- Chile

- /

- Consumer Durables

- /

- SNSE:MANQUEHUE

What Type Of Returns Would Inmobiliaria Manquehue's(SNSE:MANQUEHUE) Shareholders Have Earned If They Purchased Their SharesYear Ago?

It's easy to match the overall market return by buying an index fund. When you buy individual stocks, you can make higher profits, but you also face the risk of under-performance. For example, the Inmobiliaria Manquehue S.A. (SNSE:MANQUEHUE) share price is down 27% in the last year. That contrasts poorly with the market decline of 9.0%. Inmobiliaria Manquehue hasn't been listed for long, so although we're wary of recent listings that perform poorly, it may still prove itself with time.

Check out our latest analysis for Inmobiliaria Manquehue

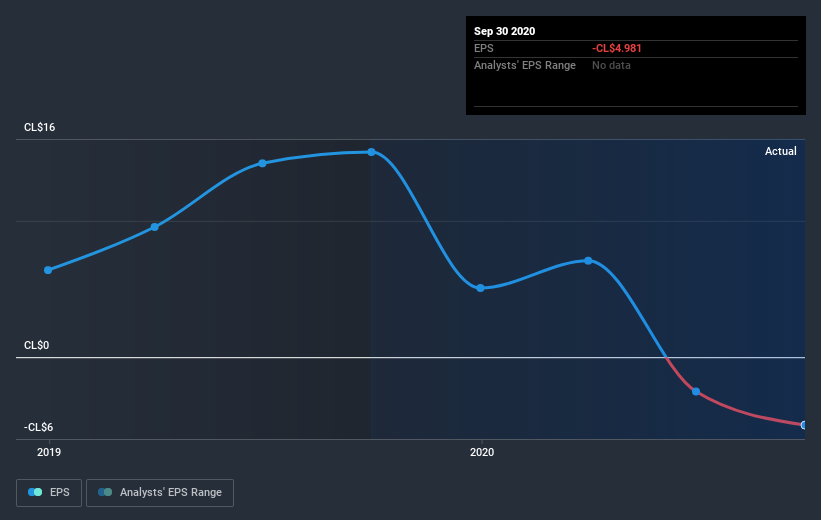

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the last year Inmobiliaria Manquehue saw its earnings per share drop below zero. Some investors no doubt dumped the stock as a result. Of course, if the company can turn the situation around, investors will likely profit.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here.

A Different Perspective

We doubt Inmobiliaria Manquehue shareholders are happy with the loss of 26% over twelve months (even including dividends). That falls short of the market, which lost 9.0%. There's no doubt that's a disappointment, but the stock may well have fared better in a stronger market. The share price decline has continued throughout the most recent three months, down 0.6%, suggesting an absence of enthusiasm from investors. Given the relatively short history of this stock, we'd remain pretty wary until we see some strong business performance. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Even so, be aware that Inmobiliaria Manquehue is showing 3 warning signs in our investment analysis , and 2 of those are a bit concerning...

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CL exchanges.

If you’re looking to trade Inmobiliaria Manquehue, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SNSE:MANQUEHUE

Inmobiliaria Manquehue

Engages in real estate development business in Chile.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives