- Chile

- /

- Electric Utilities

- /

- SNSE:ENELDXCH

The three-year loss for Enel Distribucion Chile (SNSE:ENELDXCH) shareholders likely driven by its shrinking earnings

This week we saw the Enel Distribucion Chile S.A. (SNSE:ENELDXCH) share price climb by 20%. But that doesn't change the fact that the returns over the last three years have been disappointing. In that time, the share price dropped 63%. Some might say the recent bounce is to be expected after such a bad drop. The rise has some hopeful, but turnarounds are often precarious.

While the stock has risen 20% in the past week but long term shareholders are still in the red, let's see what the fundamentals can tell us.

See our latest analysis for Enel Distribucion Chile

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

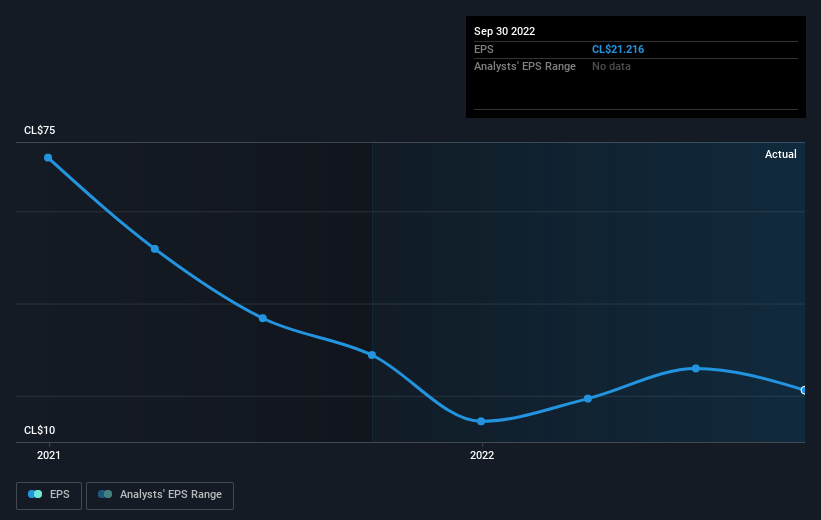

During the three years that the share price fell, Enel Distribucion Chile's earnings per share (EPS) dropped by 42% each year. This fall in the EPS is worse than the 28% compound annual share price fall. This suggests that the market retains some optimism around long term earnings stability, despite past EPS declines.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. In the case of Enel Distribucion Chile, it has a TSR of -58% for the last 3 years. That exceeds its share price return that we previously mentioned. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

Enel Distribucion Chile shareholders are down 43% for the year (even including dividends), but the market itself is up 15%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 9% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For example, we've discovered 5 warning signs for Enel Distribucion Chile (3 make us uncomfortable!) that you should be aware of before investing here.

Of course Enel Distribucion Chile may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CL exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Enel Distribucion Chile might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SNSE:ENELDXCH

Slightly overvalued very low.

Market Insights

Community Narratives