Optimistic Investors Push Linhai Co.,Ltd. (SHSE:600099) Shares Up 27% But Growth Is Lacking

Those holding Linhai Co.,Ltd. (SHSE:600099) shares would be relieved that the share price has rebounded 27% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 18% over that time.

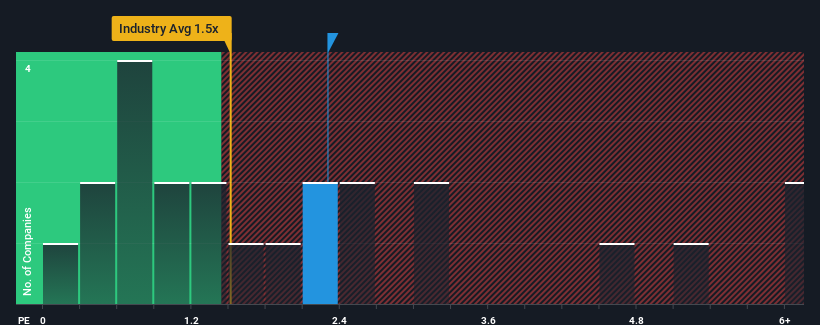

Since its price has surged higher, given close to half the companies operating in China's Auto industry have price-to-sales ratios (or "P/S") below 1.5x, you may consider LinhaiLtd as a stock to potentially avoid with its 2.3x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for LinhaiLtd

What Does LinhaiLtd's P/S Mean For Shareholders?

For example, consider that LinhaiLtd's financial performance has been poor lately as its revenue has been in decline. It might be that many expect the company to still outplay most other companies over the coming period, which has kept the P/S from collapsing. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on LinhaiLtd will help you shine a light on its historical performance.How Is LinhaiLtd's Revenue Growth Trending?

There's an inherent assumption that a company should outperform the industry for P/S ratios like LinhaiLtd's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 10% decrease to the company's top line. This has soured the latest three-year period, which nevertheless managed to deliver a decent 26% overall rise in revenue. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Comparing that to the industry, which is predicted to deliver 67% growth in the next 12 months, the company's momentum is weaker, based on recent medium-term annualised revenue results.

With this in mind, we find it worrying that LinhaiLtd's P/S exceeds that of its industry peers. It seems most investors are ignoring the fairly limited recent growth rates and are hoping for a turnaround in the company's business prospects. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

The Final Word

LinhaiLtd shares have taken a big step in a northerly direction, but its P/S is elevated as a result. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

The fact that LinhaiLtd currently trades on a higher P/S relative to the industry is an oddity, since its recent three-year growth is lower than the wider industry forecast. When we see slower than industry revenue growth but an elevated P/S, there's considerable risk of the share price declining, sending the P/S lower. Unless the recent medium-term conditions improve markedly, it's very challenging to accept these the share price as being reasonable.

Before you take the next step, you should know about the 2 warning signs for LinhaiLtd that we have uncovered.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600099

LinhaiLtd

Engages in the manufacture and sale of all-terrain vehicles, agricultural machinery, forest and fire-fighting machinery products, motorcycles, and other spare parts in China.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives

Recently Updated Narratives

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026