- Switzerland

- /

- Transportation

- /

- SWX:JFN

Jungfraubahn Holding (SWX:JFN): Assessing Valuation After Strong Share Price Momentum

Reviewed by Kshitija Bhandaru

See our latest analysis for Jungfraubahn Holding.

Jungfraubahn Holding’s recent 10% share price gain builds on a longer stretch of steady momentum. With a 1-year total shareholder return of 35%, investors are seeing a combination of solid business fundamentals and renewed optimism around growth potential. The upward trend suggests momentum is building, helped by consistent performance and a strong track record.

If this kind of sustained progress has you thinking bigger, now is a great time to expand your search and discover fast growing stocks with high insider ownership

But with shares rising so sharply, the key question now is whether Jungfraubahn Holding remains undervalued or if the recent rally means the market has already priced in further growth. Could this be a real buying opportunity?

Price-to-Earnings of 16.4x: Is it justified?

At a price-to-earnings ratio of 16.4x and a last close price of CHF226.5, Jungfraubahn Holding appears more expensive than many of its industry peers.

The price-to-earnings (P/E) ratio measures how much investors are willing to pay for each franc of earnings. For Jungfraubahn Holding, a 16.4x multiple indicates that the market is paying a significant premium for its current earnings stream, possibly pricing in future growth or strong business resilience.

This premium becomes more apparent when compared to the European transportation industry average of 15.6x, and even more so against the broader peer average of just 12.3x. In addition, the estimated fair price-to-earnings ratio for Jungfraubahn Holding is 14.6x, suggesting the share price could be elevated relative to underlying fundamentals and the level the market could move toward.

Explore the SWS fair ratio for Jungfraubahn Holding

Result: Price-to-Earnings of 16.4x (OVERVALUED)

However, slowing annual revenue growth and an above-average valuation could limit further upside if the company's performance does not accelerate meaningfully.

Find out about the key risks to this Jungfraubahn Holding narrative.

Another Perspective: Discounted Cash Flow Suggests Undervaluation

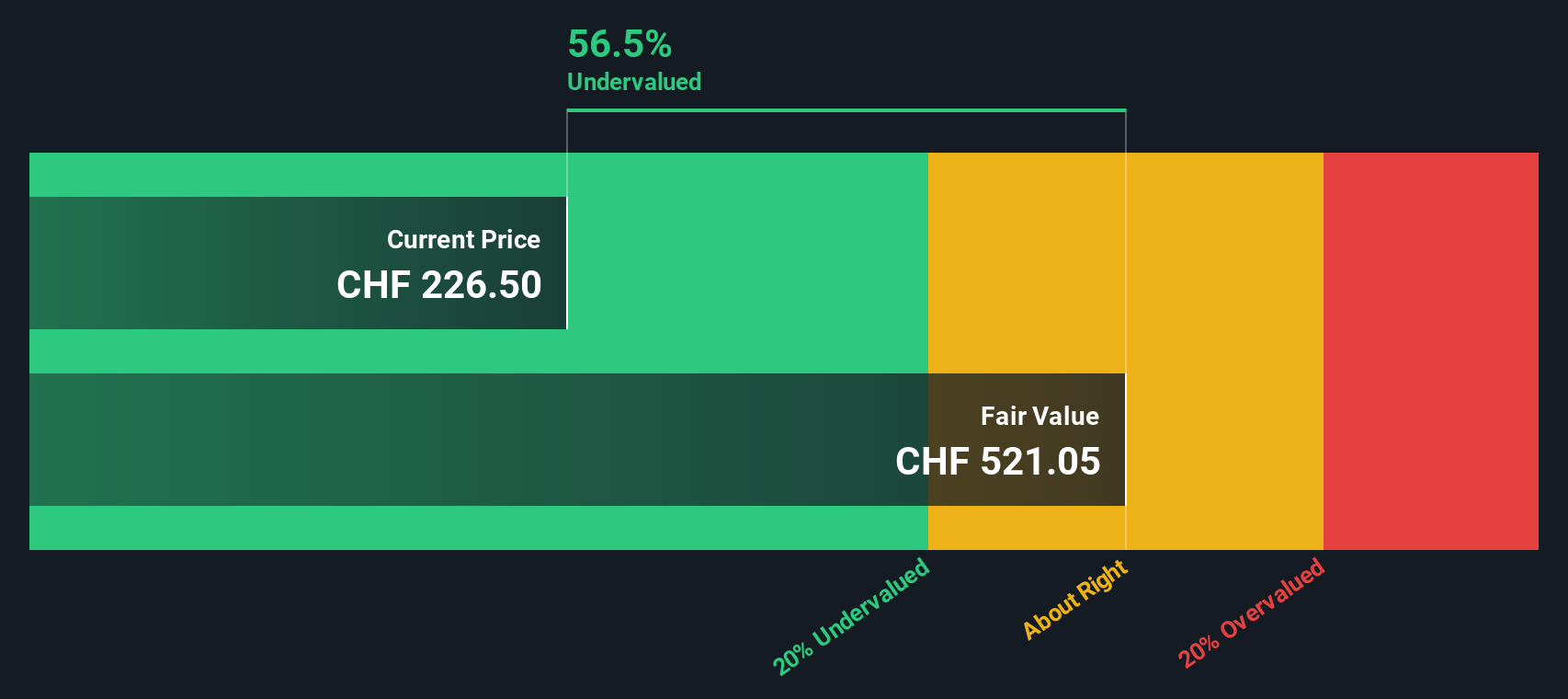

While Jungfraubahn Holding looks expensive based on earnings ratios, the SWS DCF model presents a different picture. According to this approach, the current share price is trading well below the estimated fair value, indicating significant undervaluation. Could this present a hidden opportunity for long-term investors?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Jungfraubahn Holding for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Jungfraubahn Holding Narrative

If you see things differently, or want your own take, you can dive into the numbers and build a personal view in just a few minutes, Do it your way.

A great starting point for your Jungfraubahn Holding research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investing means seizing the right opportunities before they hit the mainstream. Expand your search to sectors brimming with growth, high yields and emerging breakthroughs that others might miss.

- Maximize your income potential and spot shares offering yields above 3% with these 19 dividend stocks with yields > 3%, designed for those who want reliable payouts and financial strength.

- Ride the next wave of technology-led growth by tapping into these 24 AI penny stocks, featuring cutting-edge businesses shaping tomorrow's AI landscape.

- Capitalize on attractive entry points for long-term gains with these 904 undervalued stocks based on cash flows, focused on companies currently trading below their intrinsic value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:JFN

Jungfraubahn Holding

Operates cogwheel railway and winter sports related facilities in Jungfrau region, Switzerland.

Excellent balance sheet second-rate dividend payer.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion