- Chile

- /

- Metals and Mining

- /

- SNSE:CAP

Analysts Just Made A Huge Upgrade To Their CAP S.A. (SNSE:CAP) Forecasts

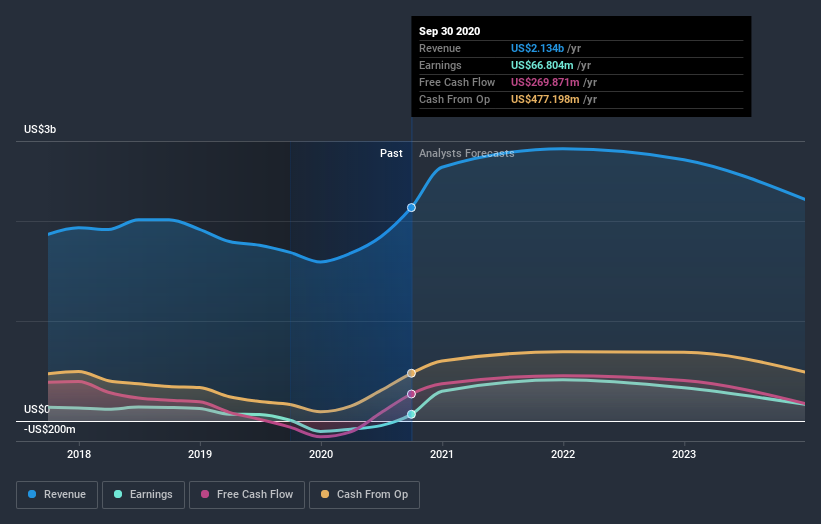

Celebrations may be in order for CAP S.A. (SNSE:CAP) shareholders, with the analysts delivering a significant upgrade to their statutory estimates for the company. The consensus statutory numbers for both revenue and earnings per share (EPS) increased, with their view clearly much more bullish on the company's business prospects. The market may be pricing in some blue sky too, with the share price gaining 14% to CL$8,738 in the last 7 days. It will be interesting to see if today's upgrade is enough to propel the stock even higher.

Following the upgrade, the most recent consensus for CAP from its five analysts is for revenues of US$2.7b in 2021 which, if met, would be a sizeable 28% increase on its sales over the past 12 months. Per-share earnings are expected to bounce 516% to US$2.75. Before this latest update, the analysts had been forecasting revenues of US$2.4b and earnings per share (EPS) of US$2.00 in 2021. So we can see there's been a pretty clear increase in analyst sentiment in recent times, with both revenues and earnings per share receiving a decent lift in the latest estimates.

Check out our latest analysis for CAP

With these upgrades, we're not surprised to see that the analysts have lifted their price target 13% to US$12.98 per share. It could also be instructive to look at the range of analyst estimates, to evaluate how different the outlier opinions are from the mean. There are some variant perceptions on CAP, with the most bullish analyst valuing it at US$12,009 and the most bearish at US$7,788 per share. As you can see the range of estimates is wide, with the lowest valuation coming in at less than half the most bullish estimate, suggesting there are some strongly diverging views on how think this business will perform. As a result it might not be possible to derive much meaning from the consensus price target, which is after all just an average of this wide range of estimates.

Of course, another way to look at these forecasts is to place them into context against the industry itself. It's clear from the latest estimates that CAP's rate of growth is expected to accelerate meaningfully, with the forecast 28% revenue growth noticeably faster than its historical growth of 4.2% p.a. over the past five years. Compare this with other companies in the same industry, which are forecast to grow their revenue 4.3% next year. It seems obvious that, while the growth outlook is brighter than the recent past, the analysts also expect CAP to grow faster than the wider industry.

The Bottom Line

The biggest takeaway for us from these new estimates is that analysts upgraded their earnings per share estimates, with improved earnings power expected for next year. They also upgraded their revenue estimates for next year, and sales are expected to grow faster than the wider market. Given that the consensus looks almost universally bullish, with a substantial increase to forecasts and a higher price target, CAP could be worth investigating further.

Still, the long-term prospects of the business are much more relevant than next year's earnings. At Simply Wall St, we have a full range of analyst estimates for CAP going out to 2023, and you can see them free on our platform here..

Another way to search for interesting companies that could be reaching an inflection point is to track whether management are buying or selling, with our free list of growing companies that insiders are buying.

When trading CAP or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About SNSE:CAP

CAP

Engages in iron ore mining, steel production, steel processing, and infrastructure businesses in Chile and internationally.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Automotive Electronics Manufacturer Consistent and Stable

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion