- Chile

- /

- Real Estate

- /

- SNSE:ZOFRI

We Think You Should Be Aware Of Some Concerning Factors In Zona Franca de Iquique's (SNSE:ZOFRI) Earnings

The recent earnings posted by Zona Franca de Iquique S.A. (SNSE:ZOFRI) were solid, but the stock didn't move as much as we expected. We believe that shareholders have noticed some concerning factors beyond the statutory profit numbers.

Zooming In On Zona Franca de Iquique's Earnings

As finance nerds would already know, the accrual ratio from cashflow is a key measure for assessing how well a company's free cash flow (FCF) matches its profit. The accrual ratio subtracts the FCF from the profit for a given period, and divides the result by the average operating assets of the company over that time. You could think of the accrual ratio from cashflow as the 'non-FCF profit ratio'.

That means a negative accrual ratio is a good thing, because it shows that the company is bringing in more free cash flow than its profit would suggest. While having an accrual ratio above zero is of little concern, we do think it's worth noting when a company has a relatively high accrual ratio. That's because some academic studies have suggested that high accruals ratios tend to lead to lower profit or less profit growth.

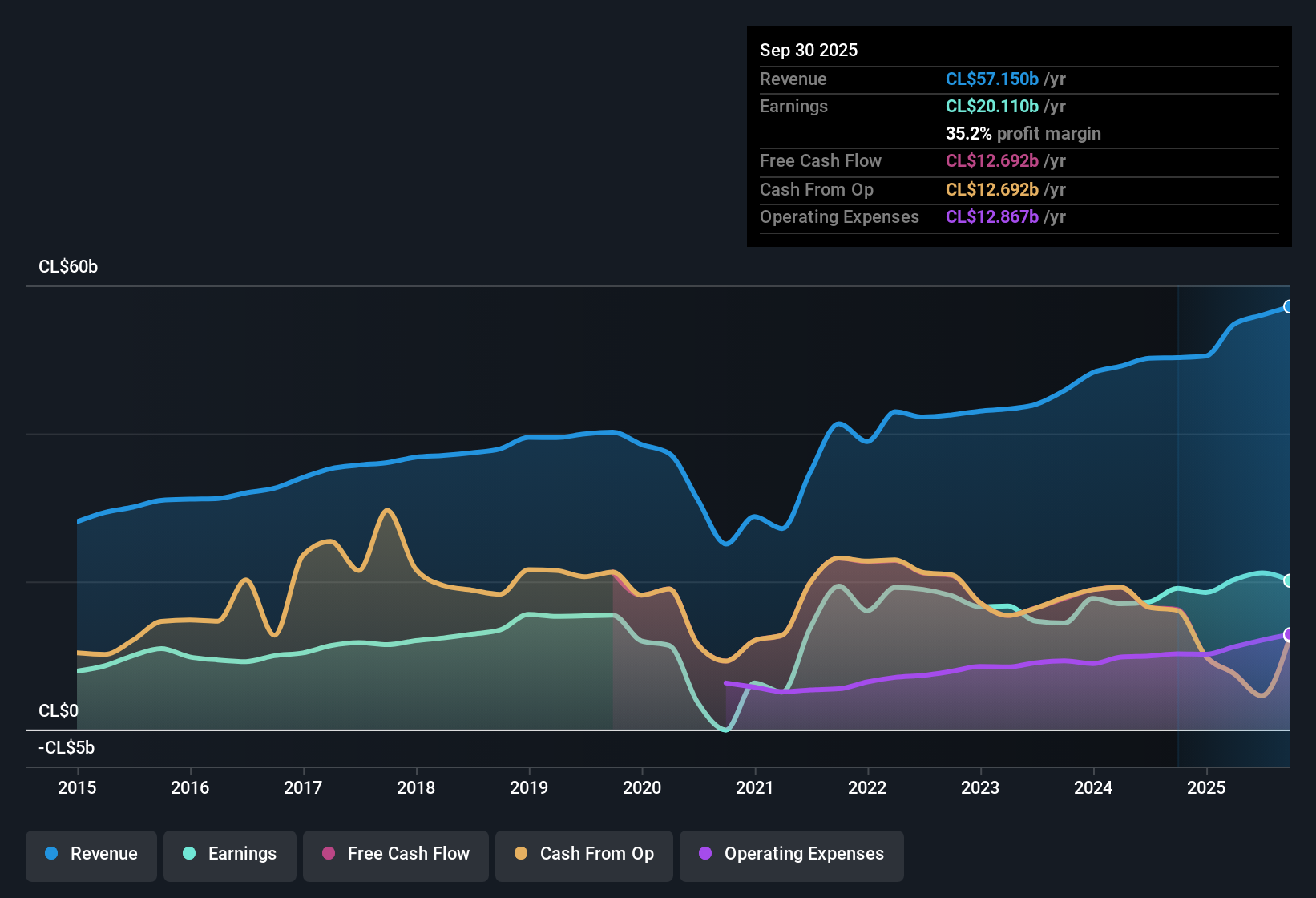

For the year to September 2025, Zona Franca de Iquique had an accrual ratio of 0.42. That means it didn't generate anywhere near enough free cash flow to match its profit. Statistically speaking, that's a real negative for future earnings. Indeed, in the last twelve months it reported free cash flow of CL$13b, which is significantly less than its profit of CL$20.1b. Zona Franca de Iquique shareholders will no doubt be hoping that its free cash flow bounces back next year, since it was down over the last twelve months.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Zona Franca de Iquique.

Our Take On Zona Franca de Iquique's Profit Performance

As we discussed above, we think Zona Franca de Iquique's earnings were not supported by free cash flow, which might concern some investors. As a result, we think it may well be the case that Zona Franca de Iquique's underlying earnings power is lower than its statutory profit. But at least holders can take some solace from the 11% per annum growth in EPS for the last three. At the end of the day, it's essential to consider more than just the factors above, if you want to understand the company properly. If you'd like to know more about Zona Franca de Iquique as a business, it's important to be aware of any risks it's facing. Our analysis shows 2 warning signs for Zona Franca de Iquique (1 is a bit unpleasant!) and we strongly recommend you look at these before investing.

Today we've zoomed in on a single data point to better understand the nature of Zona Franca de Iquique's profit. But there is always more to discover if you are capable of focussing your mind on minutiae. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks with high insider ownership.

Valuation is complex, but we're here to simplify it.

Discover if Zona Franca de Iquique might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SNSE:ZOFRI

Zona Franca de Iquique

Operates premises for wholesale and retail business centers in the duty-free zones of South America.

Flawless balance sheet second-rate dividend payer.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026