High Insider Ownership In Growth Companies Like Goodwill E-Health Info Plus Two More

Reviewed by Simply Wall St

As global markets show signs of resilience with U.S. indexes nearing record highs and a strong labor market driving positive sentiment, investors are increasingly focusing on growth companies with significant insider ownership. In this context, stocks like Goodwill E-Health Info highlight the potential advantages of having insiders who are deeply invested in the company's success, as they can align management's interests closely with those of shareholders amidst evolving economic conditions.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| SKS Technologies Group (ASX:SKS) | 32.4% | 24.8% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 41.3% |

| Laopu Gold (SEHK:6181) | 36.4% | 34% |

| Medley (TSE:4480) | 34% | 31.7% |

| Findi (ASX:FND) | 34.8% | 71.5% |

| Global Tax Free (KOSDAQ:A204620) | 19.9% | 78.4% |

| Plenti Group (ASX:PLT) | 12.8% | 120.1% |

| Fulin Precision (SZSE:300432) | 13.6% | 66.7% |

| UTI (KOSDAQ:A179900) | 33.1% | 134.6% |

Let's review some notable picks from our screened stocks.

Goodwill E-Health Info (SHSE:688246)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Goodwill E-Health Info Co., Ltd. focuses on the research and development of medical information software in China, with a market cap of CN¥3.99 billion.

Operations: The company generates revenue from its medical information software development activities in China.

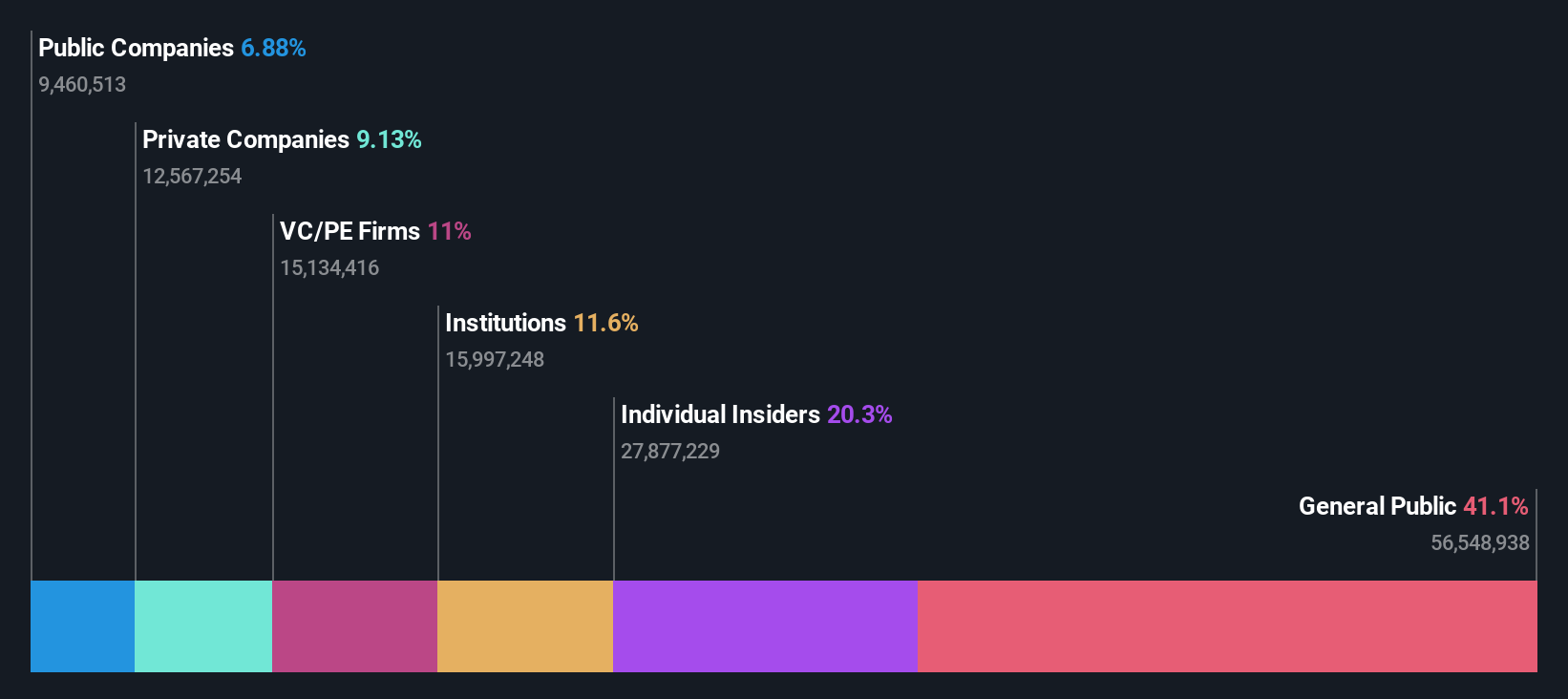

Insider Ownership: 20.3%

Revenue Growth Forecast: 23.7% p.a.

Goodwill E-Health Info has high insider ownership, aligning management interests with shareholders. Despite a recent net loss of CNY 41.26 million for the first nine months of 2024, its revenue is forecast to grow at 23.7% annually, surpassing market expectations. The company is expected to achieve profitability within three years, though its share price remains volatile and return on equity projections are modest at 7.3%.

- Dive into the specifics of Goodwill E-Health Info here with our thorough growth forecast report.

- Our valuation report unveils the possibility Goodwill E-Health Info's shares may be trading at a premium.

LEM Holding (SWX:LEHN)

Simply Wall St Growth Rating: ★★★★★☆

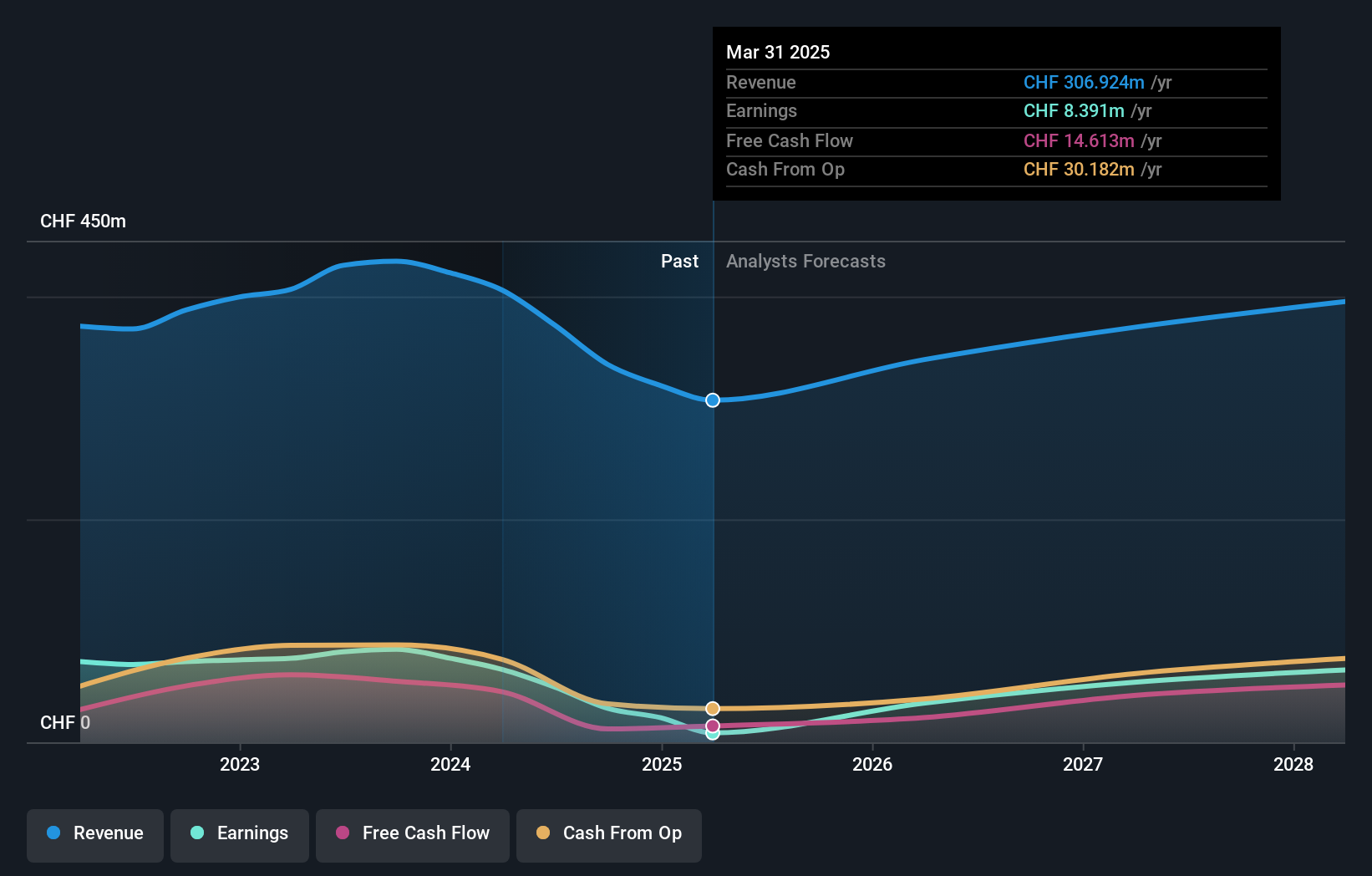

Overview: LEM Holding SA, along with its subsidiaries, offers solutions for measuring electrical parameters across various regions including China, Japan, South Korea, India, Southeast Asia, Europe, the Middle East, Africa, NAFTA and Latin America with a market cap of CHF910.01 million.

Operations: Revenue segments for LEM Holding SA encompass solutions for measuring electrical parameters across China, Japan, South Korea, India, Southeast Asia, Europe, the Middle East, Africa, NAFTA and Latin America.

Insider Ownership: 29.9%

Revenue Growth Forecast: 11.4% p.a.

LEM Holding's insider ownership supports alignment with shareholder interests, although its financial position is strained by high debt levels. The company's earnings are forecast to grow significantly at 36.9% annually, outpacing the Swiss market, despite recent declines in sales (CHF 156.55 million) and net income (CHF 8.58 million). Trading well below fair value estimates and analysts predict a potential price rise of 65.6%, though profit margins have decreased from last year.

- Click here to discover the nuances of LEM Holding with our detailed analytical future growth report.

- Our valuation report unveils the possibility LEM Holding's shares may be trading at a discount.

BASEInc (TSE:4477)

Simply Wall St Growth Rating: ★★★★☆☆

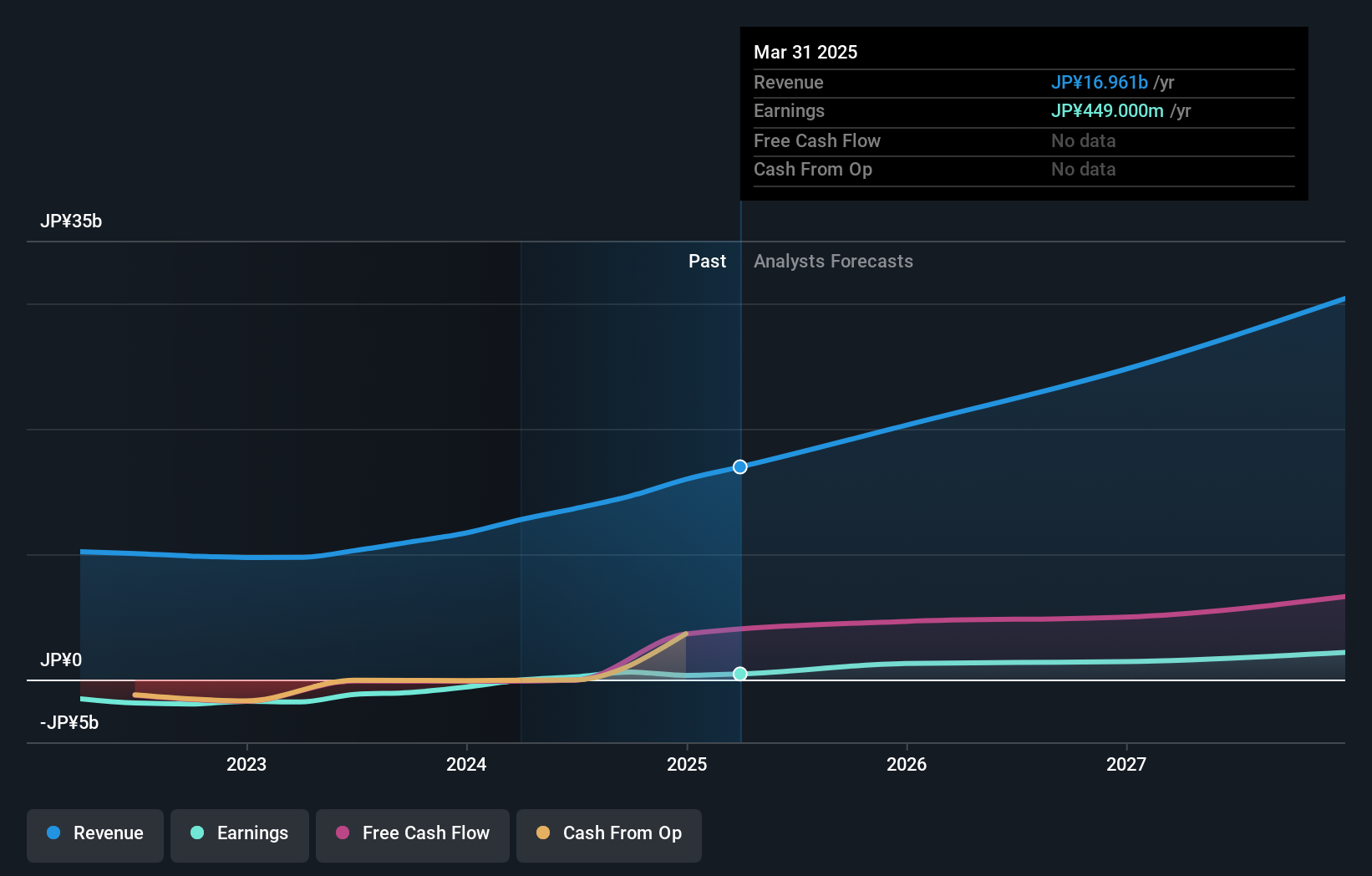

Overview: BASE, Inc. is involved in the planning, development, and operation of web services in Japan with a market cap of ¥38.79 billion.

Operations: The company's revenue is derived from three main segments: BASE Business generating ¥8.65 billion, PAY.JP Business contributing ¥5.25 billion, and YELL BANK Business with ¥743 million.

Insider Ownership: 16%

Revenue Growth Forecast: 18.6% p.a.

BASE Inc. has become profitable this year, with earnings expected to grow significantly at 39% annually, outpacing the Japanese market's growth rate. Despite a highly volatile share price recently, BASE Inc.'s revenue is forecast to rise 18.6% annually, faster than the broader market's growth of 4.2%. The company shows no substantial insider trading activity over the past three months and will report Q3 results on November 6, 2024.

- Click here and access our complete growth analysis report to understand the dynamics of BASEInc.

- In light of our recent valuation report, it seems possible that BASEInc is trading beyond its estimated value.

Next Steps

- Delve into our full catalog of 1524 Fast Growing Companies With High Insider Ownership here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if BASEInc might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4477

BASEInc

Engages in the planning, development, and operation of web services in Japan.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives