Multiexport Foods (SNSE:MULTIFOODS) Has Rewarded Shareholders With An Exceptional 356% Total Return On Their Investment

The worst result, after buying shares in a company (assuming no leverage), would be if you lose all the money you put in. But when you pick a company that is really flourishing, you can make more than 100%. Long term Multiexport Foods S.A. (SNSE:MULTIFOODS) shareholders would be well aware of this, since the stock is up 289% in five years. It's even up 5.6% in the last week.

Check out our latest analysis for Multiexport Foods

We don't think Multiexport Foods' revenue of US$493,680,000 is enough to establish significant demand. As a result, we think it's unlikely shareholders are paying much attention to current revenue, but rather speculating on growth in the years to come. Investors will be hoping that Multiexport Foods can make progress and gain better traction for the business, before it runs low on cash.

Companies that lack both meaningful revenue and profits are usually considered high risk. There is almost always a chance they will need to raise more capital, and their progress - and share price - will dictate how dilutive that is to current holders. While some companies like this go on to deliver on their plan, making good money for shareholders, many end in painful losses and eventual de-listing. Multiexport Foods has already given some investors a taste of the sweet gains that high risk investing can generate, if your timing is right.

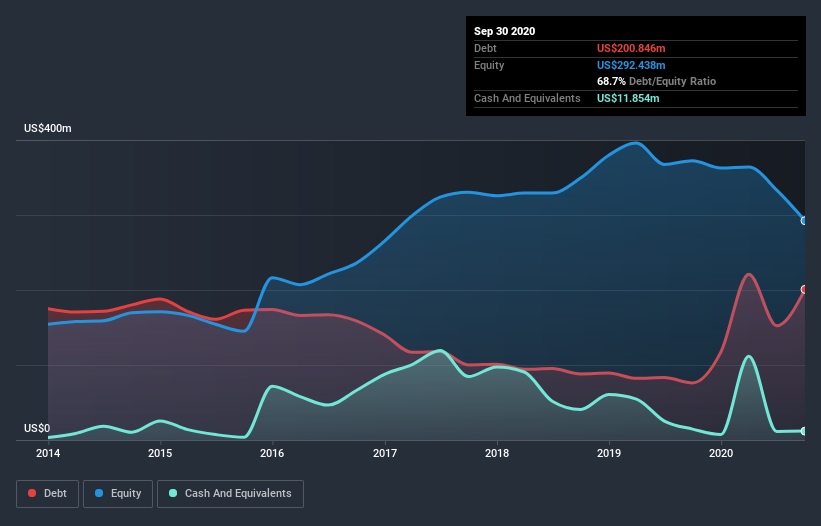

Multiexport Foods had liabilities exceeding cash by US$318m when it last reported in September 2020, according to our data. That makes it extremely high risk, in our view. So the fact that the stock is up 60% per year, over 5 years shows that high risks can lead to high rewards, sometimes. Investors must really like its potential. The image below shows how Multiexport Foods' balance sheet has changed over time; if you want to see the precise values, simply click on the image.

In reality it's hard to have much certainty when valuing a business that has neither revenue or profit. However you can take a look at whether insiders have been buying up shares. If they are buying a significant amount of shares, that's certainly a good thing. Luckily we are in a position to provide you with this free chart of insider buying (and selling).

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. As it happens, Multiexport Foods' TSR for the last 5 years was 356%, which exceeds the share price return mentioned earlier. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

While the broader market lost about 14% in the twelve months, Multiexport Foods shareholders did even worse, losing 28% (even including dividends). However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. On the bright side, long term shareholders have made money, with a gain of 35% per year over half a decade. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Take risks, for example - Multiexport Foods has 1 warning sign we think you should be aware of.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CL exchanges.

When trading Multiexport Foods or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

If you're looking to trade Multiexport Foods, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About SNSE:MULTI X

Multiexport Foods

Provides seafood products in Chile and internationally.

Imperfect balance sheet and overvalued.

Similar Companies

Market Insights

Community Narratives