- China

- /

- Trade Distributors

- /

- SHSE:600546

3 Reliable Dividend Stocks To Consider With At Least 4% Yield

Reviewed by Simply Wall St

As global markets navigate a choppy start to the year, driven by inflation concerns and shifting political landscapes, investors are keenly focused on finding stability amidst uncertainty. In such an environment, dividend stocks offering at least a 4% yield can provide a reliable income stream and potential for long-term growth, making them an attractive consideration for those seeking to balance risk with reward.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.12% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 6.38% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.08% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.61% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 4.01% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.58% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.99% | ★★★★★★ |

| E J Holdings (TSE:2153) | 4.07% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.96% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.93% | ★★★★★★ |

Click here to see the full list of 1999 stocks from our Top Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

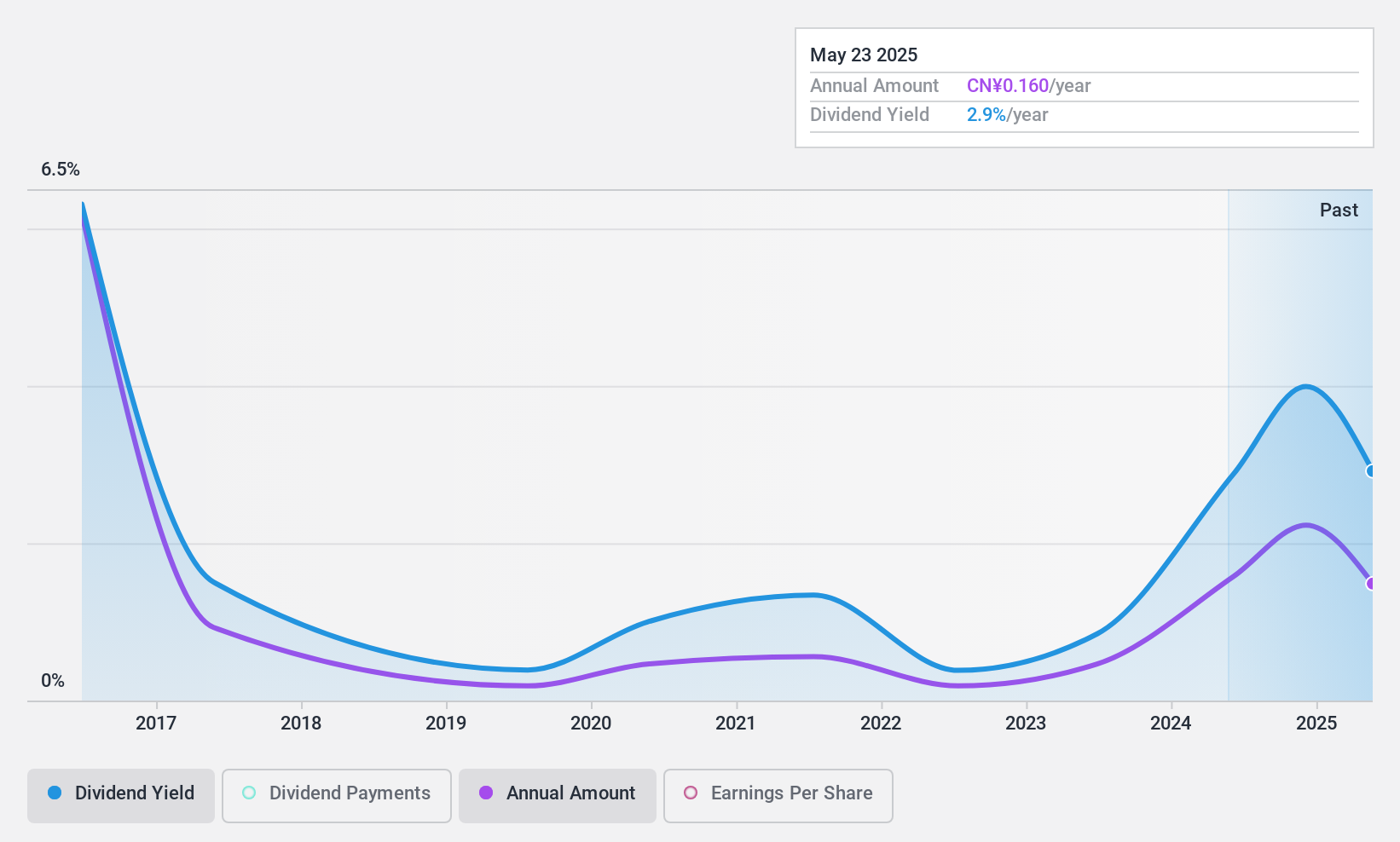

Aeolus Tyre (SHSE:600469)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Aeolus Tyre Co., Ltd. manufactures and sells tires for trucks, buses, and construction machinery vehicles both in China and internationally, with a market cap of CN¥4.36 billion.

Operations: Aeolus Tyre Co., Ltd.'s revenue is primarily derived from its Rubber and Plastic Products segment, totaling CN¥6.37 billion.

Dividend Yield: 4%

Aeolus Tyre's dividend yield of 4.01% ranks in the top 25% of the CN market, yet it faces challenges with sustainability due to a lack of free cash flow coverage. Despite a reasonable payout ratio of 61.7%, dividends have been volatile over the past decade, indicating unreliability. Earnings grew by 13.3% recently, but net income slightly decreased year-over-year to CNY 275.81 million, highlighting potential volatility in future payouts.

- Click here and access our complete dividend analysis report to understand the dynamics of Aeolus Tyre.

- The valuation report we've compiled suggests that Aeolus Tyre's current price could be inflated.

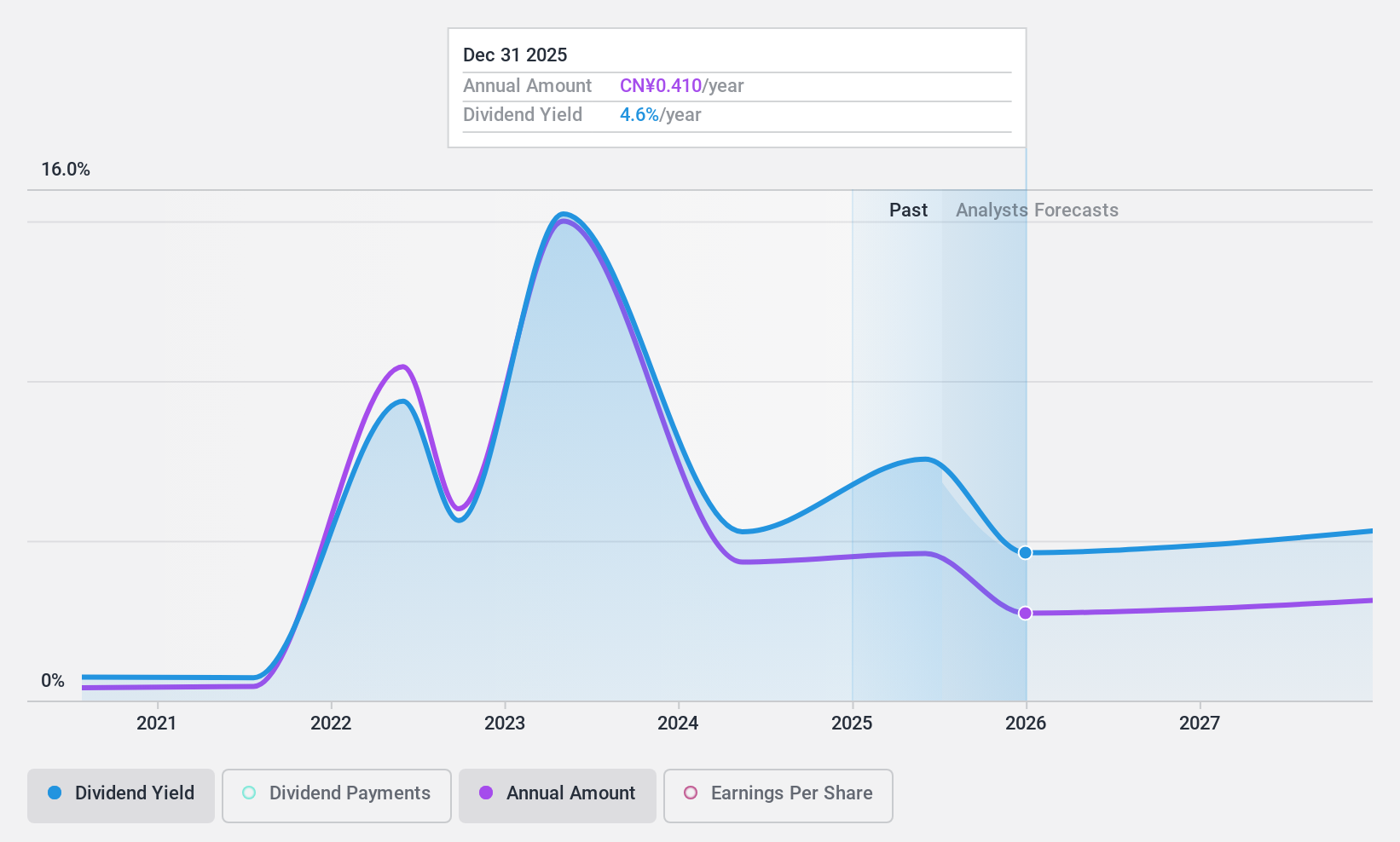

Shanxi Coal International Energy GroupLtd (SHSE:600546)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Shanxi Coal International Energy Group Co., Ltd is involved in coal production both within China and internationally, with a market cap of CN¥22.60 billion.

Operations: Shanxi Coal International Energy Group Co., Ltd's revenue segments are not specified in the provided text.

Dividend Yield: 5.7%

Shanxi Coal International Energy Group's dividend yield of 5.7% is among the top 25% in the CN market, supported by sustainable payout ratios with earnings (55%) and cash flows (51.7%). However, its dividends have been volatile and unreliable over the past decade despite recent growth. Recent earnings for nine months ending September 2024 show a decline in net income to CNY 2.08 billion from CNY 3.99 billion, reflecting potential challenges ahead.

- Navigate through the intricacies of Shanxi Coal International Energy GroupLtd with our comprehensive dividend report here.

- In light of our recent valuation report, it seems possible that Shanxi Coal International Energy GroupLtd is trading behind its estimated value.

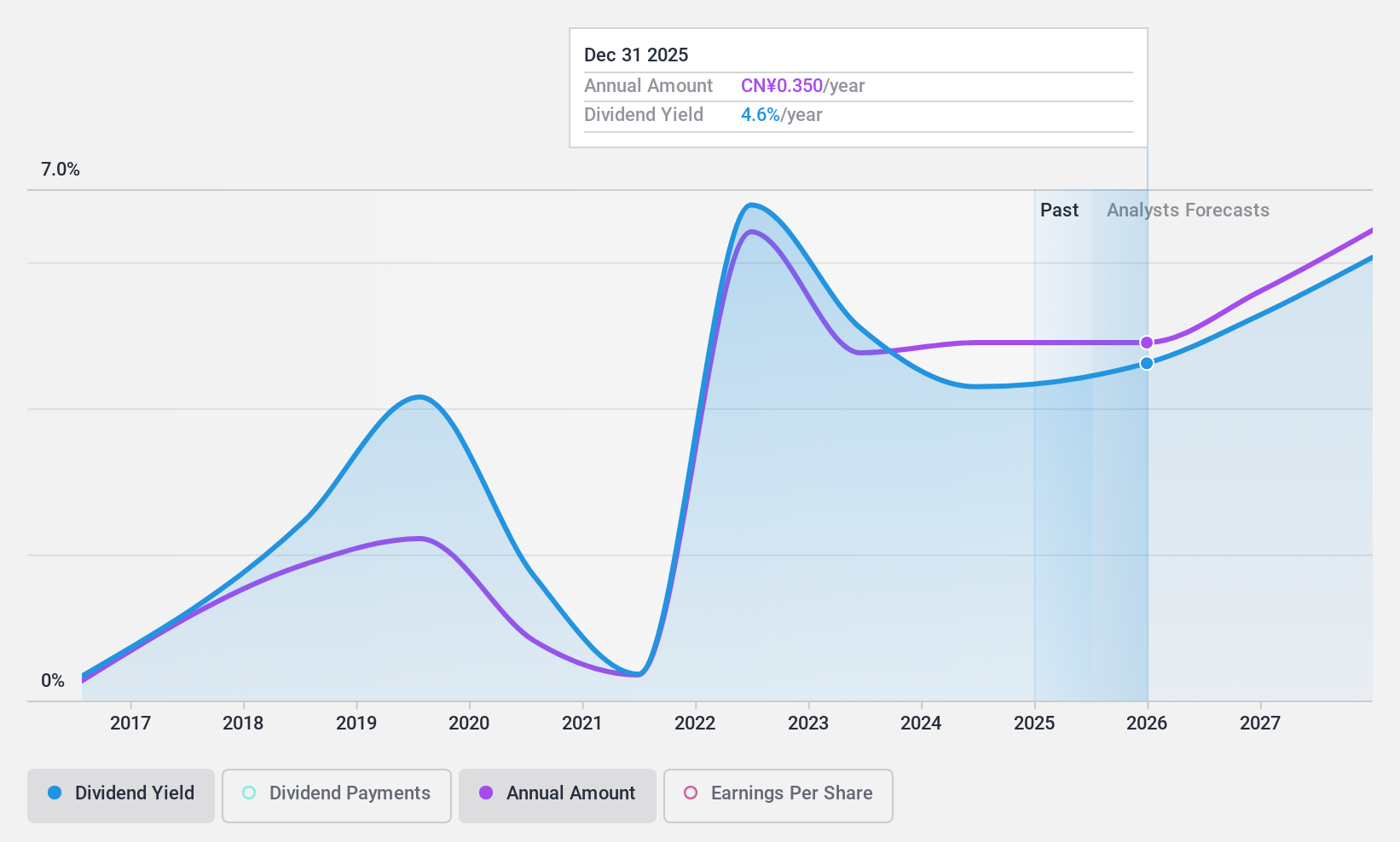

Beijing Haohua Energy Resource (SHSE:601101)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Beijing Haohua Energy Resource Co., Ltd. is involved in the mining, washing, processing, export, and sale of coal in China with a market cap of CN¥11.30 billion.

Operations: Beijing Haohua Energy Resource Co., Ltd. generates revenue through its activities in coal mining, washing, processing, and export within China.

Dividend Yield: 4.5%

Beijing Haohua Energy Resource's dividend yield of 4.46% ranks in the top 25% in the CN market, with sustainable payout ratios from earnings (43.9%) and cash flows (26.6%). Despite this, dividends have been volatile and unreliable over the past decade. Recent financial results for nine months ending September 2024 indicate growth, with net income rising to CNY 1.12 billion from CNY 1.01 billion year-over-year, suggesting improved profitability amidst value trading below estimated fair value by 52.2%.

- Dive into the specifics of Beijing Haohua Energy Resource here with our thorough dividend report.

- Our valuation report unveils the possibility Beijing Haohua Energy Resource's shares may be trading at a discount.

Taking Advantage

- Dive into all 1999 of the Top Dividend Stocks we have identified here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600546

Shanxi Coal International Energy GroupLtd

Engages in the coal production business in China and internationally.

Adequate balance sheet and fair value.

Market Insights

Community Narratives