- Chile

- /

- Paper and Forestry Products

- /

- SNSE:MASISA

Masisa's (SNSE:MASISA) Shareholders Are Down 70% On Their Shares

It is doubtless a positive to see that the Masisa S.A. (SNSE:MASISA) share price has gained some 41% in the last three months. But that is small recompense for the exasperating returns over three years. Indeed, the share price is down a tragic 70% in the last three years. So it's good to see it climbing back up. While many would remain nervous, there could be further gains if the business can put its best foot forward.

See our latest analysis for Masisa

Masisa recorded just US$562,646,000 in revenue over the last twelve months, which isn't really enough for us to consider it to have a proven product. We can't help wondering why it's publicly listed so early in its journey. Are venture capitalists not interested? So it seems that the investors focused more on what could be, than paying attention to the current revenues (or lack thereof). Investors will be hoping that Masisa can make progress and gain better traction for the business, before it runs low on cash.

We think companies that have neither significant revenues nor profits are pretty high risk. You should be aware that there is always a chance that this sort of company will need to issue more shares to raise money to continue pursuing its business plan. While some such companies go on to make revenue, profits, and generate value, others get hyped up by hopeful naifs before eventually going bankrupt. Masisa has already given some investors a taste of the bitter losses that high risk investing can cause.

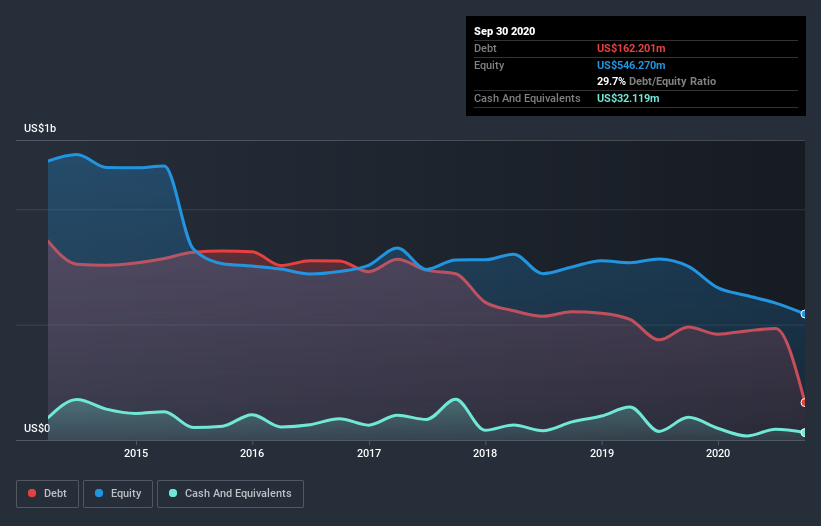

Our data indicates that Masisa had US$210m more in total liabilities than it had cash, when it last reported in September 2020. That makes it extremely high risk, in our view. But since the share price has dived 33% per year, over 3 years , it looks like some investors think it's time to abandon ship, so to speak. You can click on the image below to see (in greater detail) how Masisa's cash levels have changed over time.

Of course, the truth is that it is hard to value companies without much revenue or profit. Would it bother you if insiders were selling the stock? I'd like that just about as much as I like to drink milk and fruit juice mixed together. You can click here to see if there are insiders selling.

What about the Total Shareholder Return (TSR)?

Investors should note that there's a difference between Masisa's total shareholder return (TSR) and its share price change, which we've covered above. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Dividends have been really beneficial for Masisa shareholders, and that cash payout explains why its total shareholder loss of 56%, over the last 3 years, isn't as bad as the share price return.

A Different Perspective

Investors in Masisa had a tough year, with a total loss of 50%, against a market gain of about 2.5%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Longer term investors wouldn't be so upset, since they would have made 2%, each year, over five years. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Case in point: We've spotted 2 warning signs for Masisa you should be aware of, and 1 of them doesn't sit too well with us.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CL exchanges.

If you decide to trade Masisa, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SNSE:MASISA

Masisa

Manufactures and sells wooden boards for furniture solutions and interior spaces in Chile, the United States, Peru, Colombia, Ecuador, Canada, China, Vietnam, South Korea, and internationally.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives