Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We note that Esval S.A. (SNSE:ESVAL-C) does have debt on its balance sheet. But the real question is whether this debt is making the company risky.

When Is Debt A Problem?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first step when considering a company's debt levels is to consider its cash and debt together.

See our latest analysis for Esval

How Much Debt Does Esval Carry?

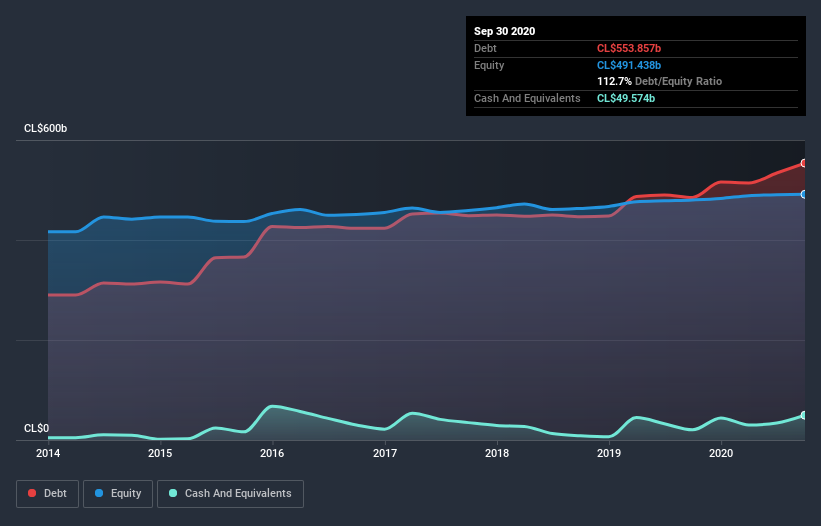

The image below, which you can click on for greater detail, shows that at September 2020 Esval had debt of CL$553.9b, up from CL$485.2b in one year. However, it also had CL$49.6b in cash, and so its net debt is CL$504.3b.

How Healthy Is Esval's Balance Sheet?

The latest balance sheet data shows that Esval had liabilities of CL$94.6b due within a year, and liabilities of CL$551.9b falling due after that. On the other hand, it had cash of CL$49.6b and CL$49.7b worth of receivables due within a year. So its liabilities total CL$547.2b more than the combination of its cash and short-term receivables.

This deficit casts a shadow over the CL$254.4b company, like a colossus towering over mere mortals. So we definitely think shareholders need to watch this one closely. After all, Esval would likely require a major re-capitalisation if it had to pay its creditors today.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

With a net debt to EBITDA ratio of 6.0, it's fair to say Esval does have a significant amount of debt. However, its interest coverage of 3.2 is reasonably strong, which is a good sign. Another concern for investors might be that Esval's EBIT fell 16% in the last year. If that's the way things keep going handling the debt load will be like delivering hot coffees on a pogo stick. When analysing debt levels, the balance sheet is the obvious place to start. But it is Esval's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. In the last three years, Esval created free cash flow amounting to 19% of its EBIT, an uninspiring performance. For us, cash conversion that low sparks a little paranoia about is ability to extinguish debt.

Our View

To be frank both Esval's net debt to EBITDA and its track record of staying on top of its total liabilities make us rather uncomfortable with its debt levels. And furthermore, its interest cover also fails to instill confidence. We should also note that Water Utilities industry companies like Esval commonly do use debt without problems. After considering the datapoints discussed, we think Esval has too much debt. That sort of riskiness is ok for some, but it certainly doesn't float our boat. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. For instance, we've identified 3 warning signs for Esval (1 can't be ignored) you should be aware of.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

If you decide to trade Esval, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Esval might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SNSE:ESVAL-C

Proven track record with imperfect balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.