- Chile

- /

- Metals and Mining

- /

- SNSE:MOLYMET

Here's Why Molibdenos y Metales (SNSE:MOLYMET) Has A Meaningful Debt Burden

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We note that Molibdenos y Metales S.A. (SNSE:MOLYMET) does have debt on its balance sheet. But the real question is whether this debt is making the company risky.

Why Does Debt Bring Risk?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

View our latest analysis for Molibdenos y Metales

What Is Molibdenos y Metales's Debt?

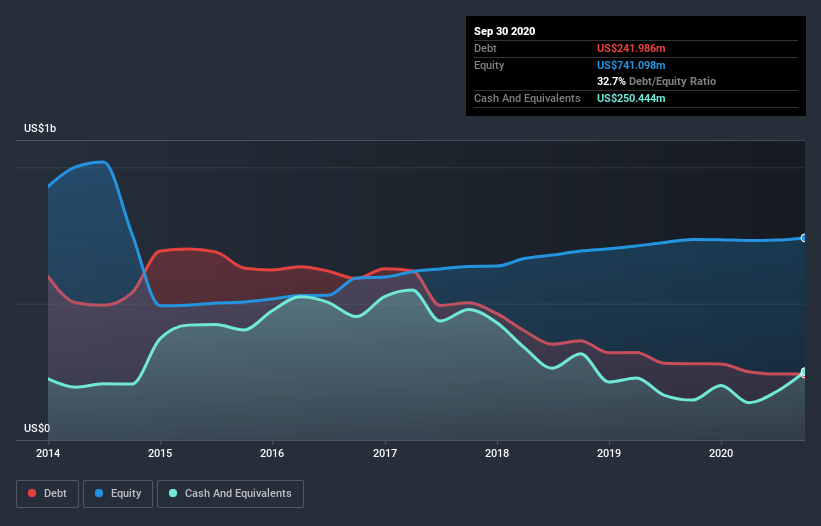

As you can see below, Molibdenos y Metales had US$242.0m of debt at September 2020, down from US$279.6m a year prior. However, its balance sheet shows it holds US$250.4m in cash, so it actually has US$8.46m net cash.

How Healthy Is Molibdenos y Metales's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Molibdenos y Metales had liabilities of US$165.6m due within 12 months and liabilities of US$349.9m due beyond that. Offsetting this, it had US$250.4m in cash and US$90.9m in receivables that were due within 12 months. So its liabilities total US$174.3m more than the combination of its cash and short-term receivables.

Given Molibdenos y Metales has a market capitalization of US$979.5m, it's hard to believe these liabilities pose much threat. But there are sufficient liabilities that we would certainly recommend shareholders continue to monitor the balance sheet, going forward. Despite its noteworthy liabilities, Molibdenos y Metales boasts net cash, so it's fair to say it does not have a heavy debt load!

Importantly, Molibdenos y Metales's EBIT fell a jaw-dropping 44% in the last twelve months. If that decline continues then paying off debt will be harder than selling foie gras at a vegan convention. The balance sheet is clearly the area to focus on when you are analysing debt. But you can't view debt in total isolation; since Molibdenos y Metales will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. Molibdenos y Metales may have net cash on the balance sheet, but it is still interesting to look at how well the business converts its earnings before interest and tax (EBIT) to free cash flow, because that will influence both its need for, and its capacity to manage debt. Looking at the most recent three years, Molibdenos y Metales recorded free cash flow of 49% of its EBIT, which is weaker than we'd expect. That's not great, when it comes to paying down debt.

Summing up

Although Molibdenos y Metales's balance sheet isn't particularly strong, due to the total liabilities, it is clearly positive to see that it has net cash of US$8.46m. So while Molibdenos y Metales does not have a great balance sheet, it's certainly not too bad. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. For example, we've discovered 2 warning signs for Molibdenos y Metales that you should be aware of before investing here.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

If you decide to trade Molibdenos y Metales, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About SNSE:MOLYMET

Molibdenos y Metales

Engages in the processing of molybdenum concentrate worldwide.

Proven track record with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)