- Switzerland

- /

- Software

- /

- SWX:TEMN

Top 3 Growth Companies With High Insider Ownership On SIX Swiss Exchange

Reviewed by Simply Wall St

Over the last 7 days, the Swiss market has dropped 2.8%, but it has risen by 5.6% over the past year, with earnings expected to grow by 12% per annum in the coming years. In this context, growth companies with high insider ownership can be particularly attractive as they often indicate strong confidence from those closest to the business.

Top 10 Growth Companies With High Insider Ownership In Switzerland

| Name | Insider Ownership | Earnings Growth |

| Stadler Rail (SWX:SRAIL) | 14.5% | 23.4% |

| VAT Group (SWX:VACN) | 10.2% | 22.5% |

| Straumann Holding (SWX:STMN) | 32.7% | 21.8% |

| LEM Holding (SWX:LEHN) | 29.9% | 17.1% |

| Swissquote Group Holding (SWX:SQN) | 11.4% | 13.1% |

| Temenos (SWX:TEMN) | 22% | 14.3% |

| Sensirion Holding (SWX:SENS) | 20.7% | 104.7% |

| Leonteq (SWX:LEON) | 12.7% | 35.1% |

| Kudelski (SWX:KUD) | 37.5% | 120.2% |

| SHL Telemedicine (SWX:SHLTN) | 16.4% | 96.2% |

Here we highlight a subset of our preferred stocks from the screener.

LEM Holding (SWX:LEHN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: LEM Holding SA, with a market cap of CHF1.44 billion, offers solutions for measuring electrical parameters across various regions including China, Japan, South Korea, India, Southeast Asia, Europe, the Middle East, Africa, NAFTA and Latin America.

Operations: The company's revenue segments encompass solutions for measuring electrical parameters in regions such as China, Japan, South Korea, India, Southeast Asia, Europe, the Middle East, Africa, NAFTA and Latin America.

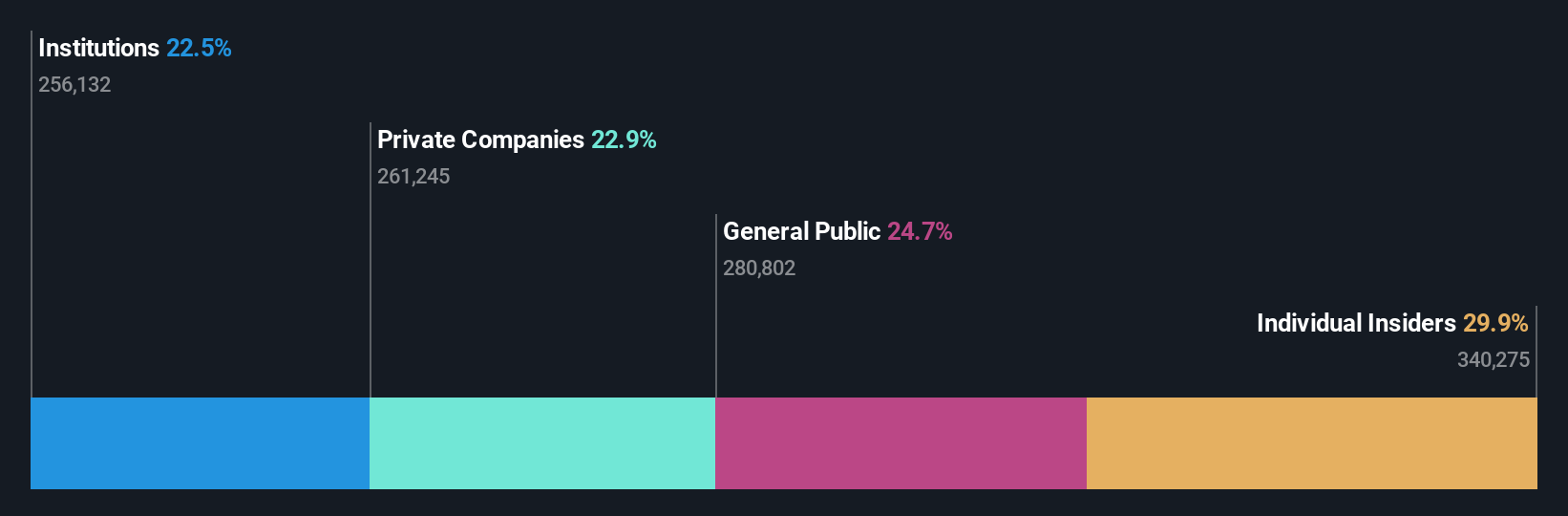

Insider Ownership: 29.9%

Earnings Growth Forecast: 17.1% p.a.

LEM Holding SA, a Swiss growth company with high insider ownership, has experienced a volatile share price recently and reported a significant drop in Q1 2024 earnings, with sales of CHF 80.96 million and net income of CHF 4.78 million. Despite trading 31.5% below its estimated fair value, analysts predict the stock price will rise by 27.8%. Forecasts indicate annual profit growth of 17.1%, outpacing the Swiss market's average of 11.7%, though revenue growth is expected to be moderate at 9% per year.

- Delve into the full analysis future growth report here for a deeper understanding of LEM Holding.

- Upon reviewing our latest valuation report, LEM Holding's share price might be too pessimistic.

Partners Group Holding (SWX:PGHN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Partners Group Holding AG is a private equity firm specializing in direct, secondary, and primary investments across private equity, real estate, infrastructure, and debt with a market cap of CHF29.01 billion.

Operations: The firm's revenue segments include CHF1.19 billion from Private Equity, CHF254.90 million from Infrastructure, CHF218.90 million from Private Credit, and CHF190.90 million from Real Estate.

Insider Ownership: 17%

Earnings Growth Forecast: 14.5% p.a.

Partners Group Holding, a Swiss firm with substantial insider ownership, is projected to grow earnings by 14.52% annually, surpassing the Swiss market average of 11.7%. Despite recent earnings showing a decline to CHF 508 million for H1 2024 from CHF 551.2 million in H1 2023, the company remains involved in significant M&A activities like the potential buyout of Lighthouse Learnings. However, its dividend yield of 3.51% is not well covered by earnings or free cash flows.

- Click to explore a detailed breakdown of our findings in Partners Group Holding's earnings growth report.

- Our expertly prepared valuation report Partners Group Holding implies its share price may be too high.

Temenos (SWX:TEMN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Temenos AG develops, markets, and sells integrated banking software systems to financial institutions globally and has a market cap of CHF4.26 billion.

Operations: Temenos generates revenue primarily from licensing, software-as-a-service (SaaS), maintenance, and services provided to banking and financial institutions worldwide.

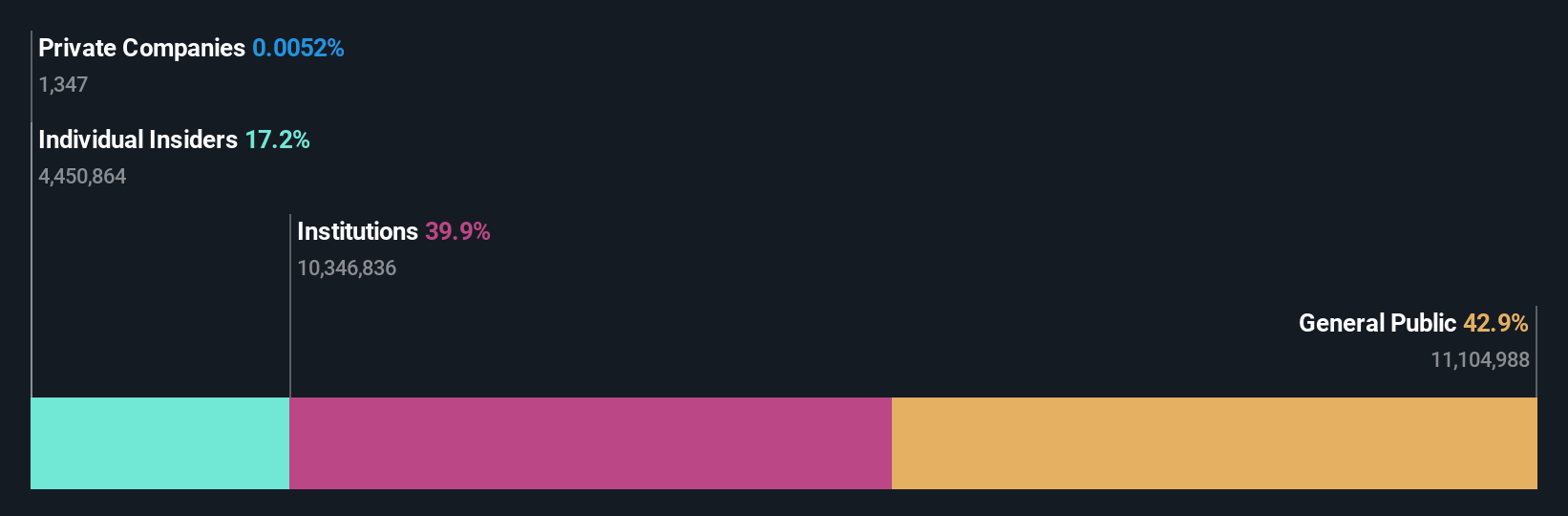

Insider Ownership: 22%

Earnings Growth Forecast: 14.3% p.a.

Temenos, a growth company with high insider ownership in Switzerland, has forecasted annual earnings growth of 14.32%, outpacing the Swiss market's 11.7%. Despite carrying high debt, it trades at 25.1% below its estimated fair value and recently completed a CHF 200 million share buyback program. Key executive appointments aim to boost SaaS and US market presence. Q2 2024 revenue was USD 248.39 million with net income slightly down from last year at USD 37.06 million.

- Get an in-depth perspective on Temenos' performance by reading our analyst estimates report here.

- Insights from our recent valuation report point to the potential undervaluation of Temenos shares in the market.

Summing It All Up

- Click through to start exploring the rest of the 9 Fast Growing SIX Swiss Exchange Companies With High Insider Ownership now.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Temenos might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:TEMN

Temenos

Develops, markets, and sells integrated banking software systems to banking and other financial institutions worldwide.

Reasonable growth potential with proven track record and pays a dividend.