3 European Growth Stocks With High Insider Ownership And Up To 60% Earnings Growth

Reviewed by Simply Wall St

Amid a backdrop of trade tensions and economic uncertainty, European markets have experienced declines, with major indices such as the STOXX Europe 600 Index ending lower. Despite these challenges, growth companies with high insider ownership can offer unique advantages by aligning management interests with shareholders and potentially driving robust earnings growth.

Top 10 Growth Companies With High Insider Ownership In Europe

| Name | Insider Ownership | Earnings Growth |

| Pharma Mar (BME:PHM) | 11.8% | 44.2% |

| MedinCell (ENXTPA:MEDCL) | 13.9% | 94% |

| Marinomed Biotech (WBAG:MARI) | 29.7% | 20.2% |

| KebNi (OM:KEBNI B) | 38.3% | 65% |

| Elliptic Laboratories (OB:ELABS) | 24.4% | 79% |

| CTT Systems (OM:CTT) | 17.5% | 37.9% |

| Circus (XTRA:CA1) | 24.7% | 94.8% |

| CD Projekt (WSE:CDR) | 29.7% | 39% |

| Bonesupport Holding (OM:BONEX) | 10.4% | 62.3% |

| Bergen Carbon Solutions (OB:BCS) | 12% | 63.2% |

We're going to check out a few of the best picks from our screener tool.

Absolent Air Care Group (OM:ABSO)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Absolent Air Care Group AB (publ) specializes in designing, developing, selling, installing, and maintaining air filtration units with a market cap of SEK3.06 billion.

Operations: The company's revenue is primarily derived from its Industrial segment, generating SEK1.07 billion, and its Commercial Kitchen segment, contributing SEK235.28 million.

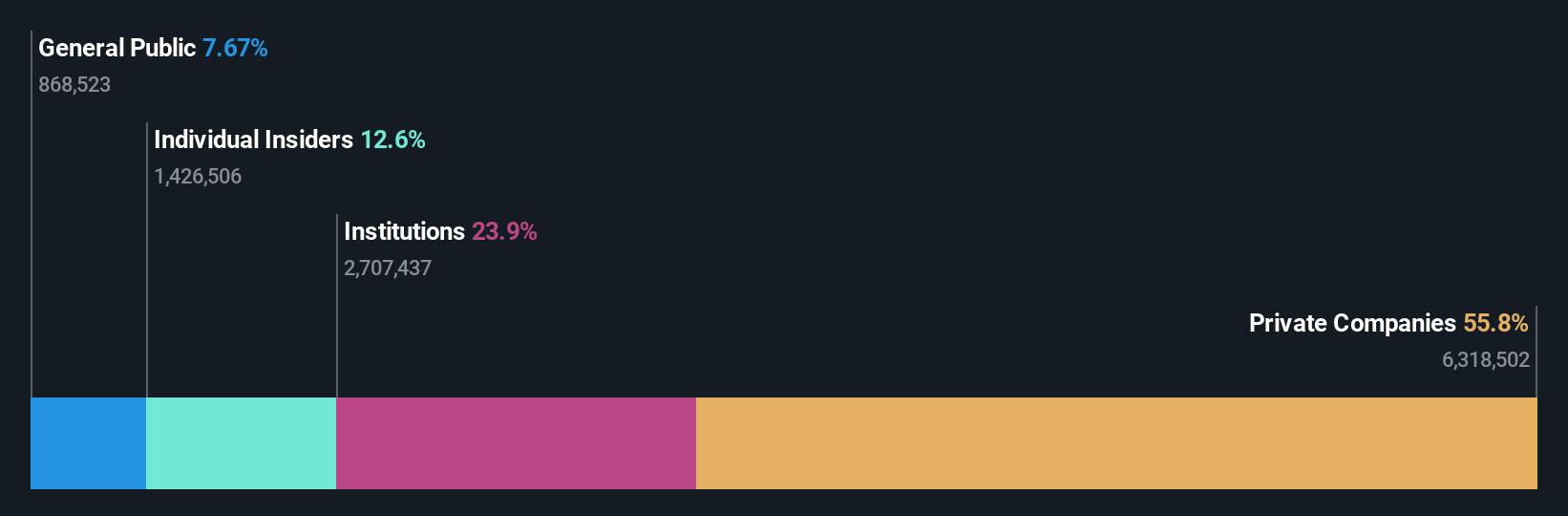

Insider Ownership: 12.6%

Earnings Growth Forecast: 40.2% p.a.

Absolent Air Care Group is trading at a significant discount to its estimated fair value, with earnings forecasted to grow substantially faster than the Swedish market. Insiders have been actively buying shares recently, indicating confidence in the company's prospects. However, recent earnings reports show a decline in sales and net income compared to last year. The company is undergoing leadership changes, with Peter Unelind set to become CEO by January 2026, bringing extensive industrial experience.

- Click here to discover the nuances of Absolent Air Care Group with our detailed analytical future growth report.

- In light of our recent valuation report, it seems possible that Absolent Air Care Group is trading beyond its estimated value.

Swedencare (OM:SECARE)

Simply Wall St Growth Rating: ★★★★☆☆

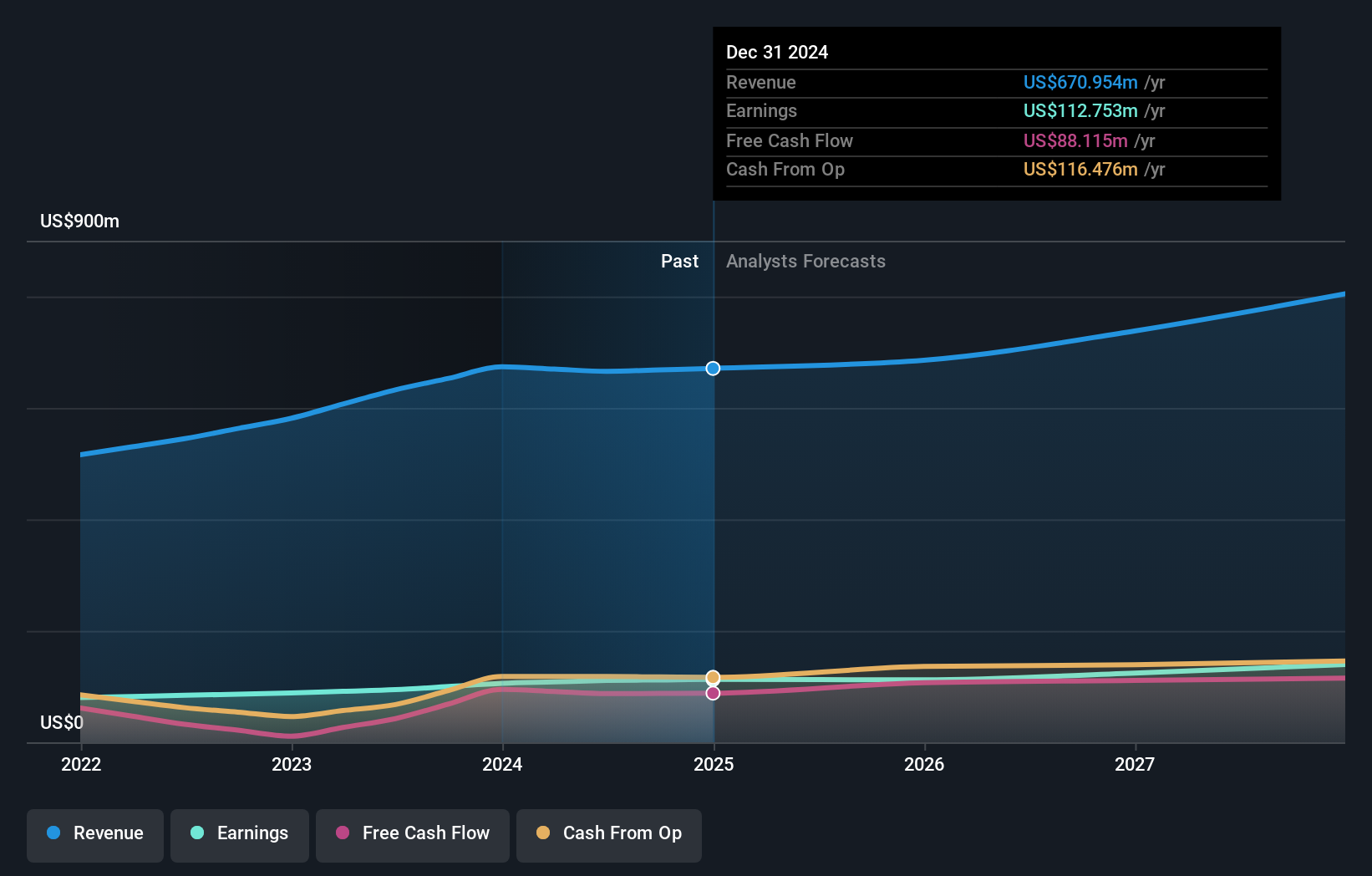

Overview: Swedencare AB (publ) and its subsidiaries develop, manufacture, market, and sell animal healthcare products for cats, dogs, and horses across North America, Europe, and other international markets with a market cap of SEK5.91 billion.

Operations: Swedencare generates revenue from several segments, including SEK557.60 million from Europe, SEK687.30 million from Production, and SEK1.59 billion from North America, while Group-Wide Functions account for a negative SEK230.40 million.

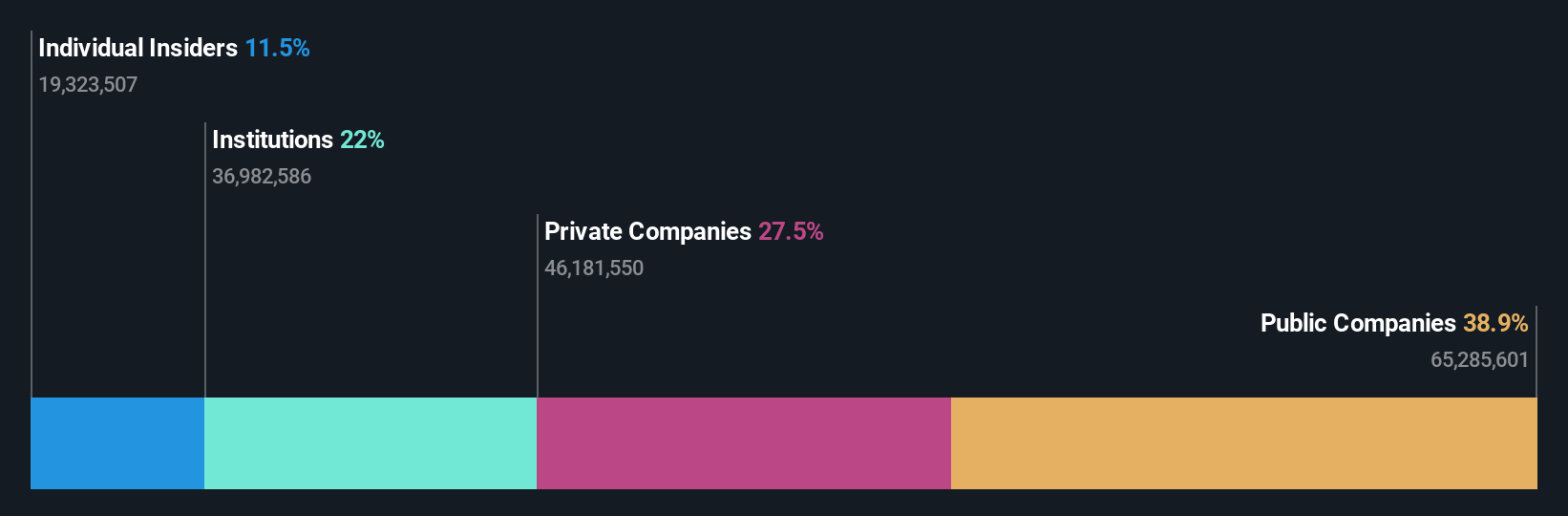

Insider Ownership: 11.5%

Earnings Growth Forecast: 60.5% p.a.

Swedencare's strong insider ownership aligns with its promising growth prospects, as earnings are projected to rise significantly above the Swedish market rate. While insider buying has occurred, it hasn't been substantial. The stock trades well below its estimated fair value, suggesting potential upside. However, recent financial results show a net loss for the quarter despite increased revenue compared to last year, highlighting challenges amidst expected revenue growth outpacing the broader market.

- Click here and access our complete growth analysis report to understand the dynamics of Swedencare.

- The analysis detailed in our Swedencare valuation report hints at an deflated share price compared to its estimated value.

INFICON Holding (SWX:IFCN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: INFICON Holding AG, with a market cap of CHF2.37 billion, develops instruments for gas analysis, measurement, and control in Switzerland and internationally.

Operations: INFICON Holding AG's revenue is derived from its development of instruments for gas analysis, measurement, and control across various international markets.

Insider Ownership: 11%

Earnings Growth Forecast: 12.2% p.a.

INFICON Holding's insider ownership supports its growth potential, with earnings forecast to grow faster than the Swiss market. Despite a lower earnings guidance for 2025, revenue is expected to exceed the market average. Recent results show a slight increase in sales but a decline in net income compared to last year. The company's price-to-earnings ratio is below the industry average, indicating potential value, while it maintains a reliable dividend payout of US$1.97%.

- Click to explore a detailed breakdown of our findings in INFICON Holding's earnings growth report.

- According our valuation report, there's an indication that INFICON Holding's share price might be on the expensive side.

Turning Ideas Into Actions

- Delve into our full catalog of 212 Fast Growing European Companies With High Insider Ownership here.

- Contemplating Other Strategies? Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:SECARE

Swedencare

Develops, manufactures, markets, and sells animal healthcare products for cats, dogs, and horses in North America, Europe, and internationally.

Reasonable growth potential and fair value.

Market Insights

Community Narratives