The European market has shown resilience recently, with the pan-European STOXX Europe 600 Index rising by 3.93% over a week, buoyed by the European Central Bank's decision to cut rates and delay in tariff increases that have lifted investor sentiment. In this dynamic environment, identifying high-growth tech stocks involves looking for companies that can navigate economic uncertainties and leverage favorable monetary policies to drive innovation and expansion.

Top 10 High Growth Tech Companies In Europe

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Pharma Mar | 23.66% | 40.07% | ★★★★★★ |

| Yubico | 20.08% | 25.52% | ★★★★★★ |

| Elicera Therapeutics | 63.53% | 97.24% | ★★★★★★ |

| Devyser Diagnostics | 26.28% | 96.54% | ★★★★★★ |

| Ascelia Pharma | 46.06% | 66.78% | ★★★★★★ |

| CD Projekt | 33.78% | 37.39% | ★★★★★★ |

| XTPL | 97.45% | 117.95% | ★★★★★★ |

| Skolon | 29.76% | 91.18% | ★★★★★★ |

| Elliptic Laboratories | 49.76% | 88.21% | ★★★★★★ |

| Xbrane Biopharma | 33.71% | 82.67% | ★★★★★★ |

Let's dive into some prime choices out of from the screener.

Norbit (OB:NORBT)

Simply Wall St Growth Rating: ★★★★★☆

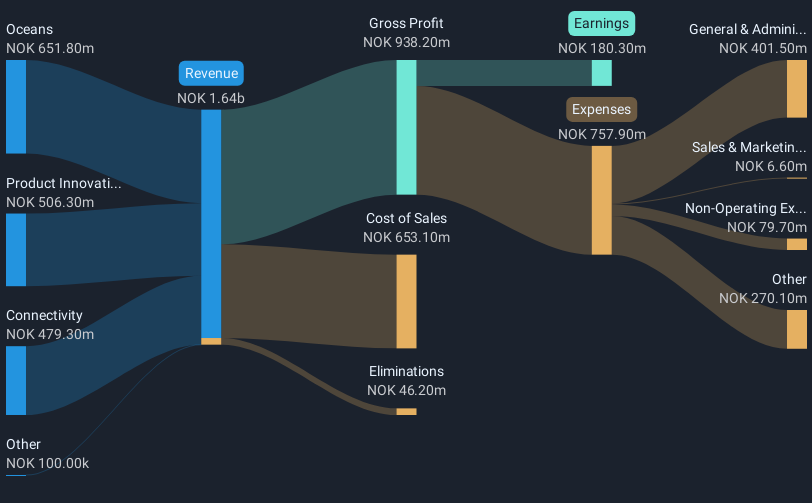

Overview: Norbit ASA is a technology solutions provider serving various industries, with a market capitalization of NOK8.34 billion.

Operations: Norbit ASA generates revenue primarily from its Oceans, Connectivity, and Product Innovation and Realization (PIR) segments, with the Oceans segment contributing NOK743.90 million and PIR adding NOK543.10 million. The Connectivity segment accounts for NOK515.70 million in revenue.

Norbit ASA, a European tech firm, has demonstrated robust growth with a 31.3% increase in earnings over the past year, outpacing the electronic industry's average of 11.1%. With revenue projected to grow at 17.7% annually, Norbit is set to exceed Norway's market growth rate of 2.2%. The company's commitment to R&D is evident as it targets significant advancements across its business segments including Oceans, which expands into ocean exploration and security applications through innovative product developments. This strategic focus on diversified products and leveraging mega-trends underpins Norbit’s potential for sustained profitability and market expansion.

- Dive into the specifics of Norbit here with our thorough health report.

Explore historical data to track Norbit's performance over time in our Past section.

Cint Group (OM:CINT)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Cint Group AB (publ) offers software solutions for digital insights and research technology on a global scale, with a market cap of SEK2.42 billion.

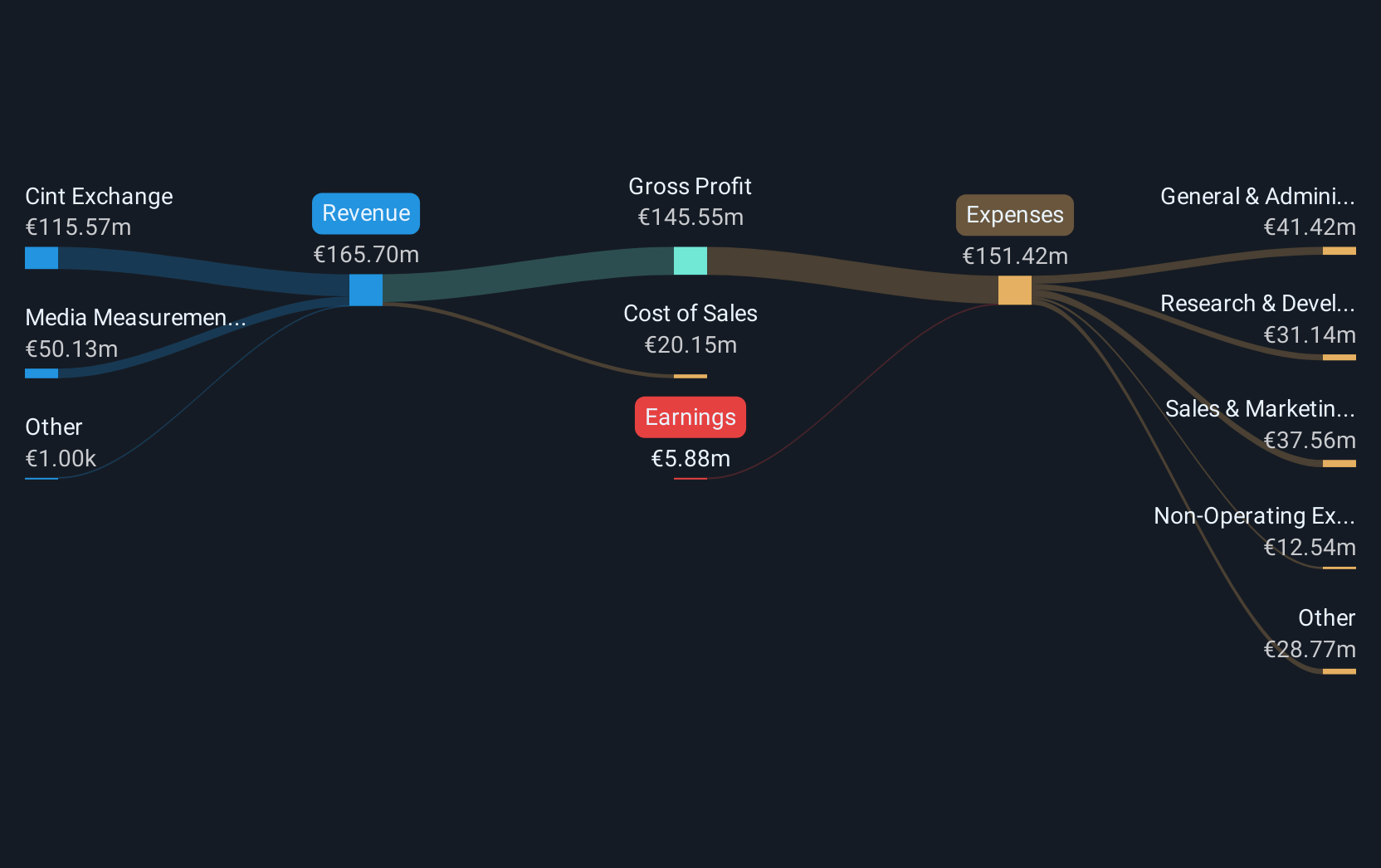

Operations: Cint Group generates revenue primarily from its Cint Exchange and Media Measurement segments, with €116.82 million and €49.37 million respectively.

Cint Group AB, amidst a challenging fiscal year with a significant reduction in annual sales from EUR 266.54 million to EUR 166.2 million, has demonstrated resilience by turning around its quarterly performance from a substantial loss to a modest net income of EUR 2.5 million. This pivot is underscored by their recent strategic equity offerings totaling SEK 584 million, aimed at bolstering their market position and capital structure. Despite the volatile share price and shareholder dilution over the past year, Cint's projected revenue growth of 5.1% annually outpaces Sweden's average of 2.6%, signaling potential recovery and profitability within three years as they streamline operations and capitalize on emerging market opportunities in the tech sector.

- Take a closer look at Cint Group's potential here in our health report.

Gain insights into Cint Group's past trends and performance with our Past report.

LEM Holding (SWX:LEHN)

Simply Wall St Growth Rating: ★★★★★☆

Overview: LEM Holding SA, along with its subsidiaries, specializes in providing solutions for measuring electrical parameters across various regions including China, Japan, South Korea, India, Southeast Asia, Europe, the Middle East, Africa, NAFTA and Latin America with a market capitalization of CHF733.61 million.

Operations: The company focuses on solutions for measuring electrical parameters across multiple regions. It operates with a market capitalization of CHF733.61 million, catering to diverse markets including Asia, Europe, and the Americas.

LEM Holding SA, navigating a challenging fiscal landscape with a revenue drop to CHF 230.88 million from CHF 316.62 million last year, still showcases robust future potential with projected annual revenue growth of 12.6% and earnings growth of 56.8%. This optimism is bolstered by strategic executive reshuffles, including the appointment of Antoine Chulia as CFO, aimed at enhancing financial strategies and operational efficiencies across European markets. Despite recent setbacks in net income, now at CHF 12.09 million down from CHF 55.43 million, LEM's commitment to innovation and leadership changes signal a strong direction towards recovering profitability and maintaining competitiveness in the high-tech industry landscape.

Seize The Opportunity

- Explore the 231 names from our European High Growth Tech and AI Stocks screener here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:CINT

Cint Group

Provides software solutions for digital insights and research technology worldwide.

Adequate balance sheet with slight risk.

Market Insights

Community Narratives