Investors in Kudelski (VTX:KUD) from five years ago are still down 70%, even after 16% gain this past week

Kudelski SA (VTX:KUD) shareholders should be happy to see the share price up 18% in the last month. But spare a thought for the long term holders, who have held the stock as it bled value over the last five years. Indeed, the share price is down a whopping 73% in that time. It's true that the recent bounce could signal the company is turning over a new leaf, but we are not so sure. The real question is whether the business can leave its past behind and improve itself over the years ahead.

The recent uptick of 16% could be a positive sign of things to come, so let's take a look at historical fundamentals.

See our latest analysis for Kudelski

Given that Kudelski didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. When a company doesn't make profits, we'd generally hope to see good revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Over half a decade Kudelski reduced its trailing twelve month revenue by 3.8% for each year. While far from catastrophic that is not good. If a business loses money, you want it to grow, so no surprises that the share price has dropped 12% each year in that time. We're generally averse to companies with declining revenues, but we're not alone in that. That is not really what the successful investors we know aim for.

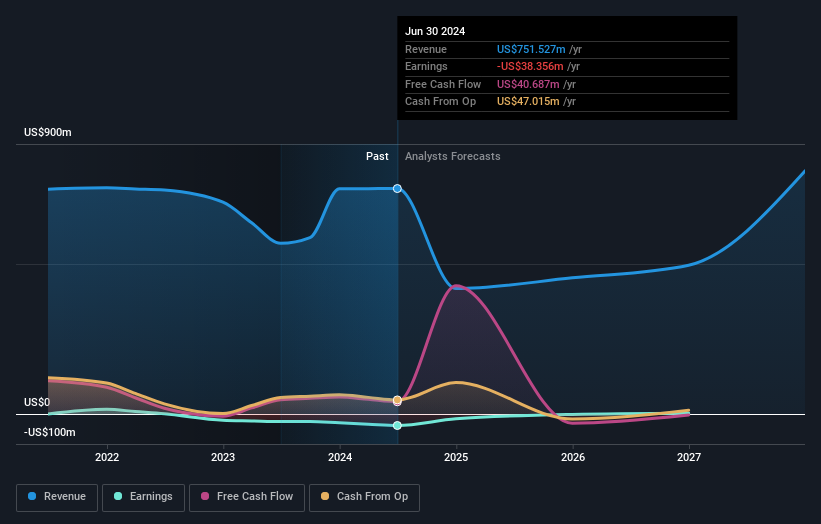

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

What About The Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Kudelski's total shareholder return (TSR) and its share price return. Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Its history of dividend payouts mean that Kudelski's TSR, which was a 70% drop over the last 5 years, was not as bad as the share price return.

A Different Perspective

We're pleased to report that Kudelski shareholders have received a total shareholder return of 16% over one year. There's no doubt those recent returns are much better than the TSR loss of 11% per year over five years. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. To that end, you should be aware of the 3 warning signs we've spotted with Kudelski .

We will like Kudelski better if we see some big insider buys. While we wait, check out this free list of undervalued stocks (mostly small caps) with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Swiss exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Kudelski might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SWX:KUD

Kudelski

Provides digital access and security solutions for digital television and interactive applications in Switzerland, the United States, France, Germany, Austria, and internationally.

Undervalued with high growth potential.

Similar Companies

Market Insights

Community Narratives