- Norway

- /

- Energy Services

- /

- OB:PLSV

January 2025's Top Growth Companies With Strong Insider Ownership

Reviewed by Simply Wall St

As global markets continue to react positively to recent political developments and AI enthusiasm, major indices like the S&P 500 are reaching new heights, with growth stocks outperforming value shares. In this buoyant environment, companies that exhibit robust insider ownership often attract attention for their potential alignment of management interests with shareholders, making them compelling candidates for those seeking growth opportunities.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 41.2% |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 26.2% |

| Propel Holdings (TSX:PRL) | 36.8% | 38.9% |

| Pharma Mar (BME:PHM) | 11.9% | 55.1% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.1% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.2% | 135% |

| Fulin Precision (SZSE:300432) | 13.6% | 71% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 119.4% |

| Findi (ASX:FND) | 35.8% | 110.7% |

Let's take a closer look at a couple of our picks from the screened companies.

Lectra (ENXTPA:LSS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Lectra SA offers industrial intelligence solutions for the fashion, automotive, and furniture markets across Northern Europe, Southern Europe, the Americas, and the Asia Pacific with a market cap of €1.03 billion.

Operations: The company's revenue segments include €172.19 million from the Americas and €124.33 million from the Asia-Pacific region.

Insider Ownership: 19.6%

Lectra is trading at 33% below its estimated fair value, indicating potential undervaluation. Its revenue is forecast to grow slightly above the French market rate, while earnings are expected to increase significantly at 25.6% annually, outpacing market averages. Despite low future return on equity projections (12.1%), analysts agree on a potential stock price rise of 20.3%. Recent earnings showed increased sales (€394.22 million) but decreased net income (€22.77 million).

- Get an in-depth perspective on Lectra's performance by reading our analyst estimates report here.

- Our valuation report here indicates Lectra may be undervalued.

Paratus Energy Services (OB:PLSV)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Paratus Energy Services Ltd. operates through its subsidiaries to own and manage jack-up drilling rigs under contracts in Mexico, with a market cap of NOK7.80 billion.

Operations: The company's revenue is derived from managing jack-up drilling rigs under contracts in Mexico.

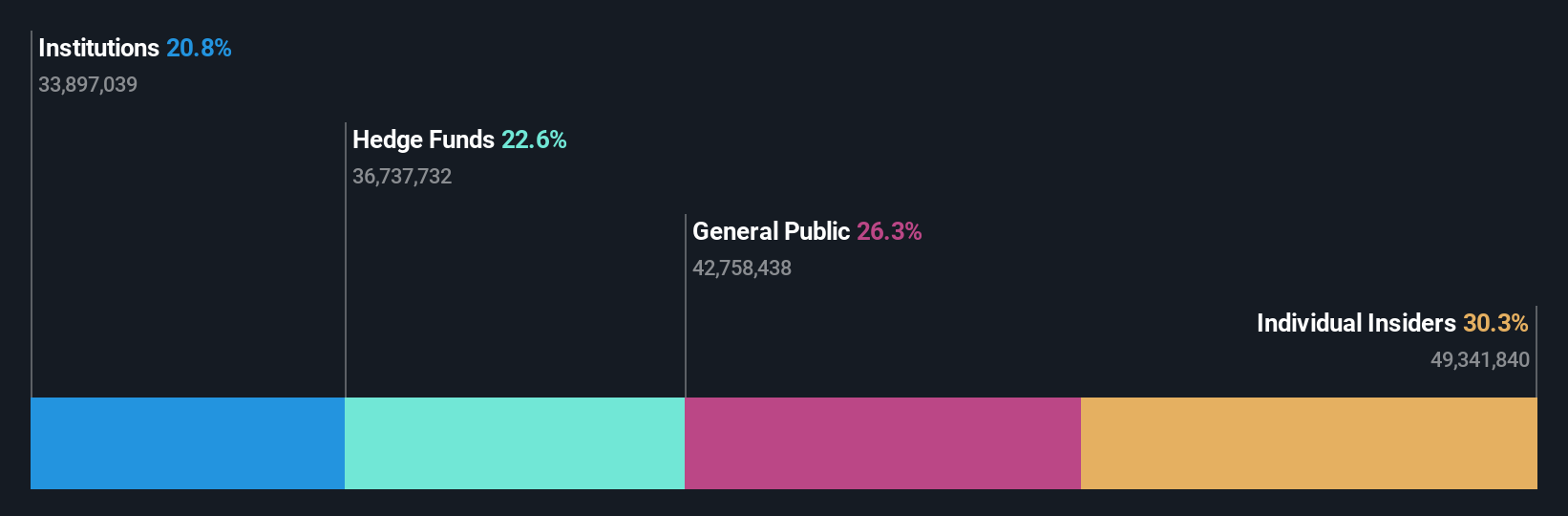

Insider Ownership: 29.1%

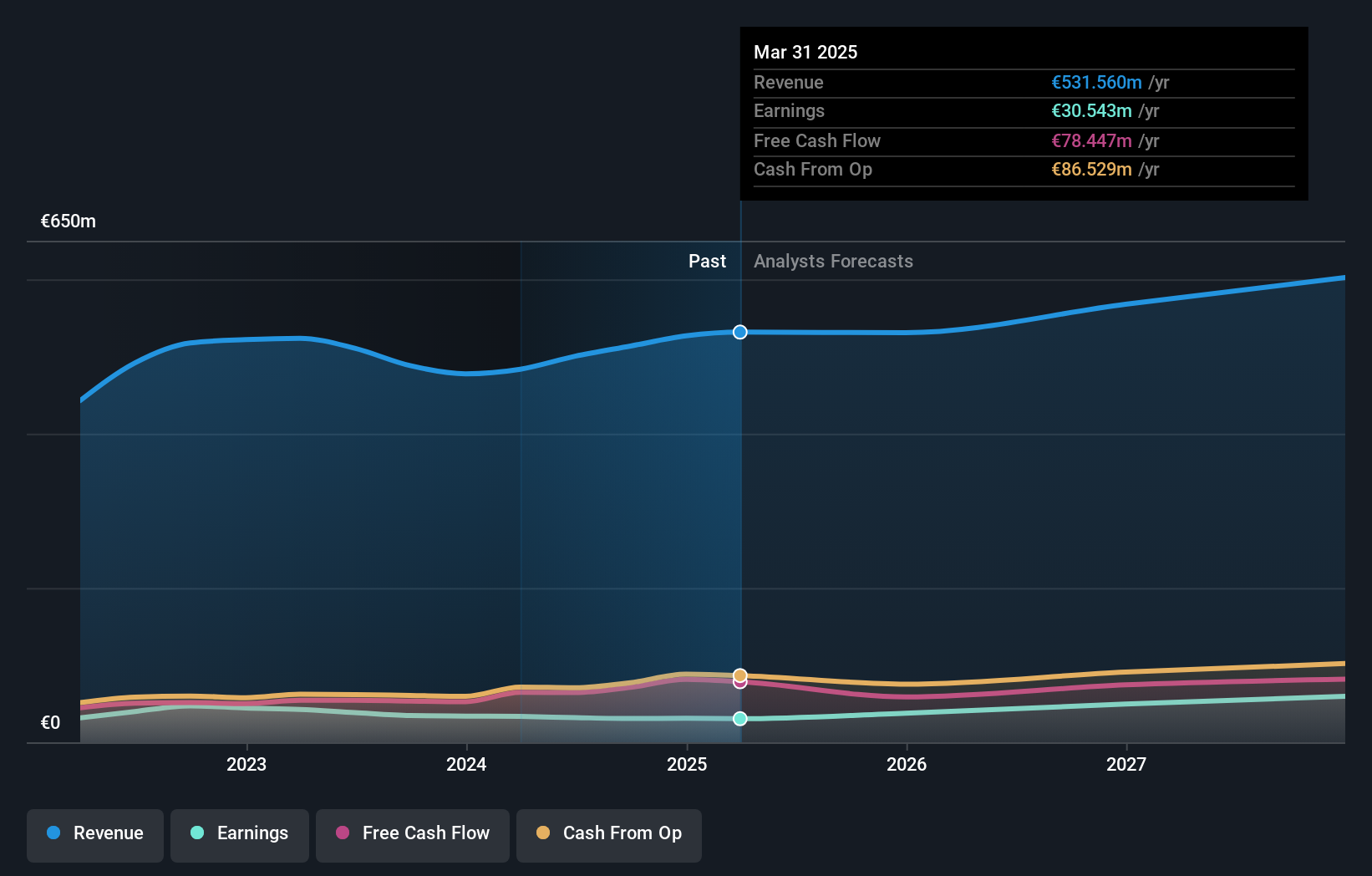

Paratus Energy Services, recently added to the S&P Global BMI Index, is trading at 53.3% below its estimated fair value, suggesting potential undervaluation. Despite a net loss in Q3 2024, the company became profitable this year with nine-month sales of US$167.3 million and net income of US$29 million. Earnings are forecast to grow significantly at 29.63% annually, surpassing Norwegian market averages, although revenue growth remains modest at 0.6% per year.

- Click here and access our complete growth analysis report to understand the dynamics of Paratus Energy Services.

- The analysis detailed in our Paratus Energy Services valuation report hints at an deflated share price compared to its estimated value.

LEM Holding (SWX:LEHN)

Simply Wall St Growth Rating: ★★★★★☆

Overview: LEM Holding SA, along with its subsidiaries, offers solutions for measuring electrical parameters across various regions including China, Japan, South Korea, India, Southeast Asia, Europe, the Middle East, Africa, NAFTA and Latin America with a market cap of CHF959.16 million.

Operations: The company's revenue is derived from two main segments: Asia, contributing CHF175.10 million, and Europe/Americas, accounting for CHF163.88 million.

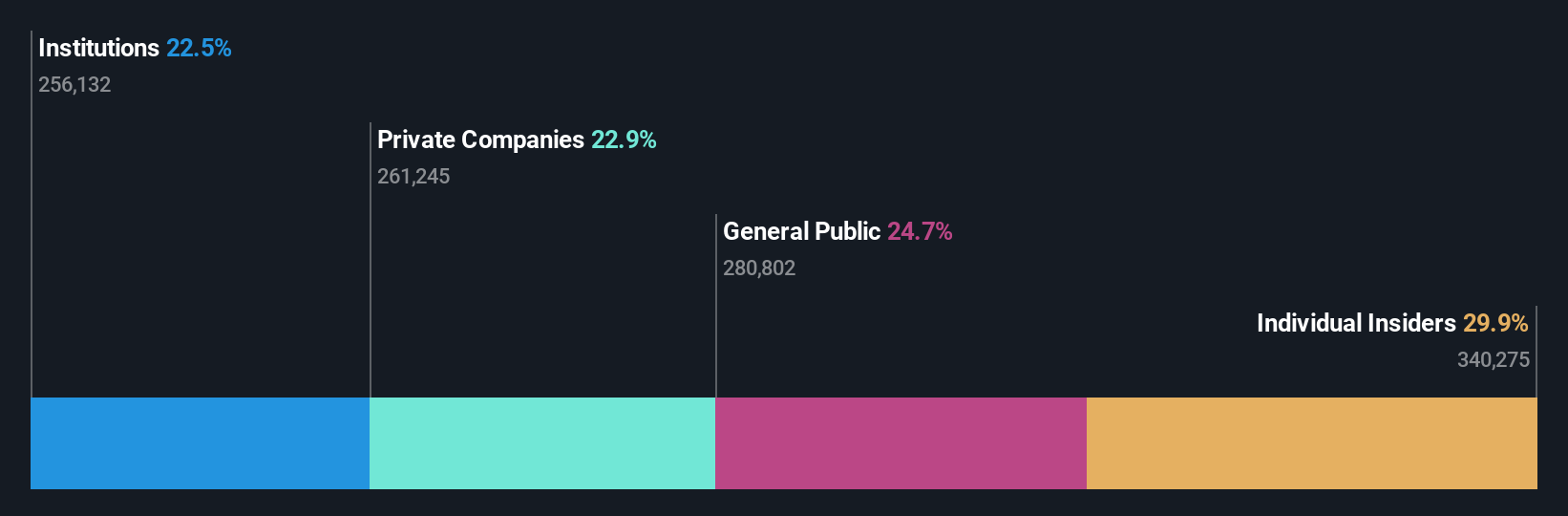

Insider Ownership: 29.9%

LEM Holding's earnings are forecast to grow significantly at 39.4% annually, outpacing the Swiss market. Despite high debt levels and recent declines in profit margins, analysts expect a 50.2% stock price increase. Revenue growth is projected at 11.6% per year, exceeding the Swiss market average but below high-growth benchmarks. Recent earnings showed a drop in sales and net income, highlighting financial challenges despite strong future growth prospects and substantial insider ownership stability.

- Take a closer look at LEM Holding's potential here in our earnings growth report.

- In light of our recent valuation report, it seems possible that LEM Holding is trading behind its estimated value.

Taking Advantage

- Investigate our full lineup of 1465 Fast Growing Companies With High Insider Ownership right here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:PLSV

Paratus Energy Services

Through its subsidiaries, provides drilling services and operates a fleet of jack-up rigs under contracts in Mexico.

Solid track record with reasonable growth potential.

Market Insights

Community Narratives