- Switzerland

- /

- Marine and Shipping

- /

- SWX:KNIN

Kuehne + Nagel (SWX:KNIN): Valuation Insights as Profit Outlook Softens on Lower Guidance and Weaker Q3 Results

Reviewed by Simply Wall St

Kuehne + Nagel International (SWX:KNIN) lowered its recurring EBIT guidance for 2025 following a quarter in which net income and sales continued to decline compared to last year, reflecting persistent headwinds in the logistics sector.

See our latest analysis for Kuehne + Nagel International.

The latest profit warning follows a sharp loss of momentum in Kuehne + Nagel International’s share price this year, with a 24.3% year-to-date share price decline and mounting headwinds weighing on sentiment. Over the past year, the company’s total shareholder return slipped 24.1%, underlining a rough patch that has eclipsed pockets of short-term relief. Investors are weighing whether earnings pressures could create longer-term value opportunities.

If the shifting outlook in logistics has you rethinking your approach, now is a great moment to broaden the search and discover fast growing stocks with high insider ownership

With shares trading at a noticeable discount and new guidance reflecting lowered expectations, the key question looms: is this dip revealing an undervalued stock, or are markets already accounting for all foreseeable growth?

Most Popular Narrative: 6.8% Undervalued

With Kuehne + Nagel International’s fair value from the most widely followed narrative sitting above the last close price, there is a distinct gap in how analysts and the market are pricing the company’s prospects. This narrative brings attention to underlying business shifts expected to drive recovery and future growth.

The rapid expansion in global e-commerce and ongoing customer wins in high-growth verticals like healthcare, semiconductors, and hyperscaler/cloud infrastructure are supporting above-market volume growth in both Sea and Air Logistics. This positions Kuehne + Nagel for future revenue acceleration as these sectors continue to outpace overall world trade.

Curious about what is fueling analyst optimism amid turbulence? The core of this narrative hints at rising efficiency, digital transformation, and a radical shift in industry mix. Want to see the full set of projections that underpin this valuation gap? Dive in to uncover where the forecasts get bold.

Result: Fair Value of $168.88 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent currency headwinds and ongoing market volatility could limit sustainable volume growth and put pressure on long-term revenues, challenging the recovery narrative.

Find out about the key risks to this Kuehne + Nagel International narrative.

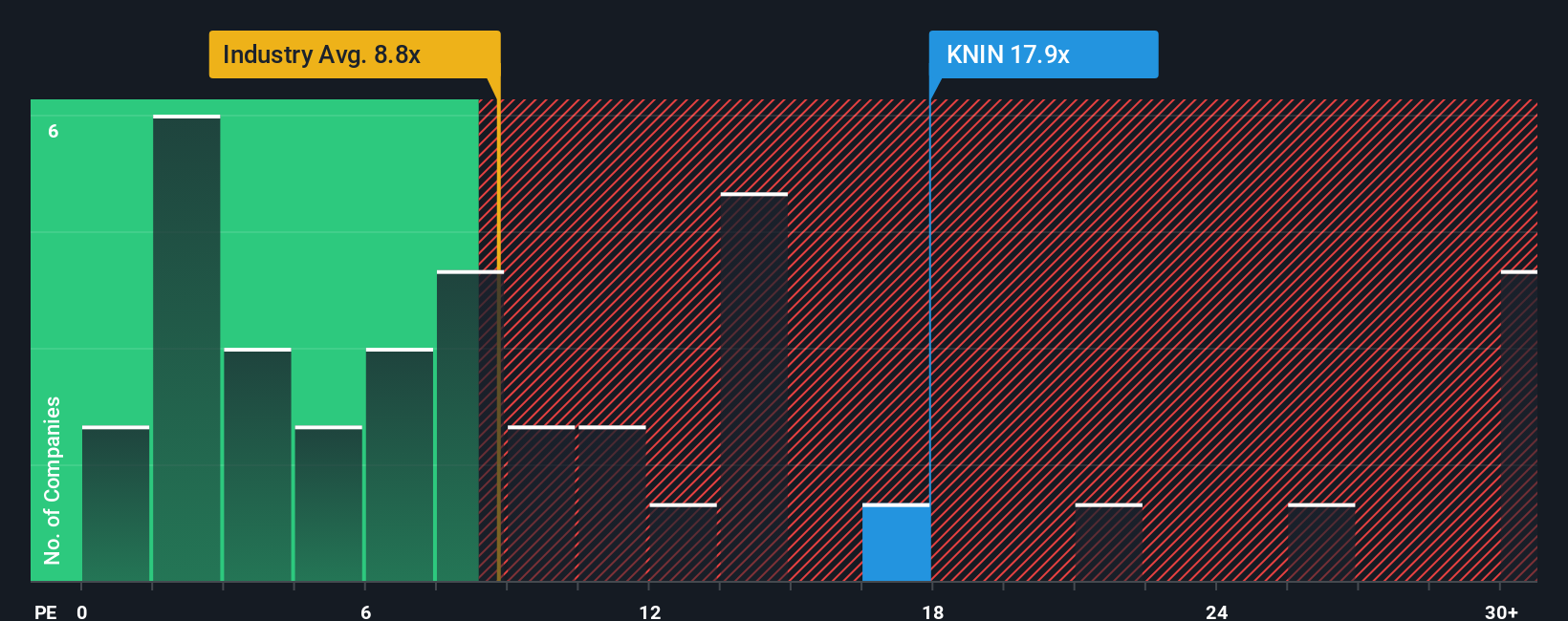

Another View: Market Multiples Tell a Different Story

Looking beyond discounted cash flow, the company's price-to-earnings ratio stands at 18.3x. This is much higher than both its peer average of 9.8x and the European shipping industry average of 9x. While this suggests the market expects greater future growth or resilience, it also increases the risk of disappointment if results fall short. Is the premium really justified, or is the market pricing in too much optimism?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Kuehne + Nagel International Narrative

If the consensus narrative doesn't match your outlook, why not dive into the data yourself and craft a perspective in just minutes? Do it your way

A great starting point for your Kuehne + Nagel International research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Expand your investing universe by tapping into opportunities other investors are missing. These screens can spotlight fresh markets, future winners, or the best values hiding in plain sight.

- Capture the hidden gems in healthcare by targeting companies shaping tomorrow’s medical breakthroughs through these 34 healthcare AI stocks.

- Boost your portfolio’s income potential by harnessing these 21 dividend stocks with yields > 3%, which offers strong yields and a track record of reliable payouts.

- Unleash growth by jumping on these 26 AI penny stocks, companies making waves with artificial intelligence leadership and rapid innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kuehne + Nagel International might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:KNIN

Kuehne + Nagel International

Provides integrated logistics services in Europe, the Middle East, Africa, the Americas, the Asia-Pacific.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives