As European markets navigate a landscape shaped by trade negotiations and slowing inflation, the pan-European STOXX Europe 600 Index has seen modest gains, supported by expectations of potential interest rate cuts from the European Central Bank. In this environment, high growth tech stocks in Europe could present intriguing opportunities for investors, as these companies often thrive on innovation and adaptability—qualities that can be particularly valuable amid economic uncertainties and evolving market conditions.

Top 10 High Growth Tech Companies In Europe

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Intellego Technologies | 30.80% | 45.66% | ★★★★★★ |

| Archos | 21.07% | 36.58% | ★★★★★★ |

| KebNi | 21.51% | 66.96% | ★★★★★★ |

| Pharma Mar | 29.61% | 44.92% | ★★★★★★ |

| Bonesupport Holding | 29.14% | 56.14% | ★★★★★★ |

| argenx | 21.50% | 26.61% | ★★★★★★ |

| Skolon | 31.51% | 99.52% | ★★★★★★ |

| Xbrane Biopharma | 24.95% | 56.77% | ★★★★★★ |

| Diamyd Medical | 86.29% | 93.04% | ★★★★★★ |

| Elliptic Laboratories | 36.33% | 78.99% | ★★★★★★ |

Let's explore several standout options from the results in the screener.

CM.com (ENXTAM:CMCOM)

Simply Wall St Growth Rating: ★★★★★☆

Overview: CM.com N.V. is a global provider of cloud software solutions for conversational commerce, with a market capitalization of €238.26 million.

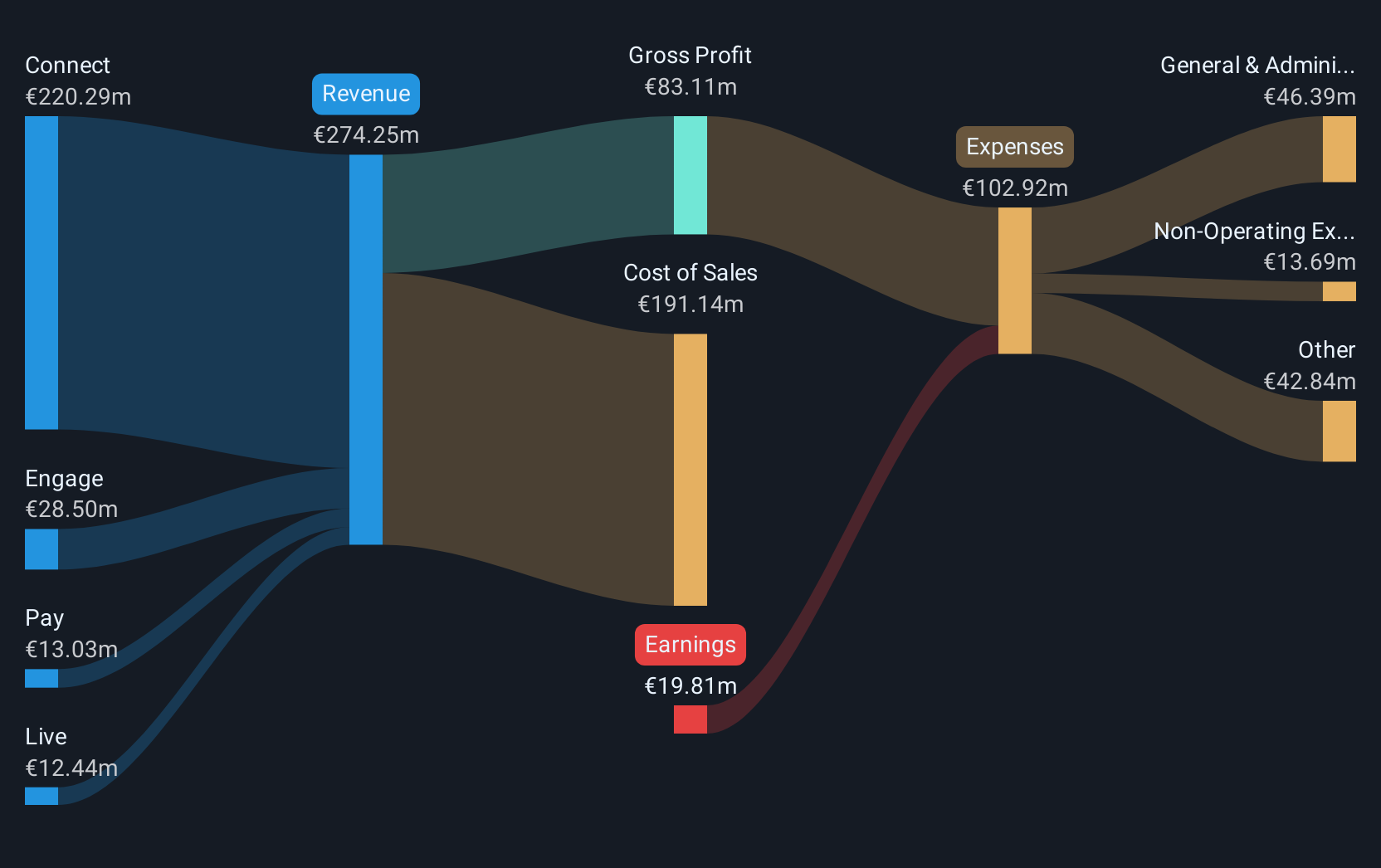

Operations: CM.com N.V. generates revenue through its four main segments: Connect (€220.29 million), Engage (€28.50 million), Pay (€13.03 million), and Live (€12.44 million).

CM.com, a player in the European tech scene, demonstrates robust potential with projected annual revenue growth at 10.2%, significantly outpacing the Dutch market's 7.5%. Despite current unprofitability, forecasts suggest a striking earnings increase of 104.5% per year, positioning it well above industry norms. The company's strategic presence at key conferences, like the recent ABN-AMRO/ODDO BHF Benelux Equities Conference in Amsterdam, underscores its active engagement and commitment to growth within the tech sector. With an anticipated return on equity of 23.6% in three years and positive free cash flow status, CM.com is aligning itself for a promising future amidst volatile market conditions.

- Click to explore a detailed breakdown of our findings in CM.com's health report.

Gain insights into CM.com's past trends and performance with our Past report.

LEM Holding (SWX:LEHN)

Simply Wall St Growth Rating: ★★★★★☆

Overview: LEM Holding SA, along with its subsidiaries, specializes in providing solutions for measuring electrical parameters across various regions including China, Japan, South Korea, India, Southeast Asia, Europe, the Middle East and Africa as well as NAFTA and Latin America; it has a market capitalization of CHF894.82 million.

Operations: The company generates revenue primarily from Asia, contributing CHF168.27 million, and Europe/Americas, with CHF138.66 million.

LEM Holding, amidst a challenging fiscal year, reported a substantial dip in sales to CHF 306.92 million from CHF 405.78 million and saw net income reduce to CHF 8.39 million from CHF 65.33 million previously. Despite these setbacks, the company is poised for recovery with an expected earnings growth of 48% per year, significantly outstripping the Swiss market's forecast of 10.7%. This resilience is underscored by a robust projected return on equity of 32.5% over the next three years, highlighting its potential in bouncing back stronger within the European tech landscape.

- Get an in-depth perspective on LEM Holding's performance by reading our health report here.

Examine LEM Holding's past performance report to understand how it has performed in the past.

Nemetschek (XTRA:NEM)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Nemetschek SE is a global provider of software solutions catering to the architecture, engineering, construction, media, and entertainment sectors with a market cap of €14.33 billion.

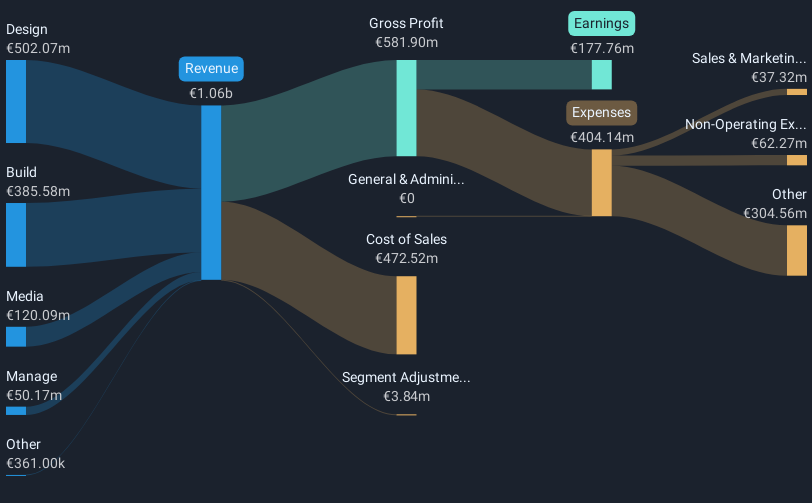

Operations: Nemetschek SE generates revenue primarily from its Design and Build segments, contributing €502.07 million and €385.58 million respectively, with additional income from its Media and Manage divisions. The company operates across Germany, Europe, the Americas, and the Asia Pacific regions.

Nemetschek SE, a leader in the digital transformation of the architectural and construction industries, has demonstrated resilience with a robust financial performance. In Q1 2025, revenue surged to EUR 285.89 million from EUR 227.33 million in the previous year, marking an annualized growth rate of 12.6%. This growth is complemented by an earnings increase to EUR 44.88 million from EUR 42.55 million, reflecting an annualized earnings growth of approximately 18%. The company's commitment to innovation is evident in its R&D investments which consistently enhance its software solutions portfolio, ensuring it remains at the forefront of technological advancements within its sector.

- Navigate through the intricacies of Nemetschek with our comprehensive health report here.

Understand Nemetschek's track record by examining our Past report.

Make It Happen

- Reveal the 228 hidden gems among our European High Growth Tech and AI Stocks screener with a single click here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nemetschek might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:NEM

Nemetschek

Provides software solutions for architecture, engineering, construction, operation, and media industries in Germany, the rest of Europe, the Americas, the Asia Pacific, and internationally.

Solid track record with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives