Three Growth Companies On SIX Swiss Exchange With Insider Ownership As High As 20%

Reviewed by Simply Wall St

In recent times, the Swiss market has shown a consistent performance, remaining flat over both the last week and the past year. However, with earnings expected to grow by 8.1% annually, investors might find particular interest in growth companies with high insider ownership on the SIX Swiss Exchange, as these can indicate strong confidence from those closest to the company.

Top 10 Growth Companies With High Insider Ownership In Switzerland

| Name | Insider Ownership | Earnings Growth |

| Stadler Rail (SWX:SRAIL) | 14.5% | 23.4% |

| VAT Group (SWX:VACN) | 10.2% | 21.2% |

| Straumann Holding (SWX:STMN) | 32.7% | 21% |

| Swissquote Group Holding (SWX:SQN) | 11.4% | 14.3% |

| Temenos (SWX:TEMN) | 17.4% | 14.7% |

| LEM Holding (SWX:LEHN) | 34.5% | 9.9% |

| Sonova Holding (SWX:SOON) | 17.7% | 10.4% |

| Arbonia (SWX:ARBN) | 28.8% | 80% |

| SHL Telemedicine (SWX:SHLTN) | 17.9% | 96.2% |

| Sensirion Holding (SWX:SENS) | 20.7% | 78.8% |

Let's explore several standout options from the results in the screener.

INFICON Holding (SWX:IFCN)

Simply Wall St Growth Rating: ★★★★☆☆

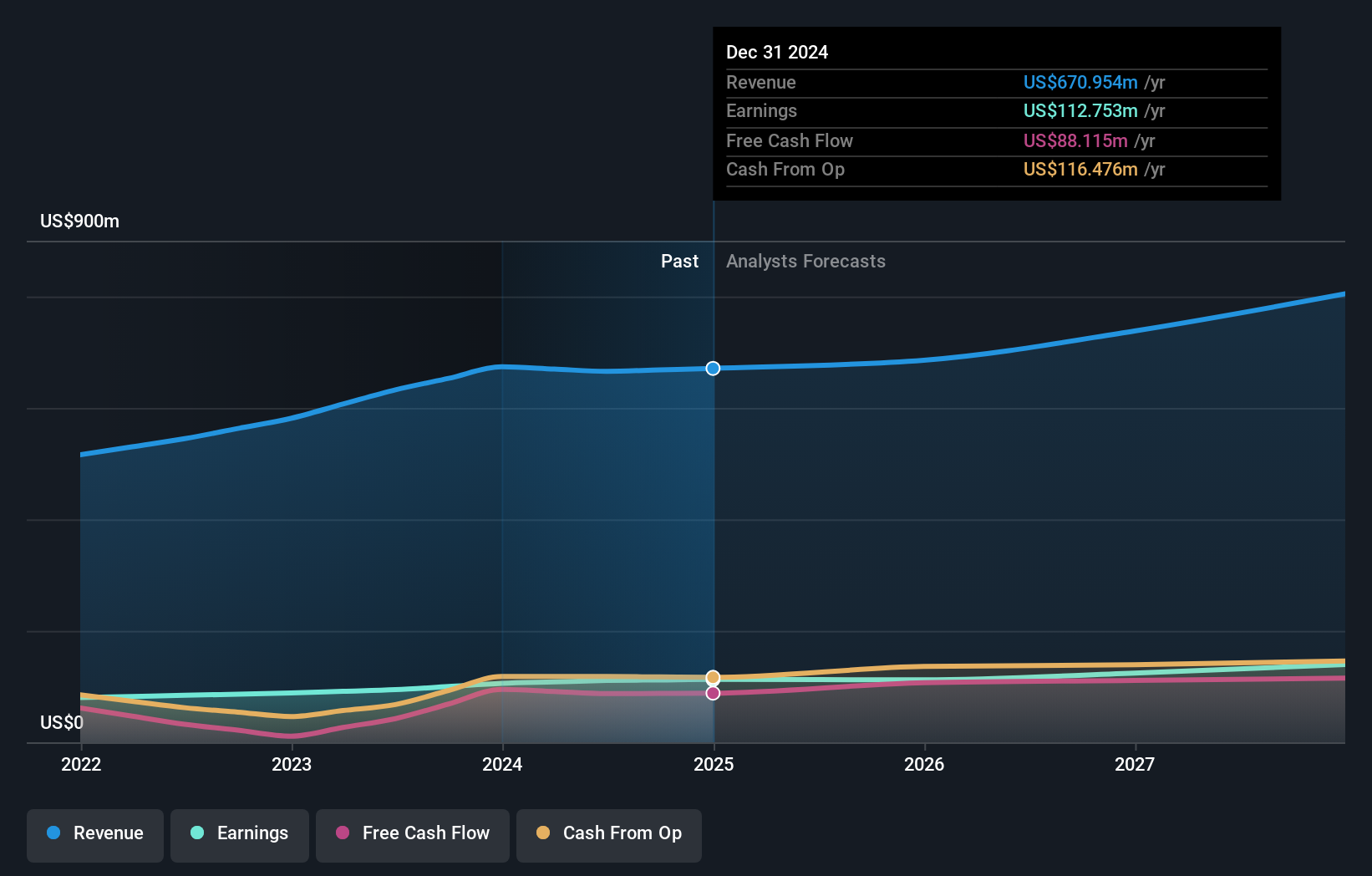

Overview: INFICON Holding AG specializes in developing instruments for gas analysis, measurement, and control, operating both in Switzerland and globally, with a market capitalization of approximately CHF 3.48 billion.

Operations: The company generates revenue primarily through its global instrumentation segment for gas analysis, measurement, and control, totaling $673.71 million.

Insider Ownership: 10.3%

INFICON Holding AG, a Swiss company with high insider ownership, demonstrates solid growth potential. In 2023, the firm reported a sales increase to US$673.71 million and net income growth to US$105.68 million. Earnings per share also rose from US$36.22 to US$43.24, reflecting a healthy profit trajectory with earnings expected to grow by 9.9% annually, outpacing the Swiss market's average of 8.1%. However, its revenue growth forecast of 7.2% yearly is modest compared to higher industry standards.

- Get an in-depth perspective on INFICON Holding's performance by reading our analyst estimates report here.

- Our valuation report here indicates INFICON Holding may be overvalued.

Sensirion Holding (SWX:SENS)

Simply Wall St Growth Rating: ★★★★☆☆

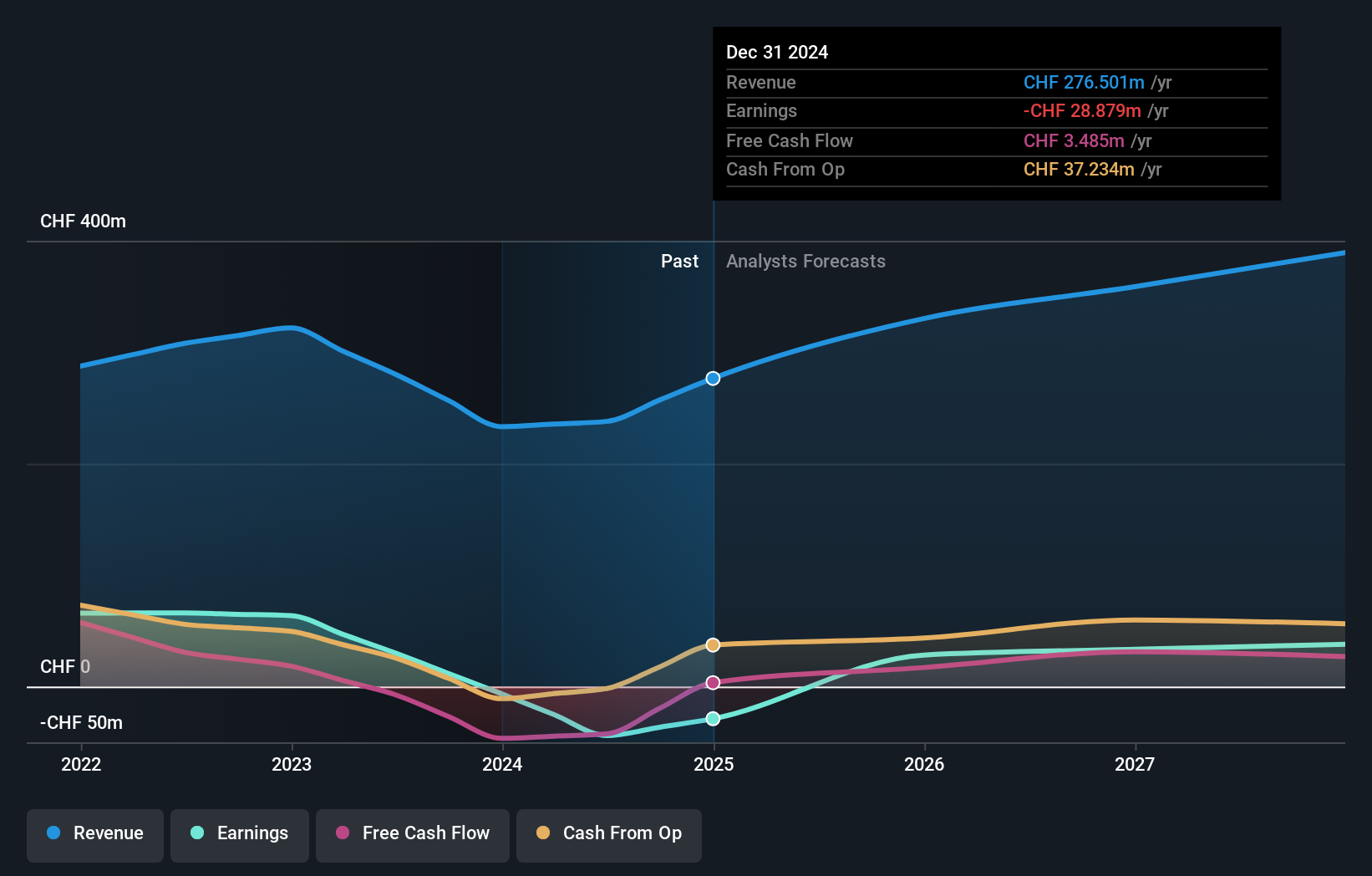

Overview: Sensirion Holding AG operates globally, specializing in the development, production, sale, and servicing of sensor systems, modules, and components with a market capitalization of CHF 1.16 billion.

Operations: The company generates CHF 233.17 million from its sensor systems, modules, and components segment.

Insider Ownership: 20.7%

Sensirion Holding, amidst a challenging financial year with sales dropping to CHF 233.17 million and a shift from net income to a loss of CHF 6.58 million, is refocusing its business towards methane emission monitoring. Despite these hurdles, its revenue is expected to grow at 13.3% annually, outpacing the Swiss market's 4.3%. The company's return on equity in three years is projected low at 10.3%, yet it aims for profitability within this period with an anticipated profit growth significantly above the market average.

- Click here to discover the nuances of Sensirion Holding with our detailed analytical future growth report.

- The valuation report we've compiled suggests that Sensirion Holding's current price could be inflated.

Temenos (SWX:TEMN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Temenos AG is a global provider of integrated banking software systems, serving banks and financial institutions, with a market capitalization of approximately CHF 4.20 billion.

Operations: The company generates its revenue by marketing and selling integrated banking software systems to financial institutions across the globe.

Insider Ownership: 17.4%

Temenos, a Swiss-based growth company with substantial insider ownership, recently showcased its commitment to innovation and sustainability. On May 15, 2024, Temenos demonstrated significant efficiency improvements in its cloud-native banking platform on Microsoft Azure. This advancement not only supports banks in achieving their sustainability goals by reducing carbon impact but also enhances operational efficiencies through more effective code and architecture. Additionally, the recent selection of Temenos by President's Choice Financial to expand into the Canadian market underscores its capability to rapidly scale banking solutions and penetrate new markets effectively. Despite these positive developments, Temenos trades at a considerable discount to fair value and maintains a stable yet unremarkable dividend yield of 2.06%.

- Navigate through the intricacies of Temenos with our comprehensive analyst estimates report here.

- According our valuation report, there's an indication that Temenos' share price might be on the cheaper side.

Seize The Opportunity

- Take a closer look at our Fast Growing SIX Swiss Exchange Companies With High Insider Ownership list of 17 companies by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:SENS

Sensirion Holding

Engages in the development, production, sale, and servicing of sensor systems, modules, and components worldwide.

Flawless balance sheet and good value.