Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We can see that Quiñenco S.A. (SNSE:QUINENCO) does use debt in its business. But the real question is whether this debt is making the company risky.

What Risk Does Debt Bring?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. The first step when considering a company's debt levels is to consider its cash and debt together.

View our latest analysis for Quiñenco

What Is Quiñenco's Debt?

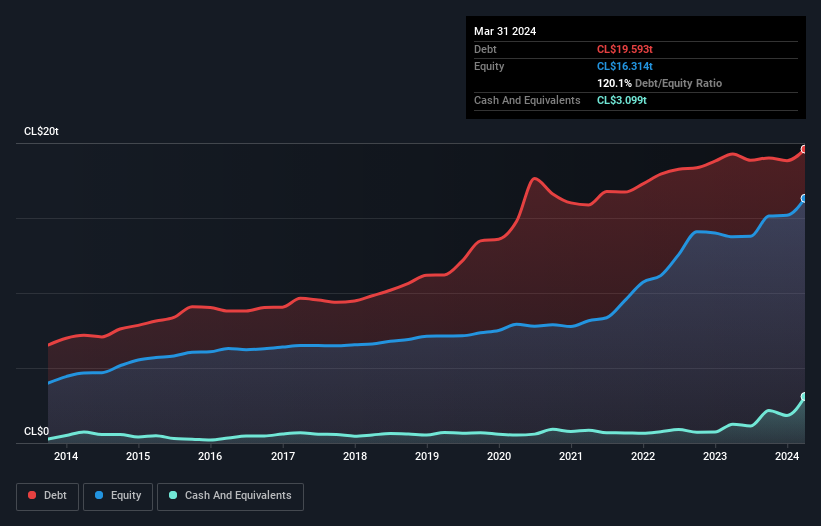

The chart below, which you can click on for greater detail, shows that Quiñenco had CL$20t in debt in March 2024; about the same as the year before. On the flip side, it has CL$3.10t in cash leading to net debt of about CL$16t.

A Look At Quiñenco's Liabilities

According to the last reported balance sheet, Quiñenco had liabilities of CL$41t due within 12 months, and liabilities of CL$15t due beyond 12 months. Offsetting this, it had CL$3.10t in cash and CL$1.10t in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by CL$51t.

The deficiency here weighs heavily on the CL$5.32t company itself, as if a child were struggling under the weight of an enormous back-pack full of books, his sports gear, and a trumpet. So we'd watch its balance sheet closely, without a doubt. After all, Quiñenco would likely require a major re-capitalisation if it had to pay its creditors today.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Strangely Quiñenco has a sky high EBITDA ratio of 8.6, implying high debt, but a strong interest coverage of 1k. So either it has access to very cheap long term debt or that interest expense is going to grow! We saw Quiñenco grow its EBIT by 2.7% in the last twelve months. That's far from incredible but it is a good thing, when it comes to paying off debt. There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since Quiñenco will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. Happily for any shareholders, Quiñenco actually produced more free cash flow than EBIT over the last three years. That sort of strong cash conversion gets us as excited as the crowd when the beat drops at a Daft Punk concert.

Our View

While Quiñenco's level of total liabilities has us nervous. To wit both its interest cover and conversion of EBIT to free cash flow were encouraging signs. Taking the abovementioned factors together we do think Quiñenco's debt poses some risks to the business. While that debt can boost returns, we think the company has enough leverage now. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. Case in point: We've spotted 4 warning signs for Quiñenco you should be aware of, and 1 of them is potentially serious.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

Valuation is complex, but we're here to simplify it.

Discover if Quiñenco might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SNSE:QUINENCO

Quiñenco

Quiñenco S.A., a business conglomerate, operates in the industrial and financial services sectors in Chile and internationally.

Excellent balance sheet slight.