The goal of this article is to teach you how to use price to earnings ratios (P/E ratios). To keep it practical, we'll show how Nibsa S.A.'s (SNSE:NIBSA) P/E ratio could help you assess the value on offer. Based on the last twelve months, Nibsa's P/E ratio is 37.95. In other words, at today's prices, investors are paying CLP37.95 for every CLP1 in prior year profit.

See our latest analysis for Nibsa

How Do You Calculate A P/E Ratio?

The formula for price to earnings is:

Price to Earnings Ratio = Share Price ÷ Earnings per Share (EPS)

Or for Nibsa:

P/E of 37.95 = CLP6700.000 ÷ CLP176.530 (Based on the year to December 2019.)

(Note: the above calculation results may not be precise due to rounding.)

Is A High Price-to-Earnings Ratio Good?

A higher P/E ratio means that buyers have to pay a higher price for each CLP1 the company has earned over the last year. That isn't necessarily good or bad, but a high P/E implies relatively high expectations of what a company can achieve in the future.

How Does Nibsa's P/E Ratio Compare To Its Peers?

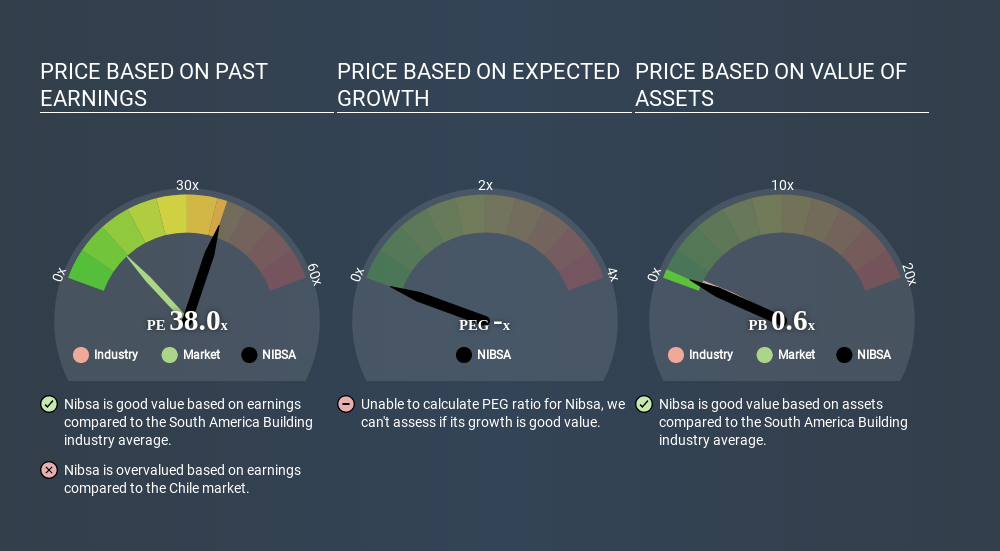

One good way to get a quick read on what market participants expect of a company is to look at its P/E ratio. As you can see below Nibsa has a P/E ratio that is fairly close for the average for the building industry, which is 38.0.

Nibsa's P/E tells us that market participants think its prospects are roughly in line with its industry. So if Nibsa actually outperforms its peers going forward, that should be a positive for the share price. Checking factors such as director buying and selling. could help you form your own view on if that will happen.

How Growth Rates Impact P/E Ratios

Earnings growth rates have a big influence on P/E ratios. Earnings growth means that in the future the 'E' will be higher. That means even if the current P/E is high, it will reduce over time if the share price stays flat. So while a stock may look expensive based on past earnings, it could be cheap based on future earnings.

Nibsa increased earnings per share by an impressive 10% over the last twelve months. And it has improved its earnings per share by 24% per year over the last three years. This could arguably justify a relatively high P/E ratio. In contrast, EPS has decreased by 21%, annually, over 5 years.

Don't Forget: The P/E Does Not Account For Debt or Bank Deposits

The 'Price' in P/E reflects the market capitalization of the company. Thus, the metric does not reflect cash or debt held by the company. Theoretically, a business can improve its earnings (and produce a lower P/E in the future) by investing in growth. That means taking on debt (or spending its cash).

Such expenditure might be good or bad, in the long term, but the point here is that the balance sheet is not reflected by this ratio.

So What Does Nibsa's Balance Sheet Tell Us?

Nibsa has net cash of CL$94m. That should lead to a higher P/E than if it did have debt, because its strong balance sheets gives it more options.

The Bottom Line On Nibsa's P/E Ratio

Nibsa's P/E is 38.0 which is way above average (11.6) in its market. Its strong balance sheet gives the company plenty of resources for extra growth, and it has already proven it can grow. So it does not seem strange that the P/E is above average.

When the market is wrong about a stock, it gives savvy investors an opportunity. As value investor Benjamin Graham famously said, 'In the short run, the market is a voting machine but in the long run, it is a weighing machine. We don't have analyst forecasts, but you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Of course you might be able to find a better stock than Nibsa. So you may wish to see this free collection of other companies that have grown earnings strongly.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

About SNSE:NIBSA

Nibsa

Develops, manufactures, and sells plumbing, bathroom fitting, and other products and solutions in Chile.

Excellent balance sheet, good value and pays a dividend.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Not a Bubble, But the "Industrial Revolution 4.0" Engine

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026