- Chile

- /

- Capital Markets

- /

- SNSE:BOLSASTGO

It Might Not Be A Great Idea To Buy Bolsa de Comercio de Santiago, Bolsa de Valores (SNSE:BOLSASTGO) For Its Next Dividend

Bolsa de Comercio de Santiago, Bolsa de Valores (SNSE:BOLSASTGO) stock is about to trade ex-dividend in 3 days. Ex-dividend means that investors that purchase the stock on or after the 14th of December will not receive this dividend, which will be paid on the 18th of December.

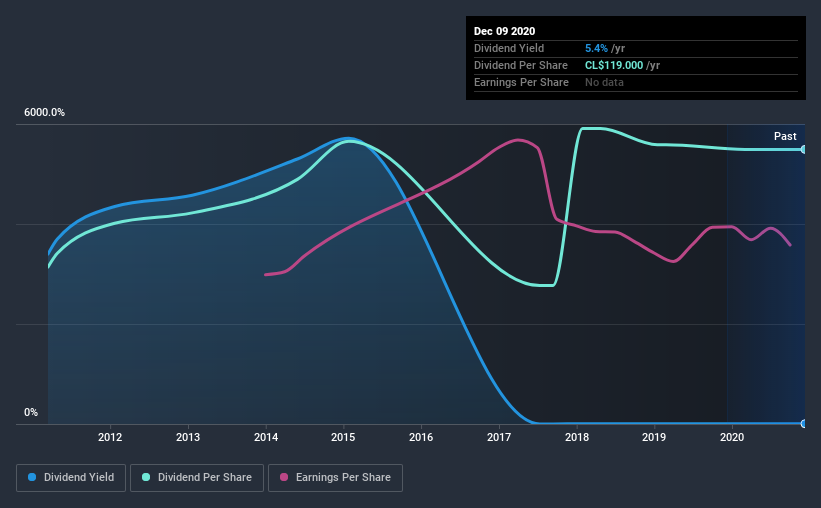

Bolsa de Comercio de Santiago Bolsa de Valores's next dividend payment will be CL$13.42 per share. Last year, in total, the company distributed CL$119 to shareholders. Last year's total dividend payments show that Bolsa de Comercio de Santiago Bolsa de Valores has a trailing yield of 5.4% on the current share price of CLP2220. If you buy this business for its dividend, you should have an idea of whether Bolsa de Comercio de Santiago Bolsa de Valores's dividend is reliable and sustainable. So we need to investigate whether Bolsa de Comercio de Santiago Bolsa de Valores can afford its dividend, and if the dividend could grow.

View our latest analysis for Bolsa de Comercio de Santiago Bolsa de Valores

If a company pays out more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. Bolsa de Comercio de Santiago Bolsa de Valores paid out 56% of its earnings to investors last year, a normal payout level for most businesses.

When a company paid out less in dividends than it earned in profit, this generally suggests its dividend is affordable. The lower the % of its profit that it pays out, the greater the margin of safety for the dividend if the business enters a downturn.

Have Earnings And Dividends Been Growing?

Companies with falling earnings are riskier for dividend shareholders. If earnings fall far enough, the company could be forced to cut its dividend. Readers will understand then, why we're concerned to see Bolsa de Comercio de Santiago Bolsa de Valores's earnings per share have dropped 13% a year over the past five years. Such a sharp decline casts doubt on the future sustainability of the dividend.

Another key way to measure a company's dividend prospects is by measuring its historical rate of dividend growth. In the past 10 years, Bolsa de Comercio de Santiago Bolsa de Valores has increased its dividend at approximately 5.8% a year on average. That's interesting, but the combination of a growing dividend despite declining earnings can typically only be achieved by paying out more of the company's profits. This can be valuable for shareholders, but it can't go on forever.

The Bottom Line

Should investors buy Bolsa de Comercio de Santiago Bolsa de Valores for the upcoming dividend? Earnings per share have been declining and the company is paying out more than half its profits to shareholders; not an enticing combination. These characteristics don't generally lead to outstanding dividend performance, and investors may not be happy with the results of owning this stock for its dividend.

Having said that, if you're looking at this stock without much concern for the dividend, you should still be familiar of the risks involved with Bolsa de Comercio de Santiago Bolsa de Valores. Every company has risks, and we've spotted 2 warning signs for Bolsa de Comercio de Santiago Bolsa de Valores (of which 1 makes us a bit uncomfortable!) you should know about.

If you're in the market for dividend stocks, we recommend checking our list of top dividend stocks with a greater than 2% yield and an upcoming dividend.

If you’re looking to trade Bolsa de Comercio de Santiago Bolsa de Valores, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Bolsa de Comercio de Santiago Bolsa de Valores might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About SNSE:BOLSASTGO

Bolsa de Comercio de Santiago Bolsa de Valores

Operates as a securities exchange that provides services to financial market players in Chile.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives