How Much Did Hortifrut's(SNSE:HF) Shareholders Earn From Share Price Movements Over The Last Three Years?

While not a mind-blowing move, it is good to see that the Hortifrut S.A. (SNSE:HF) share price has gained 22% in the last three months. But that doesn't change the fact that the returns over the last three years have been disappointing. Tragically, the share price declined 55% in that time. So it's good to see it climbing back up. The rise has some hopeful, but turnarounds are often precarious.

View our latest analysis for Hortifrut

With just US$640,892,000 worth of revenue in twelve months, we don't think the market considers Hortifrut to have proven its business plan. We can't help wondering why it's publicly listed so early in its journey. Are venture capitalists not interested? As a result, we think it's unlikely shareholders are paying much attention to current revenue, but rather speculating on growth in the years to come. It seems likely some shareholders believe that Hortifrut will significantly advance the business plan before too long.

We think companies that have neither significant revenues nor profits are pretty high risk. You should be aware that there is always a chance that this sort of company will need to issue more shares to raise money to continue pursuing its business plan. While some such companies go on to make revenue, profits, and generate value, others get hyped up by hopeful naifs before eventually going bankrupt. Hortifrut has already given some investors a taste of the bitter losses that high risk investing can cause.

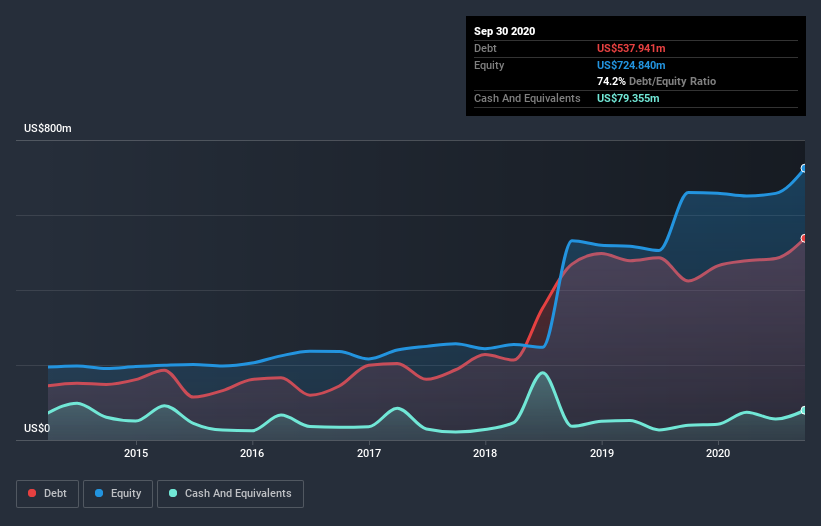

Our data indicates that Hortifrut had US$669m more in total liabilities than it had cash, when it last reported in September 2020. That puts it in the highest risk category, according to our analysis. But since the share price has dived 24% per year, over 3 years , it looks like some investors think it's time to abandon ship, so to speak. You can click on the image below to see (in greater detail) how Hortifrut's cash levels have changed over time.

Of course, the truth is that it is hard to value companies without much revenue or profit. What if insiders are ditching the stock hand over fist? It would bother me, that's for sure. It only takes a moment for you to check whether we have identified any insider sales recently.

A Different Perspective

We regret to report that Hortifrut shareholders are down 21% for the year (even including dividends). Unfortunately, that's worse than the broader market decline of 1.1%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Longer term investors wouldn't be so upset, since they would have made 9%, each year, over five years. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For instance, we've identified 3 warning signs for Hortifrut (1 is concerning) that you should be aware of.

But note: Hortifrut may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CL exchanges.

If you’re looking to trade Hortifrut, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Hortifrut might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SNSE:HF

Poor track record with worrying balance sheet.

Market Insights

Community Narratives