- Chile

- /

- Electric Utilities

- /

- SNSE:ENELCHILE

Enel Chile S.A.'s (SNSE:ENELCHILE) Share Price Not Quite Adding Up

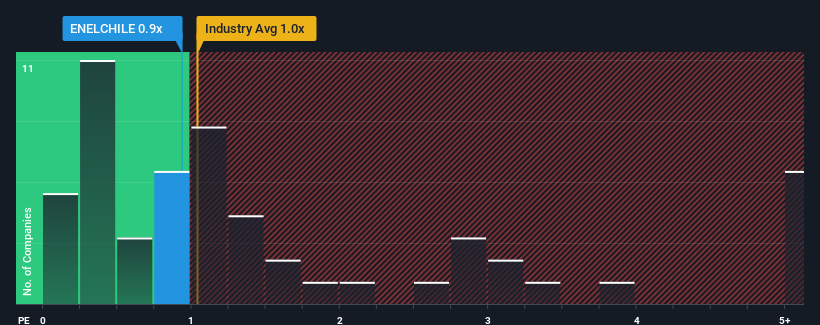

There wouldn't be many who think Enel Chile S.A.'s (SNSE:ENELCHILE) price-to-sales (or "P/S") ratio of 0.9x is worth a mention when the median P/S for the Electric Utilities industry in Chile is similar at about 0.6x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for Enel Chile

What Does Enel Chile's Recent Performance Look Like?

With revenue growth that's superior to most other companies of late, Enel Chile has been doing relatively well. One possibility is that the P/S ratio is moderate because investors think this strong revenue performance might be about to tail off. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Enel Chile will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The P/S?

The only time you'd be comfortable seeing a P/S like Enel Chile's is when the company's growth is tracking the industry closely.

If we review the last year of revenue growth, the company posted a worthy increase of 11%. The latest three year period has also seen an excellent 68% overall rise in revenue, aided somewhat by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Shifting to the future, estimates from the six analysts covering the company are not good at all, suggesting revenue should decline by 11% over the next year. The industry is also set to see revenue decline 2.2% but the stock is shaping up to perform materially worse.

In light of this, it's somewhat peculiar that Enel Chile's P/S sits in line with the majority of other companies. When revenue shrink rapidly the P/S often shrinks too, which could set up shareholders for future disappointment. Maintaining these prices will be difficult to achieve as the weak outlook is likely to weigh down the shares eventually.

The Final Word

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Enel Chile currently trades on a higher P/S than expected based on revenue decline, even more so since its revenue forecast is even worse than the struggling industry. It's not unusual in cases where revenue growth is poor, that the share price declines, sending the moderate P/S lower relative to the industry. We also have our reservations about the company's ability to sustain this level of performance amidst the challenging industry conditions. This presents a risk to investors if the P/S were to decline to a level that more accurately reflects the company's revenue prospects.

Having said that, be aware Enel Chile is showing 4 warning signs in our investment analysis, and 1 of those is a bit unpleasant.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Enel Chile might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SNSE:ENELCHILE

Enel Chile

An electricity utility company, engages in the generation, transmission, and distribution of electricity in Chile.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives