The Switzerland market ended on a dismal note on Friday with stocks falling lower and lower as the session progressed amid fears the U.S. could fall into a recession. The recent weak U.S. manufacturing activity report, and today's data from the Labor Department showing a much less than expected addition of jobs in the month of July, has raised concerns about growth in the world's largest economy. In this challenging environment, identifying strong small-cap stocks that can weather economic uncertainties becomes crucial for investors. Here are three undiscovered gems in Switzerland that show resilience and potential despite current market conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In Switzerland

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| APG|SGA | NA | 1.12% | -16.11% | ★★★★★★ |

| TX Group | 0.96% | -2.25% | 15.99% | ★★★★★★ |

| naturenergie holding | NA | 17.32% | 34.71% | ★★★★★★ |

| IVF Hartmann Holding | NA | 1.26% | -4.29% | ★★★★★★ |

| Datacolor | NA | 3.59% | 30.14% | ★★★★★★ |

| Burkhalter Holding | 59.92% | 17.59% | 21.59% | ★★★★★☆ |

| Compagnie Financière Tradition | 49.32% | 1.35% | 11.45% | ★★★★★☆ |

| Elma Electronic | 42.57% | 2.00% | -1.74% | ★★★★★☆ |

| Jungfraubahn Holding | 17.74% | 3.55% | 9.25% | ★★★★☆☆ |

| Bergbahnen Engelberg-Trübsee-Titlis | 3.00% | -10.81% | -16.31% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Elma Electronic (SWX:ELMN)

Simply Wall St Value Rating: ★★★★★☆

Overview: Elma Electronic AG manufactures and sells electronic packaging products for the embedded systems market worldwide, with a market cap of CHF235.35 million.

Operations: Elma Electronic AG generates revenue primarily from its Electronic Components and Parts segment, which amounted to CHF167.14 million.

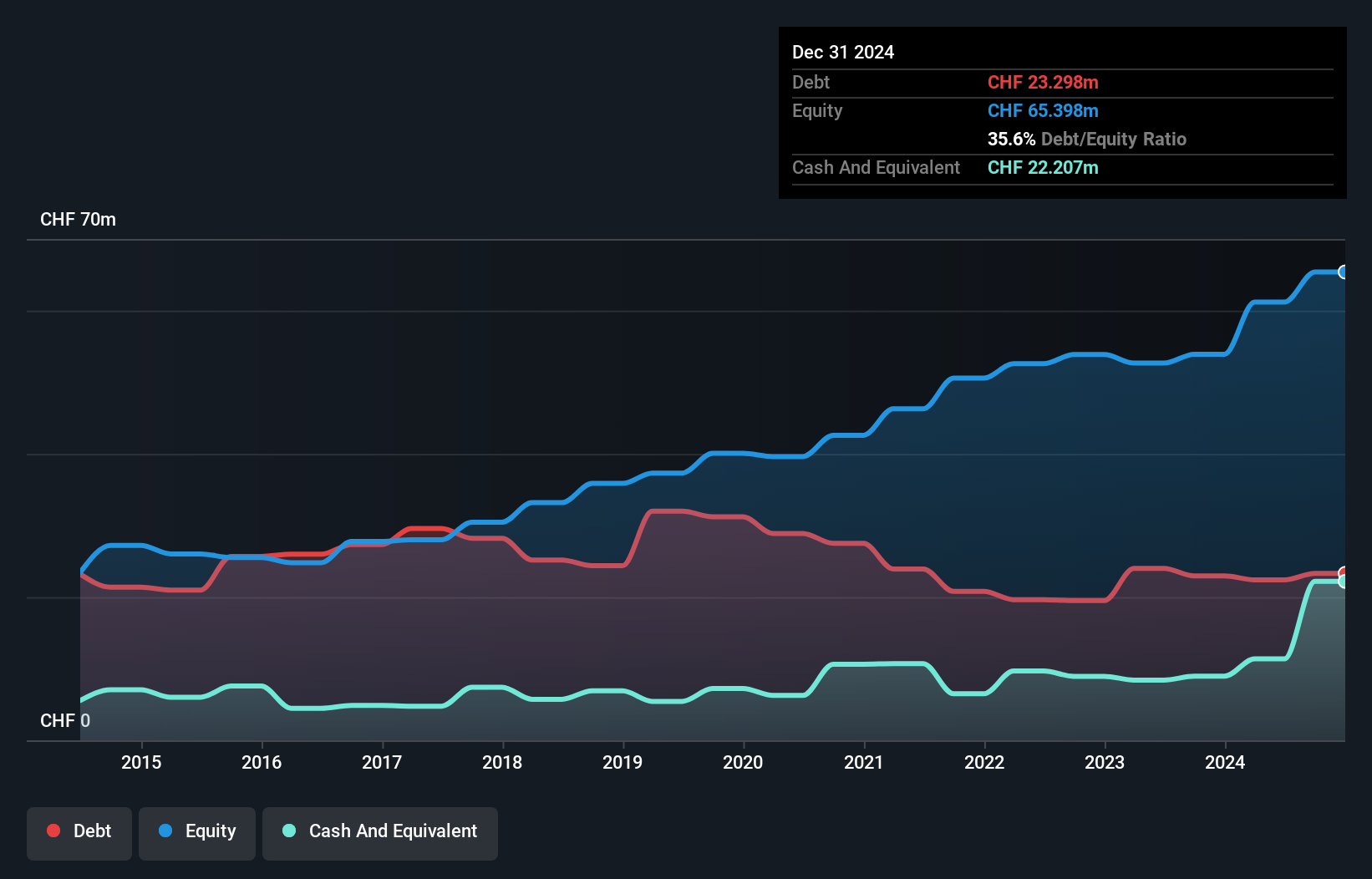

Elma Electronic's debt to equity ratio has improved significantly, dropping from 68% to 42.6% over the past five years. Despite a yearly earnings decline of 1.7%, recent performance is promising with a 20.6% earnings growth last year, outpacing the electronic industry’s -20.4%. The company’s net debt to equity ratio stands at a satisfactory 26%, and its interest payments are well covered by EBIT at a robust 17.2x coverage, highlighting strong financial health.

- Take a closer look at Elma Electronic's potential here in our health report.

Examine Elma Electronic's past performance report to understand how it has performed in the past.

IVF Hartmann Holding (SWX:VBSN)

Simply Wall St Value Rating: ★★★★★★

Overview: IVF Hartmann Holding AG, with a market cap of CHF326.28 million, specializes in providing medical consumer goods both in Switzerland and internationally.

Operations: IVF Hartmann Holding AG generates revenue primarily from Wound Care (CHF40.21 million), Infection Management (CHF54.18 million), and Incontinence Management (CHF32.11 million).

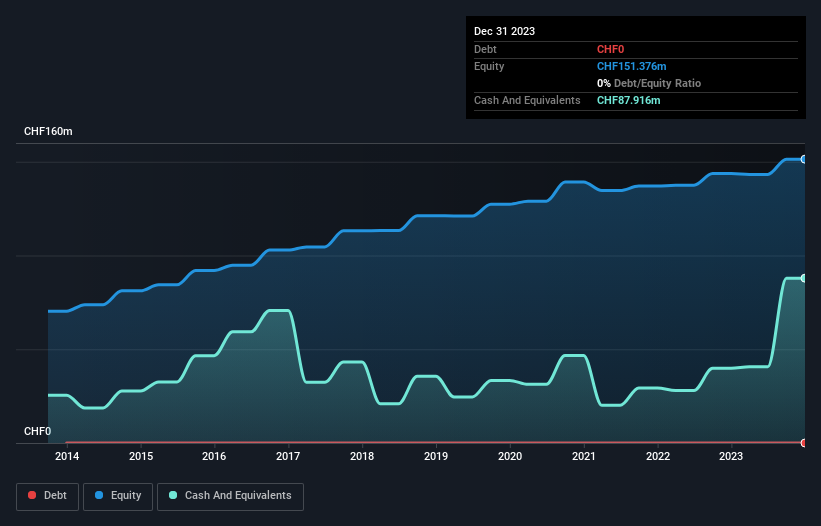

IVF Hartmann Holding, a notable player in the medical equipment sector, has seen earnings growth of 34.9% over the past year, significantly outpacing the industry average of -2.4%. With no debt for the last five years and a price-to-earnings ratio of 21.5x, it appears undervalued compared to the Swiss market's 21.7x. Despite a 4.3% annual earnings decline over five years, its high-quality earnings and positive free cash flow make it an intriguing prospect.

- Click here and access our complete health analysis report to understand the dynamics of IVF Hartmann Holding.

Explore historical data to track IVF Hartmann Holding's performance over time in our Past section.

V-ZUG Holding (SWX:VZUG)

Simply Wall St Value Rating: ★★★★★★

Overview: V-ZUG Holding AG develops, manufactures, markets, sells, and services kitchen and laundry appliances for private households in Switzerland and internationally with a market cap of CHF366.43 million.

Operations: V-ZUG Holding AG generates revenue primarily from its Household Appliances segment, which reported CHF571.35 million. The company's financial performance is influenced by this key revenue stream.

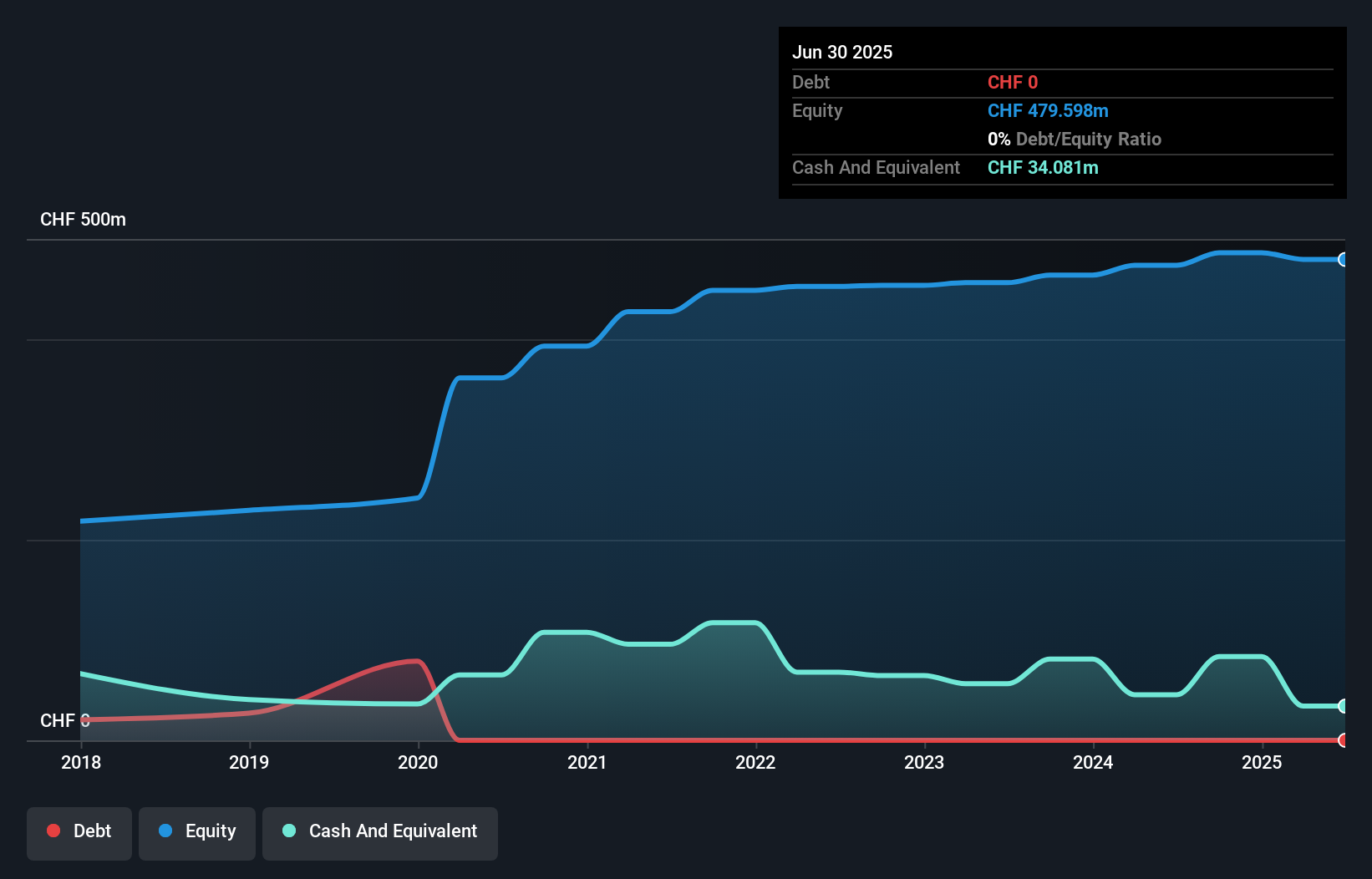

V-ZUG Holding AG has shown impressive earnings growth, with an 89.2% increase over the past year, significantly outpacing the Consumer Durables industry’s 0.2%. The company reported CHF 8.73 million in net income for the first half of 2024, up from CHF 4.33 million a year ago, and basic earnings per share rose to CHF 1.36 from CHF 0.67 last year. Notably, V-ZUG is debt-free and enjoys high-quality earnings, positioning it well for future growth.

- Get an in-depth perspective on V-ZUG Holding's performance by reading our health report here.

Gain insights into V-ZUG Holding's past trends and performance with our Past report.

Taking Advantage

- Discover the full array of 16 SIX Swiss Exchange Undiscovered Gems With Strong Fundamentals right here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Elma Electronic might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:ELMN

Elma Electronic

Manufactures and sells electronic packaging products for the embedded systems market worldwide.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives