- China

- /

- Auto Components

- /

- SHSE:600114

NBTM New Materials Group Co., Ltd. (SHSE:600114) Stocks Shoot Up 31% But Its P/E Still Looks Reasonable

NBTM New Materials Group Co., Ltd. (SHSE:600114) shares have had a really impressive month, gaining 31% after a shaky period beforehand. The last 30 days bring the annual gain to a very sharp 52%.

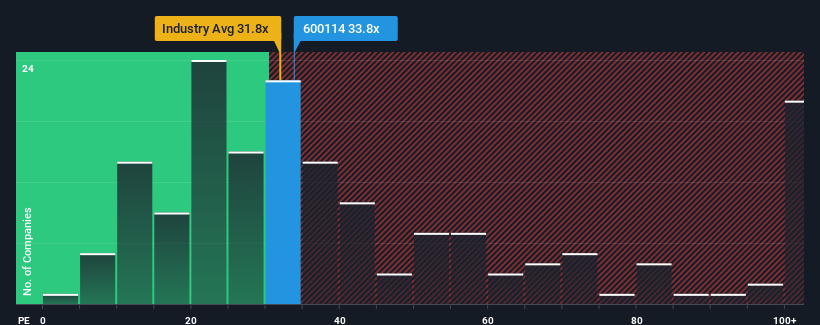

Although its price has surged higher, it's still not a stretch to say that NBTM New Materials Group's price-to-earnings (or "P/E") ratio of 33.8x right now seems quite "middle-of-the-road" compared to the market in China, where the median P/E ratio is around 35x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

With its earnings growth in positive territory compared to the declining earnings of most other companies, NBTM New Materials Group has been doing quite well of late. One possibility is that the P/E is moderate because investors think the company's earnings will be less resilient moving forward. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

View our latest analysis for NBTM New Materials Group

What Are Growth Metrics Telling Us About The P/E?

In order to justify its P/E ratio, NBTM New Materials Group would need to produce growth that's similar to the market.

Retrospectively, the last year delivered an exceptional 125% gain to the company's bottom line. The strong recent performance means it was also able to grow EPS by 201% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Shifting to the future, estimates from the six analysts covering the company suggest earnings should grow by 36% over the next year. That's shaping up to be similar to the 38% growth forecast for the broader market.

With this information, we can see why NBTM New Materials Group is trading at a fairly similar P/E to the market. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

What We Can Learn From NBTM New Materials Group's P/E?

Its shares have lifted substantially and now NBTM New Materials Group's P/E is also back up to the market median. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of NBTM New Materials Group's analyst forecasts revealed that its market-matching earnings outlook is contributing to its current P/E. Right now shareholders are comfortable with the P/E as they are quite confident future earnings won't throw up any surprises. Unless these conditions change, they will continue to support the share price at these levels.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with NBTM New Materials Group (at least 1 which can't be ignored), and understanding them should be part of your investment process.

If these risks are making you reconsider your opinion on NBTM New Materials Group, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if NBTM New Materials Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600114

NBTM New Materials Group

Produces and sells powder metallurgy mechanical parts worldwide.

Solid track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives