- Chile

- /

- Electric Utilities

- /

- SNSE:ECL

Risks To Shareholder Returns Are Elevated At These Prices For Engie Energia Chile S.A. (SNSE:ECL)

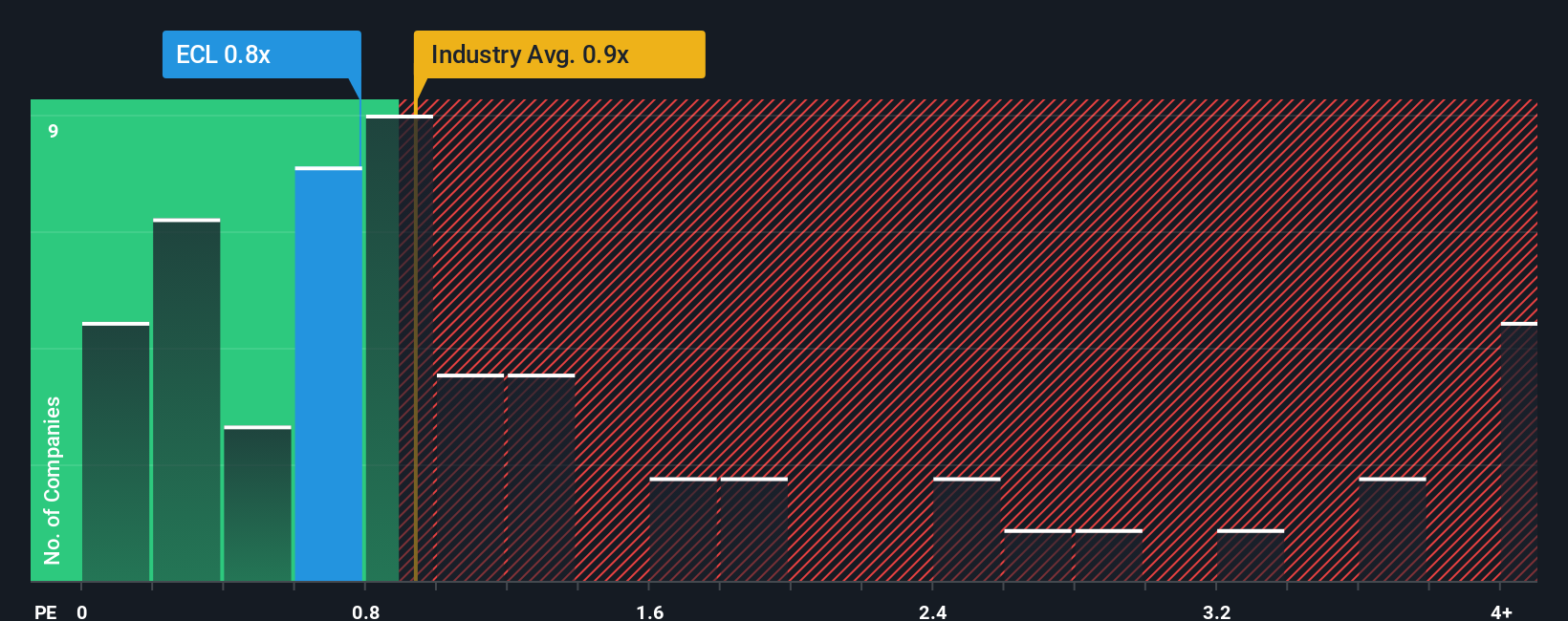

With a median price-to-sales (or "P/S") ratio of close to 0.8x in the Electric Utilities industry in Chile, you could be forgiven for feeling indifferent about Engie Energia Chile S.A.'s (SNSE:ECL) P/S ratio, which comes in at about the same. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for Engie Energia Chile

What Does Engie Energia Chile's P/S Mean For Shareholders?

With its revenue growth in positive territory compared to the declining revenue of most other companies, Engie Energia Chile has been doing quite well of late. It might be that many expect the strong revenue performance to deteriorate like the rest, which has kept the P/S ratio from rising. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Engie Energia Chile will help you uncover what's on the horizon.Is There Some Revenue Growth Forecasted For Engie Energia Chile?

The only time you'd be comfortable seeing a P/S like Engie Energia Chile's is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered a decent 4.3% gain to the company's revenues. The solid recent performance means it was also able to grow revenue by 21% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

Looking ahead now, revenue is anticipated to plummet, contracting by 11% during the coming year according to the four analysts following the company. Meanwhile, the broader industry is forecast to moderate by 8.2%, which indicates the company should perform poorly indeed.

In light of this, it's somewhat peculiar that Engie Energia Chile's P/S sits in line with the majority of other companies. When revenue shrink rapidly the P/S often shrinks too, which could set up shareholders for future disappointment. There's potential for the P/S to fall to lower levels if the company doesn't improve its top-line growth.

What We Can Learn From Engie Energia Chile's P/S?

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Engie Energia Chile currently trades on a higher P/S than expected based on revenue decline, even more so since its revenue forecast is even worse than the struggling industry. It's not unusual in cases where revenue growth is poor, that the share price declines, sending the moderate P/S lower relative to the industry. We're also cautious about the company's ability to resist even greater pain to its business from the broader industry turmoil. A positive change is needed in order to justify the current price-to-sales ratio.

Before you take the next step, you should know about the 3 warning signs for Engie Energia Chile (1 shouldn't be ignored!) that we have uncovered.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Engie Energia Chile might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SNSE:ECL

Engie Energia Chile

Engages in the generation, transmission, and supply of electricity primarily in Chile.

Undervalued average dividend payer.

Similar Companies

Market Insights

Community Narratives