- Chile

- /

- Electric Utilities

- /

- SNSE:ECL

These 4 Measures Indicate That Engie Energia Chile (SNSE:ECL) Is Using Debt Extensively

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. Importantly, Engie Energia Chile S.A. (SNSE:ECL) does carry debt. But the more important question is: how much risk is that debt creating?

Why Does Debt Bring Risk?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

See our latest analysis for Engie Energia Chile

How Much Debt Does Engie Energia Chile Carry?

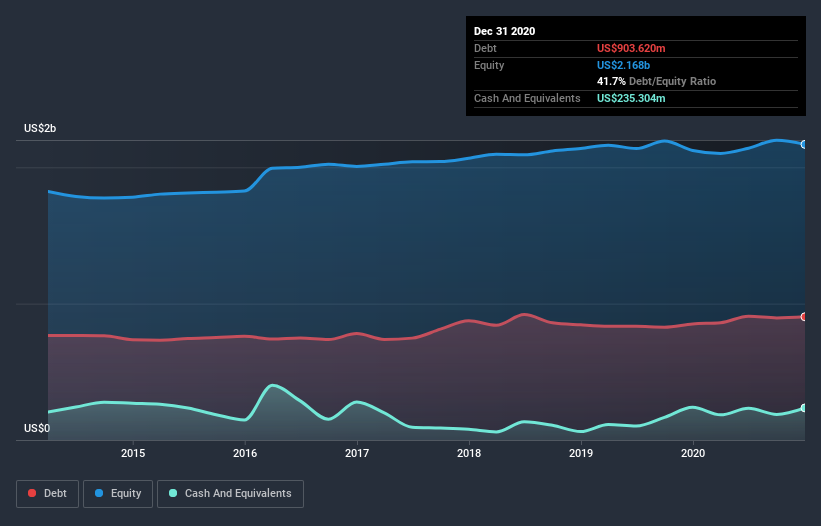

As you can see below, at the end of December 2020, Engie Energia Chile had US$903.6m of debt, up from US$851.2m a year ago. Click the image for more detail. However, it does have US$235.3m in cash offsetting this, leading to net debt of about US$668.3m.

How Healthy Is Engie Energia Chile's Balance Sheet?

We can see from the most recent balance sheet that Engie Energia Chile had liabilities of US$323.5m falling due within a year, and liabilities of US$1.23b due beyond that. Offsetting this, it had US$235.3m in cash and US$124.4m in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by US$1.19b.

Given this deficit is actually higher than the company's market capitalization of US$1.17b, we think shareholders really should watch Engie Energia Chile's debt levels, like a parent watching their child ride a bike for the first time. In the scenario where the company had to clean up its balance sheet quickly, it seems likely shareholders would suffer extensive dilution.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Looking at its net debt to EBITDA of 1.5 and interest cover of 4.8 times, it seems to us that Engie Energia Chile is probably using debt in a pretty reasonable way. So we'd recommend keeping a close eye on the impact financing costs are having on the business. Importantly, Engie Energia Chile's EBIT fell a jaw-dropping 26% in the last twelve months. If that decline continues then paying off debt will be harder than selling foie gras at a vegan convention. There's no doubt that we learn most about debt from the balance sheet. But it is future earnings, more than anything, that will determine Engie Energia Chile's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. In the last three years, Engie Energia Chile's free cash flow amounted to 48% of its EBIT, less than we'd expect. That's not great, when it comes to paying down debt.

Our View

We'd go so far as to say Engie Energia Chile's EBIT growth rate was disappointing. But on the bright side, its net debt to EBITDA is a good sign, and makes us more optimistic. We should also note that Electric Utilities industry companies like Engie Energia Chile commonly do use debt without problems. Looking at the bigger picture, it seems clear to us that Engie Energia Chile's use of debt is creating risks for the company. If everything goes well that may pay off but the downside of this debt is a greater risk of permanent losses. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. We've identified 2 warning signs with Engie Energia Chile , and understanding them should be part of your investment process.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

When trading Engie Energia Chile or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Engie Energia Chile might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SNSE:ECL

Engie Energia Chile

Engages in the generation, transmission, and supply of electricity primarily in Chile and Argentina.

Undervalued average dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success