How Sensirion's Miniature CO2 Sensor Launch (SWX:SENS) Has Changed Its Investment Story

Reviewed by Simply Wall St

- Sensirion recently announced the global launch of its STCC4 miniature CO2 sensor, now available through its international network of distributors for a wide range of mass-market indoor air quality applications.

- This innovation, featuring one of the world's smallest direct CO2 sensors, enables more accessible, efficient, and accurate air quality monitoring in compact electronic devices.

- We'll now explore how the release of this ultra-compact sensor could affect Sensirion's growth prospects in environmental sensing applications.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Sensirion Holding Investment Narrative Recap

Investors who see Sensirion as a leader in environmental sensing are often betting on the company’s ability to commercialize breakthrough technologies in mass-market air quality monitoring. The release of the STCC4 miniaturized CO₂ sensor directly supports this growth catalyst, as it may unlock new applications and deepen market penetration. However, in the short term, the material impact will likely hinge on how quickly adoption ramps up and whether new mass-market drivers can offset normalization in recent industrial sales; the biggest risk remains Sensirion’s dependence on one-off growth drivers, with uncertainty over finding the next revenue engine.

Among Sensirion’s recent announcements, the upcoming launch of the SCD43 Photoacoustic NDIR CO₂ sensor in February stands out as highly relevant. This further expands the company’s advanced CO₂ sensing offerings, particularly in smart ventilation and building controls, complementing the STCC4 launch and strengthening the narrative around sustained product innovation as a key catalyst for future growth.

Yet, unlike the excitement around innovative sensors, investors should not lose sight of the risk that Sensirion might struggle to replicate the surge recently seen in industrial sales due to...

Read the full narrative on Sensirion Holding (it's free!)

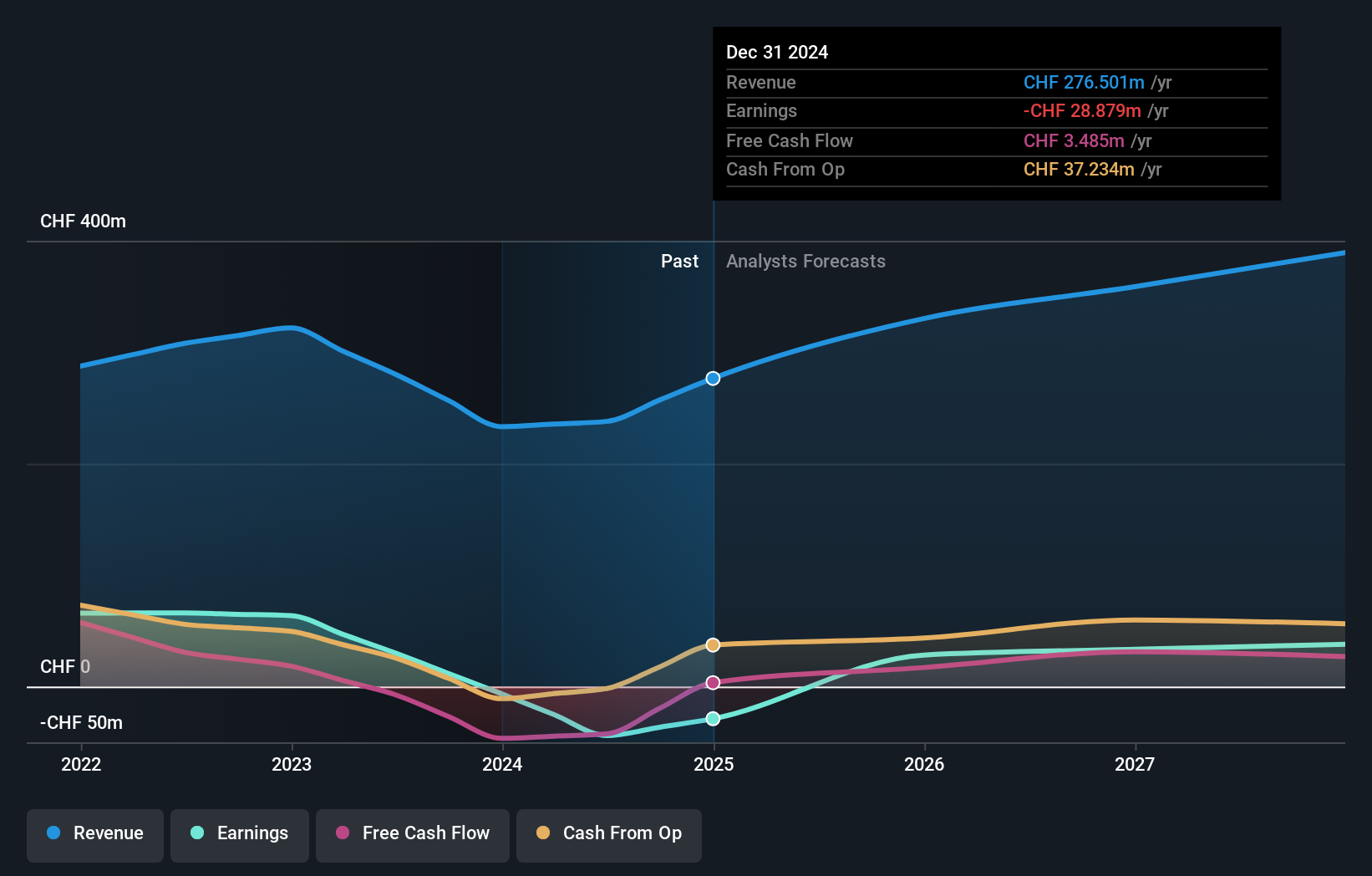

Sensirion Holding's narrative projects CHF403.7 million revenue and CHF44.2 million earnings by 2028. This requires 6.6% yearly revenue growth and a CHF26.6 million earnings increase from CHF17.6 million.

Uncover how Sensirion Holding's forecasts yield a CHF87.00 fair value, a 37% upside to its current price.

Exploring Other Perspectives

The Simply Wall St Community sets Sensirion’s fair value at CHF87, with all estimates clustering at this single point based on one analysis. As you consider this uniform outlook, remember the big unknown remains Sensirion’s ability to identify fresh, high-impact growth drivers beyond specialized sensors.

Explore another fair value estimate on Sensirion Holding - why the stock might be worth as much as 37% more than the current price!

Build Your Own Sensirion Holding Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sensirion Holding research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Sensirion Holding research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sensirion Holding's overall financial health at a glance.

Interested In Other Possibilities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 29 best rare earth metal stocks of the very few that mine this essential strategic resource.

- This technology could replace computers: discover 23 stocks that are working to make quantum computing a reality.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:SENS

Sensirion Holding

Engages in the development, production, sale, and servicing of sensor systems, modules, and components in the Asia Pacific, Europe, the Middle East, Africa, and the Americas.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives