- Chile

- /

- Specialty Stores

- /

- SNSE:COPEC

Empresas Copec S.A.'s (SNSE:COPEC) Subdued P/S Might Signal An Opportunity

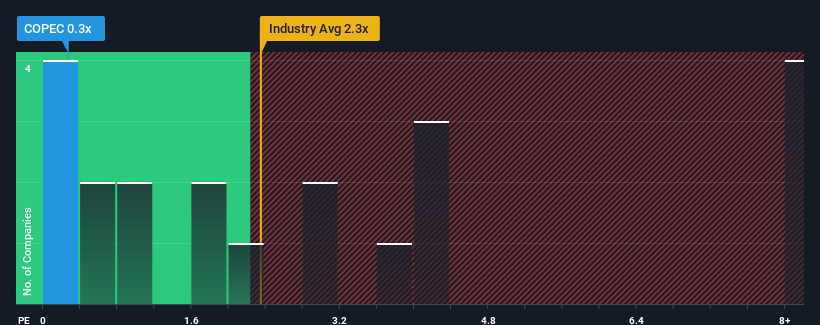

Empresas Copec S.A.'s (SNSE:COPEC) price-to-sales (or "P/S") ratio of 0.3x might make it look like a strong buy right now compared to the Oil and Gas industry in Chile, where around half of the companies have P/S ratios above 2.3x and even P/S above 5x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

View our latest analysis for Empresas Copec

How Empresas Copec Has Been Performing

With its revenue growth in positive territory compared to the declining revenue of most other companies, Empresas Copec has been doing quite well of late. It might be that many expect the strong revenue performance to degrade substantially, possibly more than the industry, which has repressed the P/S. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on Empresas Copec will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The Low P/S?

In order to justify its P/S ratio, Empresas Copec would need to produce anemic growth that's substantially trailing the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 9.2%. This was backed up an excellent period prior to see revenue up by 65% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Turning to the outlook, the next three years should bring diminished returns, with revenue decreasing 0.1% per annum as estimated by the eleven analysts watching the company. With the rest of the industry predicted to shrink by 2.2% each year, it's still an optimal result.

With this in mind, we find it curious but not unexplainable that Empresas Copec's P/S falls short of its industry peers. With revenue going in reverse, it's not guaranteed that the P/S has found a floor yet. Even just maintaining these prices could be difficult to achieve as the weak outlook is already weighing down the shares excessively.

The Bottom Line On Empresas Copec's P/S

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Empresas Copec currently trades on a much lower than expected P/S since its revenue forecast is not as bad as the struggling industry. The P/S ratio may not align with the more favourable outlook due to the market pricing in potential revenue risks. Amidst challenging industry conditions, a key concern is whether the company can sustain its superior revenue growth trajectory. It appears many are indeed anticipating revenue instability, because the company's current prospects should normally constitute a higher P/S and thus share price.

And what about other risks? Every company has them, and we've spotted 4 warning signs for Empresas Copec (of which 2 are significant!) you should know about.

If these risks are making you reconsider your opinion on Empresas Copec, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Empresas Copec might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SNSE:COPEC

Empresas Copec

Operates in the natural resources and energy sectors in Chile and internationally.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives