there is increasing interest in identifying stocks that may have been overlooked but possess strong fundamentals and growth potential. In this environment, a good stock often stands out due to its resilience amidst market volatility, sound financial health, and strategic positioning that aligns with emerging trends or regulatory shifts.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Suez Canal Company for Technology Settling (S.A.E) | NA | 22.31% | 13.60% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Transcorp Power | 46.33% | 114.79% | 152.92% | ★★★★★☆ |

| Thai Energy Storage Technology | 9.49% | -1.42% | 1.73% | ★★★★★☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

| Tethys Petroleum | NA | 29.98% | 44.48% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

NICE Information Service (KOSE:A030190)

Simply Wall St Value Rating: ★★★★★☆

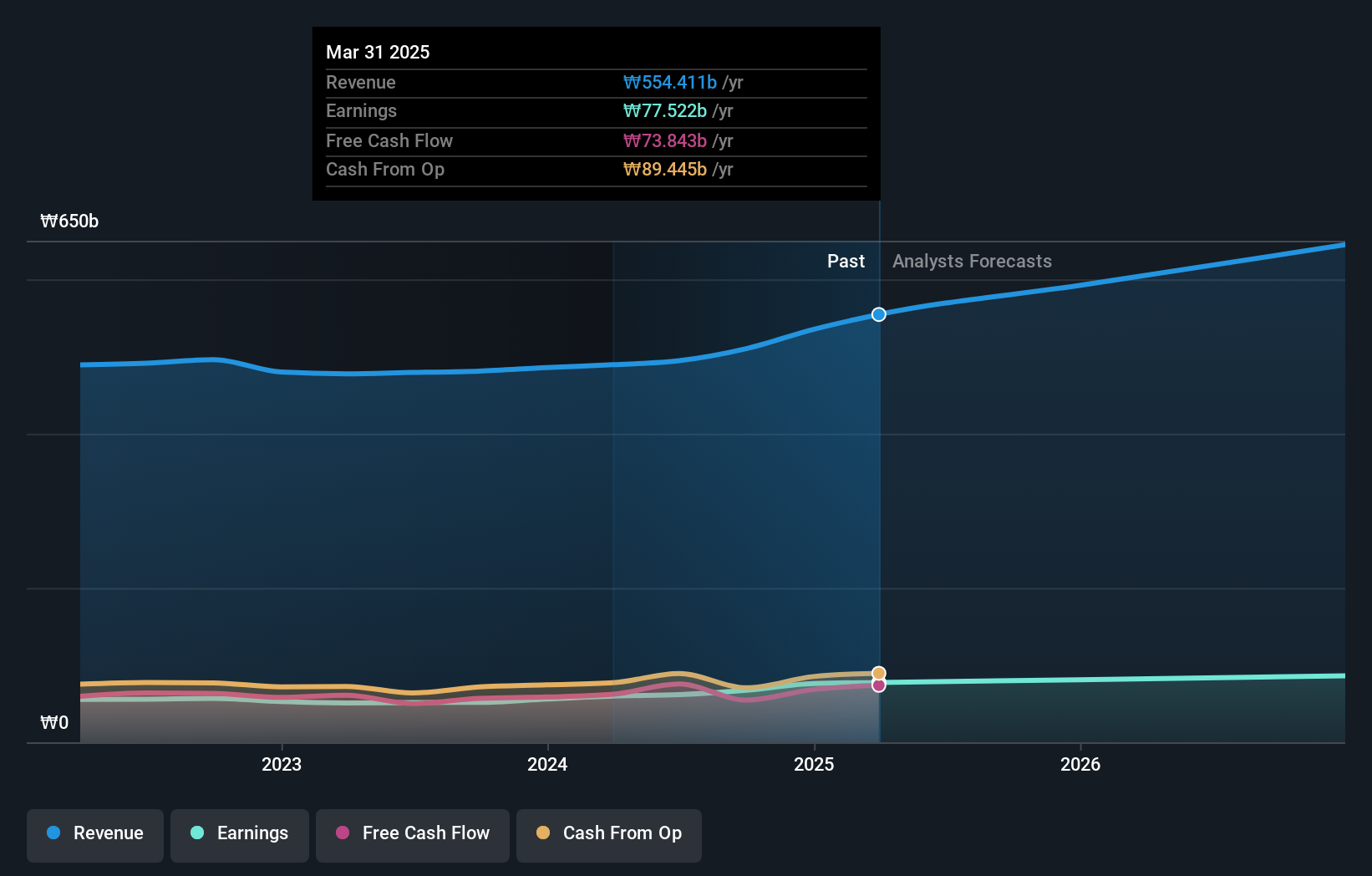

Overview: NICE Information Service Co., Ltd. operates in South Korea, offering credit evaluation, credit inquiries, credit investigations, and debt collection services with a market capitalization of approximately ₩677.32 billion.

Operations: NICE Information Service Co., Ltd. generates revenue primarily from corporate and personal credit information services, amounting to approximately ₩426.03 billion, and debt collection services, contributing around ₩68.44 billion. The company's net profit margin reflects its financial efficiency in managing costs relative to revenue generation.

NICE Information Service, a promising player in the financial sector, is trading at 67.6% below its estimated fair value, indicating potential undervaluation. The company has demonstrated high-quality earnings and boasts a robust free cash flow position with US$75.47 million as of June 2024. Its debt-to-equity ratio has slightly increased to 0.4% over five years but remains manageable given its cash surplus over total debt. Earnings have grown by an impressive 19.9%, outpacing the Professional Services industry’s -13.6%. With earnings forecasted to grow nearly 10% annually, NICE appears poised for continued success in its field.

Ling Yun Industrial (SHSE:600480)

Simply Wall St Value Rating: ★★★★★★

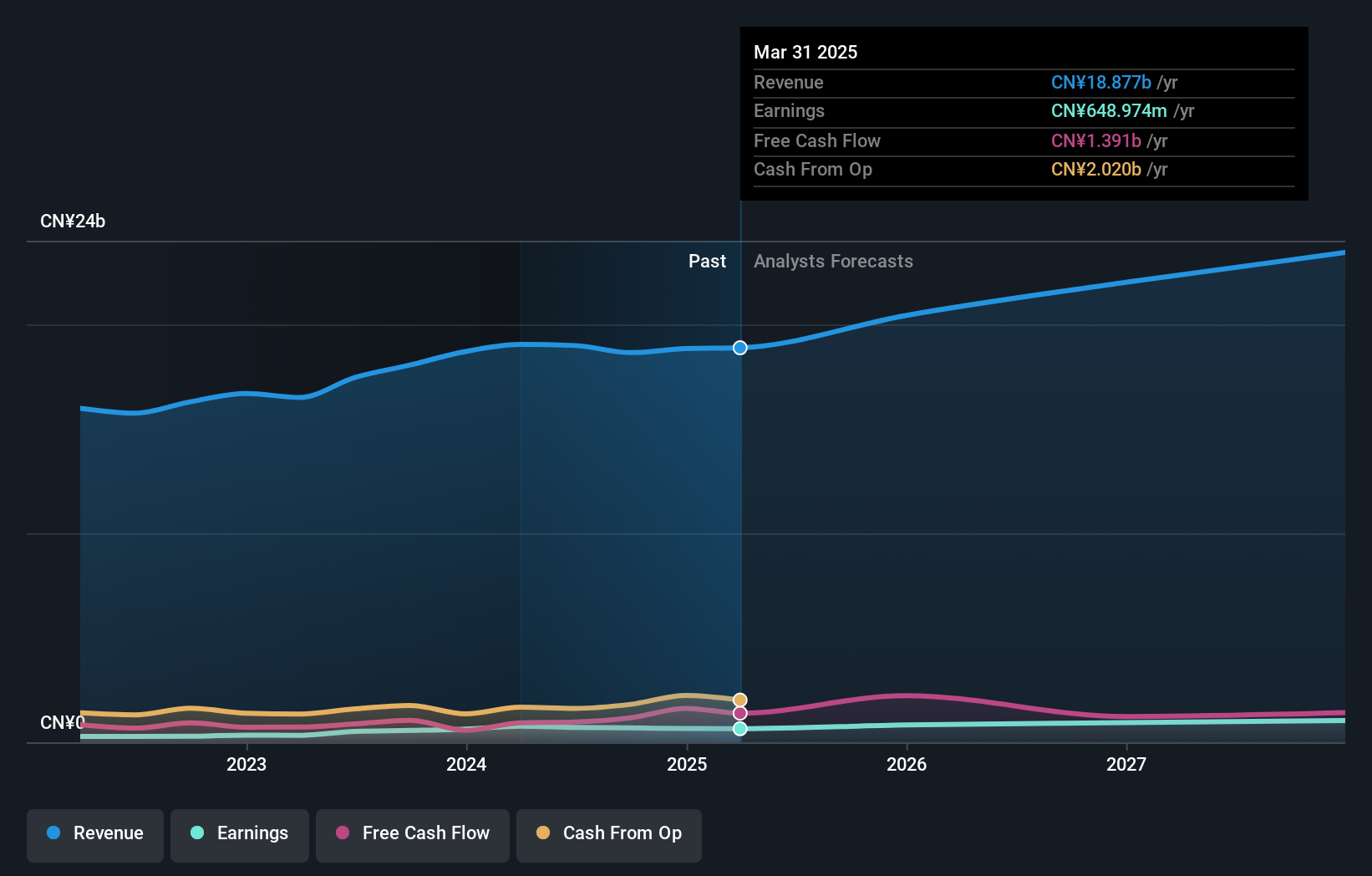

Overview: Ling Yun Industrial Corporation Limited focuses on the production and sale of metal, automotive plastic, and plastic piping systems in China, with a market cap of CN¥9.69 billion.

Operations: Ling Yun Industrial derives its revenue primarily from the sale of metal, automotive plastic, and plastic piping systems. The company's net profit margin has shown fluctuations over recent periods.

Ling Yun Industrial, a smaller player in the auto components sector, has shown promising financial health with earnings growth of 21.9% over the past year, outpacing the industry average of 11%. Its debt to equity ratio improved significantly from 57.4% to 22.2% over five years, indicating better financial stability. Recent reports for nine months ending September 2024 reveal sales at CNY 13.35 billion and net income rising to CNY 500.78 million from CNY 442.26 million last year, with basic earnings per share climbing to CNY 0.55 from CNY 0.48, reflecting solid operational performance despite stable revenue figures.

Cyber Power Systems (TWSE:3617)

Simply Wall St Value Rating: ★★★★★★

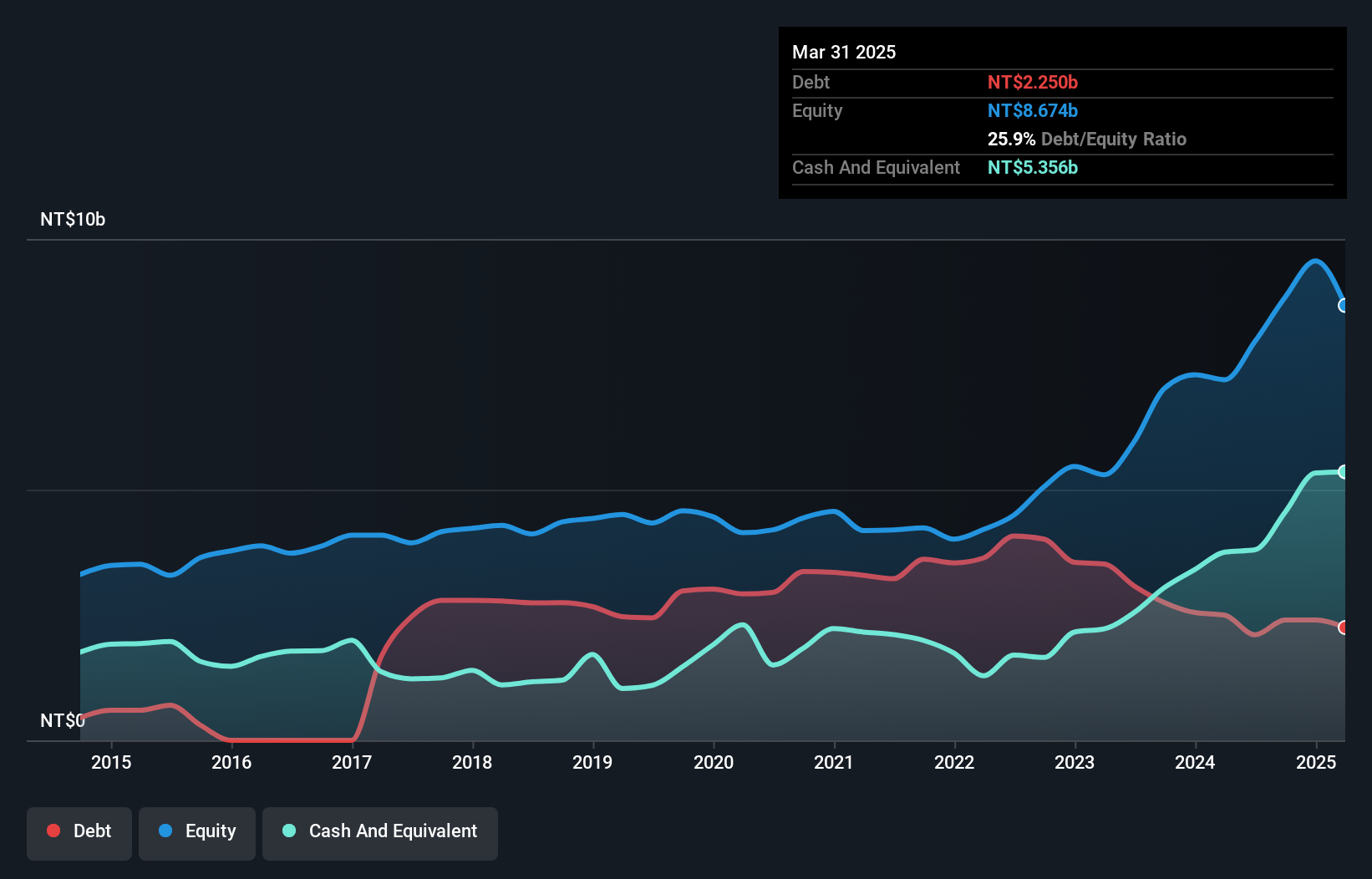

Overview: Cyber Power Systems, Inc. designs, manufactures, and sells power protection products and computer peripheral accessories worldwide with a market cap of NT$29.35 billion.

Operations: Cyber Power Systems generates revenue primarily from the sale of power protection products and computer peripheral accessories. The company's net profit margin has shown notable fluctuations, reflecting variations in operational efficiency and cost management.

Cyber Power Systems has demonstrated impressive growth, with earnings jumping 39% over the last year, outpacing the Electrical industry's 6% rise. Despite shareholder dilution in the past year, it boasts high-quality earnings and a robust debt profile; its debt-to-equity ratio has shrunk from 65% to 27% over five years. The company is trading at a significant discount of nearly 25% below its fair value estimate. Recent third-quarter results show sales reaching TWD 3.44 billion and net income of TWD 494 million, indicating steady performance despite slight fluctuations in basic earnings per share compared to last year.

- Get an in-depth perspective on Cyber Power Systems' performance by reading our health report here.

Assess Cyber Power Systems' past performance with our detailed historical performance reports.

Key Takeaways

- Reveal the 4627 hidden gems among our Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NICE Information Service might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A030190

NICE Information Service

Provides credit evaluation, credit inquiries, credit investigations, and debt collection services in South Korea.

Undervalued with solid track record.

Market Insights

Community Narratives