- South Korea

- /

- Auto Components

- /

- KOSE:A064960

3 Dividend Stocks To Enhance Your Portfolio

Reviewed by Simply Wall St

As global markets navigate a landscape of cooling inflation and robust bank earnings, major U.S. stock indexes have rebounded, with value stocks notably outperforming growth shares. This environment highlights the potential appeal of dividend stocks, which can offer investors a steady income stream while potentially benefiting from sectors showing strong performance.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.27% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.90% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.68% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.54% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.48% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.44% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.45% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.65% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.82% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.88% | ★★★★★★ |

Click here to see the full list of 1979 stocks from our Top Dividend Stocks screener.

We'll examine a selection from our screener results.

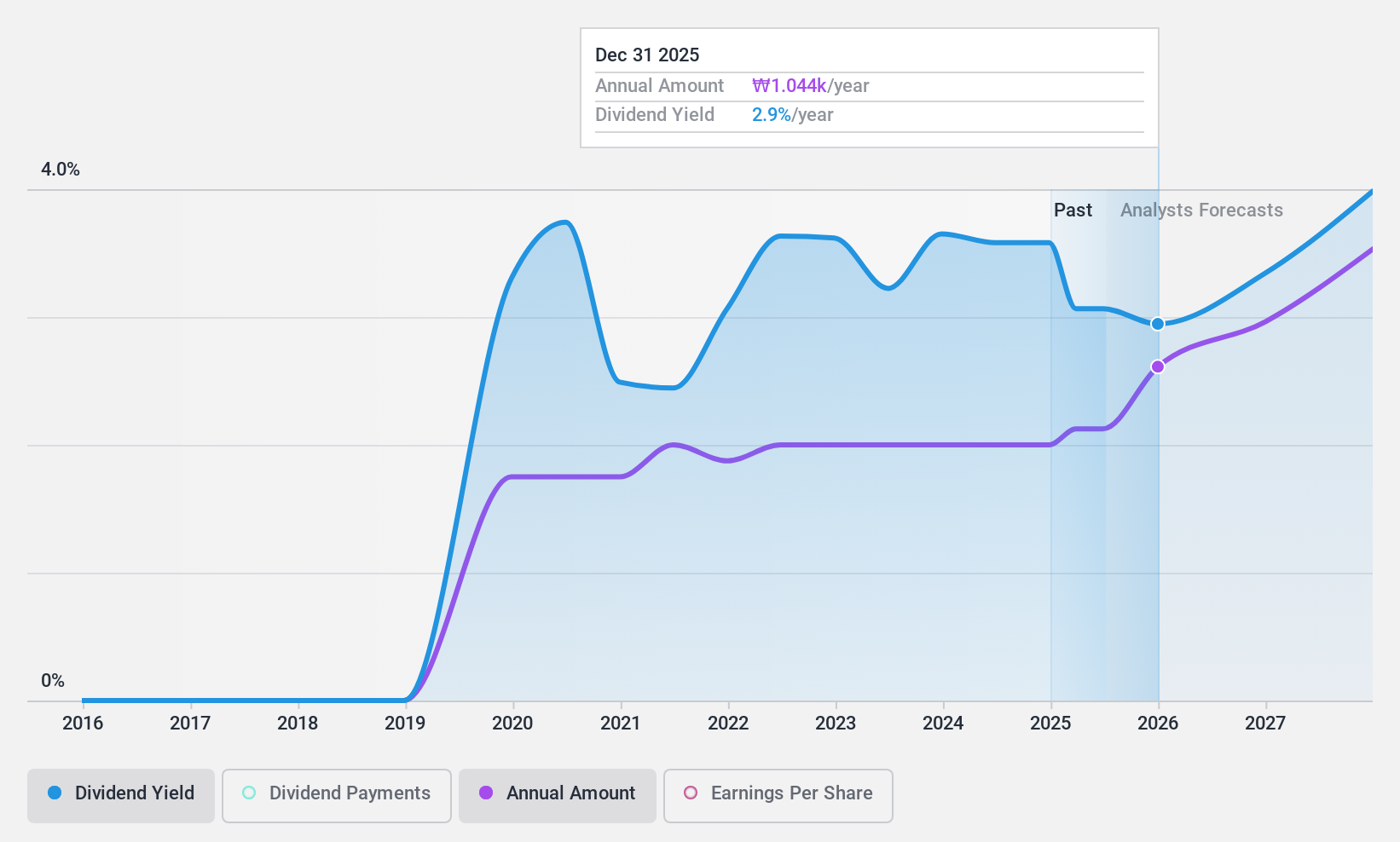

SNT Motiv (KOSE:A064960)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: SNT Motiv Co., Ltd. is engaged in the production, development, and sale of products for the defense and automotive industries both in South Korea and internationally, with a market cap of ₩303.89 billion.

Operations: SNT Motiv Co., Ltd. generates revenue primarily from its Vehicle Parts segment, amounting to ₩718.41 million.

Dividend Yield: 6.3%

SNT Motiv has demonstrated a volatile dividend history, with payments showing significant annual drops despite increasing over the past five years. The company's dividends are well-covered by both earnings and cash flows, with payout ratios of 28.9% and 24.1%, respectively, suggesting sustainability in the near term. Trading at a value below its estimated fair value and offering a competitive yield of 6.27%, it remains attractive compared to peers in the KR market despite its short dividend-paying history. Recent buybacks may further bolster investor confidence.

- Navigate through the intricacies of SNT Motiv with our comprehensive dividend report here.

- Our valuation report unveils the possibility SNT Motiv's shares may be trading at a discount.

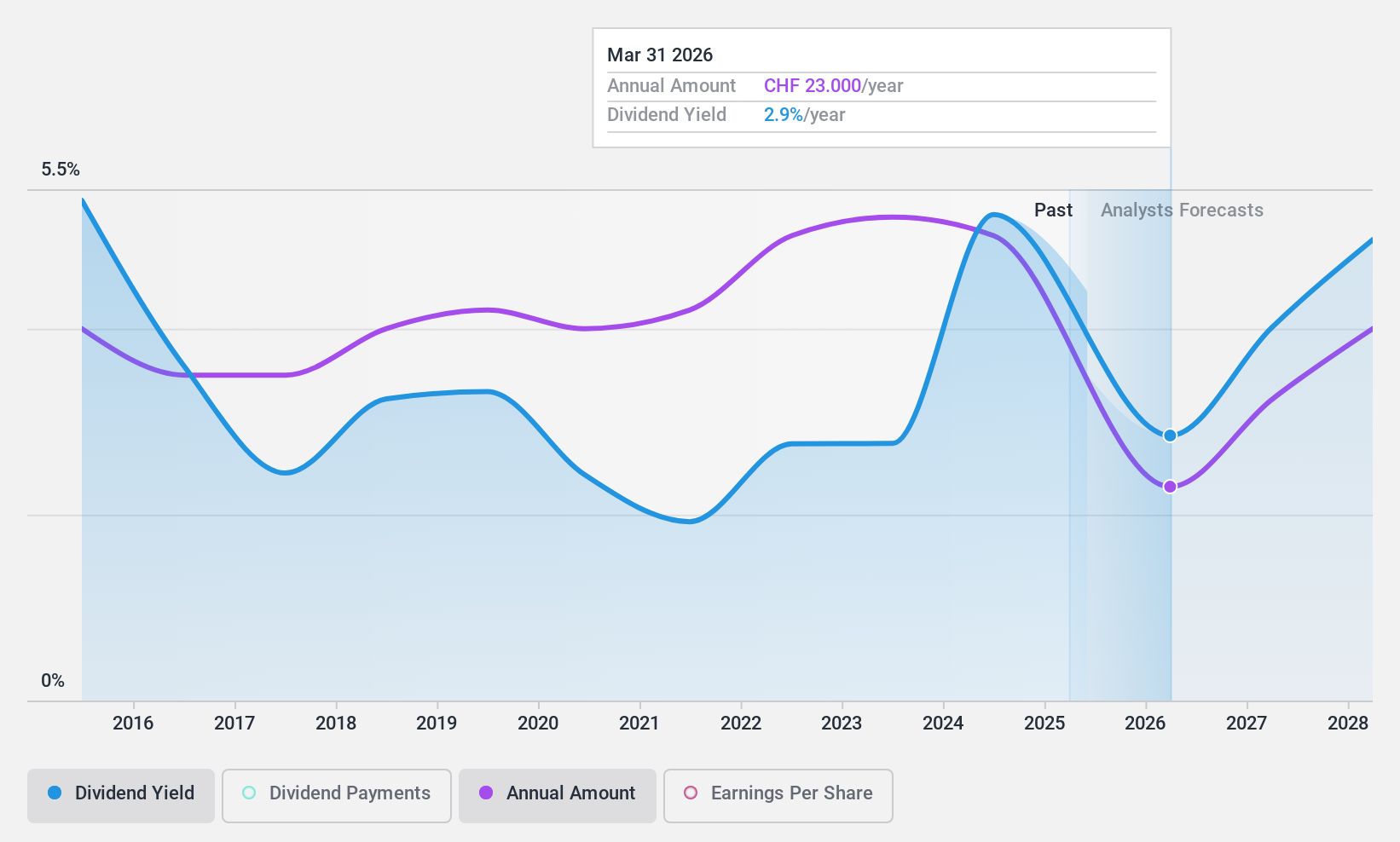

LEM Holding (SWX:LEHN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: LEM Holding SA, along with its subsidiaries, offers solutions for measuring electrical parameters across various regions including China, Japan, South Korea, India, Southeast Asia, Europe, the Middle East, Africa, NAFTA and Latin America with a market capitalization of CHF931.82 million.

Operations: LEM Holding SA generates revenue from two main segments: Asia, contributing CHF175.10 million, and Europe/Americas, contributing CHF163.88 million.

Dividend Yield: 5.9%

LEM Holding's dividend yield of 6.11% ranks in the top 25% of Swiss dividend payers, yet its sustainability is questionable due to high payout ratios—186.7% for earnings and 477.2% for cash flows—indicating dividends are not well covered. Despite stable and reliable payments over the past decade, recent financial results show declining sales (CHF 156.55 million) and net income (CHF 8.58 million), raising concerns about future dividend viability amidst high debt levels and volatile share prices.

- Click here and access our complete dividend analysis report to understand the dynamics of LEM Holding.

- The valuation report we've compiled suggests that LEM Holding's current price could be quite moderate.

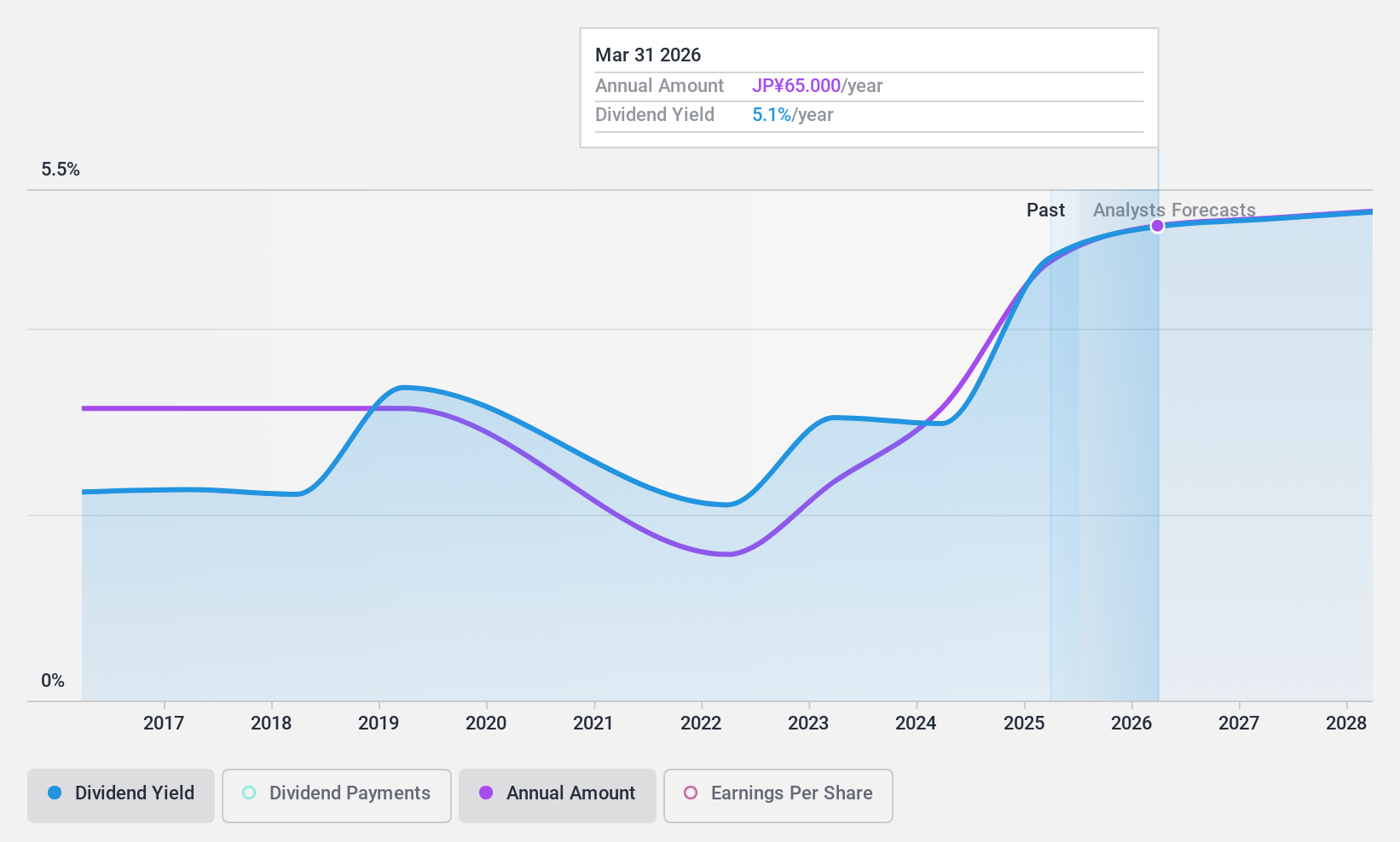

Tokyo Rope Mfg (TSE:5981)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Tokyo Rope Mfg. Co., Ltd. is a company that produces and distributes wire ropes, steel cords, and carbon fiber composite cables both in Japan and internationally, with a market cap of ¥20.47 billion.

Operations: Tokyo Rope Mfg. Co., Ltd.'s revenue is primarily derived from its cable steel wire related segment at ¥28.97 billion, followed by development product related at ¥18.12 billion, energy real estate at ¥7.34 billion, steel cord related at ¥6.48 billion, and industrial machinery at ¥4.07 billion.

Dividend Yield: 4.6%

Tokyo Rope Mfg.'s dividend yield of 4.63% is among the top 25% in Japan, yet it's not well covered by cash flows due to a high cash payout ratio of 98.1%. Although dividends have increased over the past decade, they remain unstable and unreliable. Recent share repurchases totaling ¥98.9 million aim to enhance shareholder value, alongside plans to increase per-share dividends from ¥40.00 to ¥60.00 for fiscal year ending March 2025.

- Click to explore a detailed breakdown of our findings in Tokyo Rope Mfg's dividend report.

- Our comprehensive valuation report raises the possibility that Tokyo Rope Mfg is priced lower than what may be justified by its financials.

Summing It All Up

- Click this link to deep-dive into the 1979 companies within our Top Dividend Stocks screener.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A064960

SNT Motiv

Engages in the production, development, and sale of products for defense and automotive industries in South Korea and internationally.

Flawless balance sheet with solid track record.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)