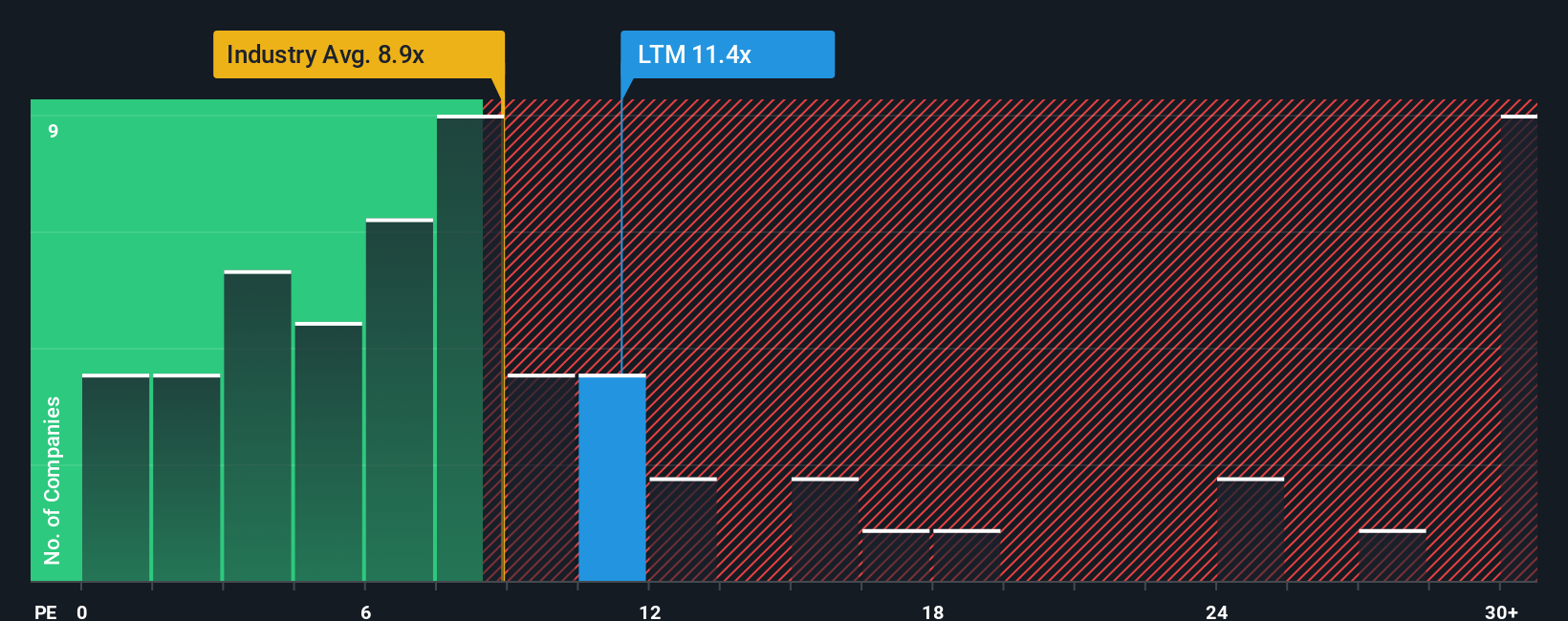

It's not a stretch to say that LATAM Airlines Group S.A.'s (SNSE:LTM) price-to-earnings (or "P/E") ratio of 11.4x right now seems quite "middle-of-the-road" compared to the market in Chile, where the median P/E ratio is around 11x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

With earnings growth that's superior to most other companies of late, LATAM Airlines Group has been doing relatively well. It might be that many expect the strong earnings performance to wane, which has kept the P/E from rising. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

See our latest analysis for LATAM Airlines Group

How Is LATAM Airlines Group's Growth Trending?

The only time you'd be comfortable seeing a P/E like LATAM Airlines Group's is when the company's growth is tracking the market closely.

Taking a look back first, we see that the company grew earnings per share by an impressive 63% last year. Although, its longer-term performance hasn't been as strong with three-year EPS growth being relatively non-existent overall. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

Looking ahead now, EPS is anticipated to climb by 14% each year during the coming three years according to the ten analysts following the company. With the market only predicted to deliver 9.2% per annum, the company is positioned for a stronger earnings result.

In light of this, it's curious that LATAM Airlines Group's P/E sits in line with the majority of other companies. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Bottom Line On LATAM Airlines Group's P/E

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

Our examination of LATAM Airlines Group's analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E as much as we would have predicted. There could be some unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. It appears some are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

Having said that, be aware LATAM Airlines Group is showing 2 warning signs in our investment analysis, and 1 of those is a bit unpleasant.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SNSE:LTM

LATAM Airlines Group

Provides passenger and cargo air transportation services in Chile, Argentina, Peru, Colombia, Ecuador, Brazil, the United States, other Latin American countries, the Caribbean, Europe, and Oceania.

Solid track record and good value.

Similar Companies

Market Insights

Community Narratives