- Switzerland

- /

- Electric Utilities

- /

- SWX:NEAG

Discovering Switzerland's Hidden Stock Gems This October 2024

Reviewed by Simply Wall St

The Switzerland market recently experienced a modest uptick, with the SMI index closing slightly higher amid cautious investor sentiment and limited market triggers. In this environment of restrained movements, identifying hidden stock gems requires a keen eye for companies that demonstrate resilience and potential amidst fluctuating conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In Switzerland

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| IVF Hartmann Holding | NA | 0.24% | 0.63% | ★★★★★★ |

| naturenergie holding | NA | 17.32% | 34.71% | ★★★★★★ |

| TX Group | 0.93% | -1.67% | 7.21% | ★★★★★★ |

| Datacolor | NA | 3.59% | 30.14% | ★★★★★★ |

| Elma Electronic | 36.60% | 3.13% | 3.10% | ★★★★★★ |

| Compagnie Financière Tradition | 47.15% | 1.91% | 11.44% | ★★★★★☆ |

| Vaudoise Assurances Holding | NA | 1.52% | 1.85% | ★★★★★☆ |

| Bergbahnen Engelberg-Trübsee-Titlis | 1.66% | -1.82% | 12.78% | ★★★★★☆ |

| Procimmo Group | 157.49% | 0.65% | 4.94% | ★★★★☆☆ |

| lastminute.com | 42.65% | 4.93% | 3.11% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Elma Electronic (SWX:ELMN)

Simply Wall St Value Rating: ★★★★★★

Overview: Elma Electronic AG is a company that manufactures and sells electronic packaging products for the embedded systems market globally, with a market capitalization of CHF239.92 million.

Operations: Elma generates revenue primarily from its Electronic Components and Parts segment, totaling CHF179.44 million.

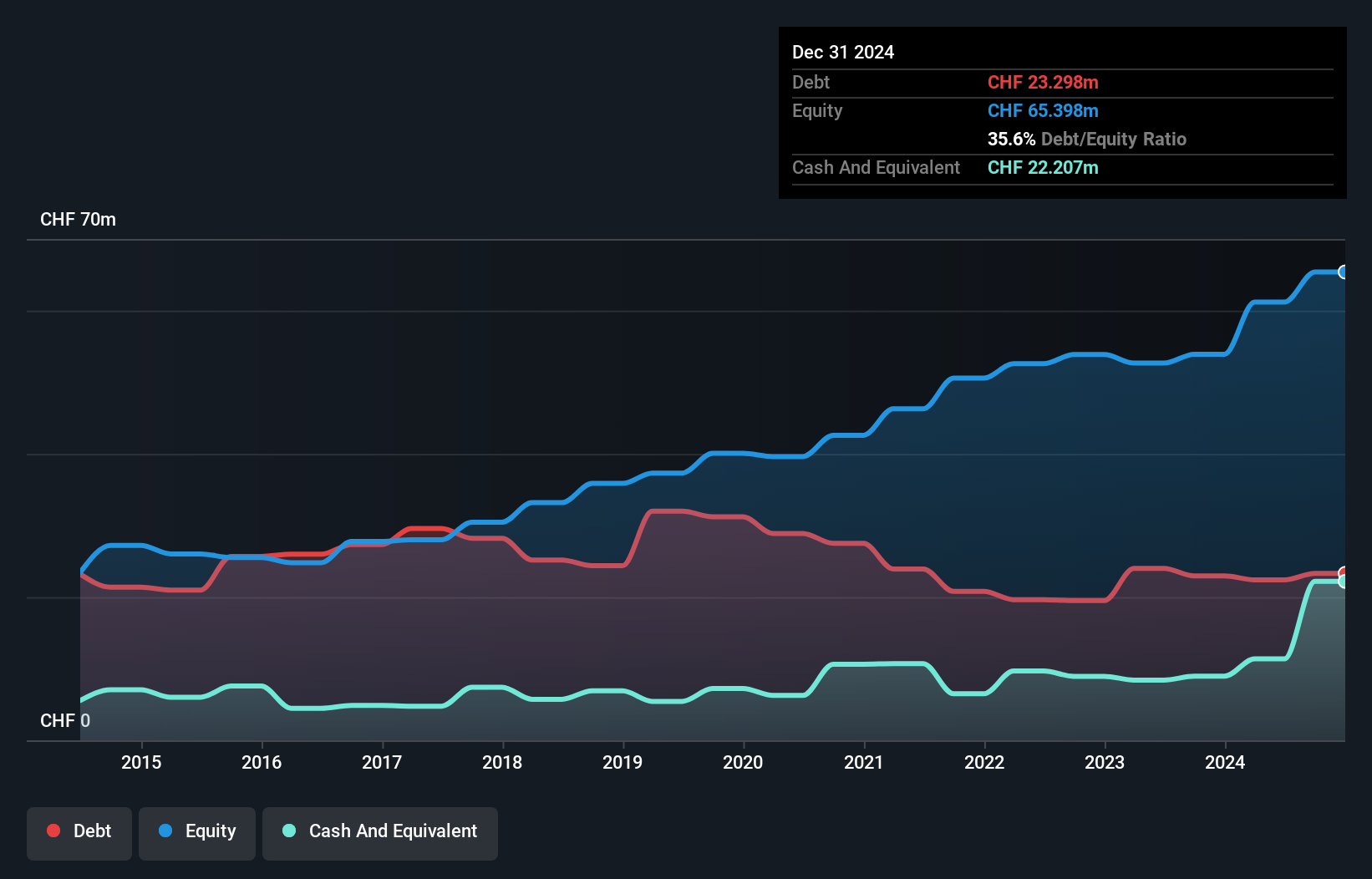

Elma Electronic, a notable player in the electronics sector, has shown impressive financial performance. Their net income for the first half of 2024 was CHF 4.51 million, a significant jump from CHF 0.56 million the previous year, with basic earnings per share rising to CHF 19.72 from CHF 2.45. The company boasts a satisfactory net debt to equity ratio of 18%, and its interest payments are well covered by EBIT at a multiple of 29.2x. With earnings growth outpacing industry norms at an impressive rate of 170.7% over the past year, Elma seems poised for continued success in its niche market segment.

- Get an in-depth perspective on Elma Electronic's performance by reading our health report here.

Understand Elma Electronic's track record by examining our Past report.

naturenergie holding (SWX:NEAG)

Simply Wall St Value Rating: ★★★★★★

Overview: Naturenergie Holding AG, with a market cap of CHF 1.25 billion, operates through its subsidiaries in the production, distribution, and sale of electricity under the naturenergie brand both in Switzerland and internationally.

Operations: Naturenergie Holding AG generates revenue primarily from Customer-Oriented Energy Solutions (€1.15 billion) and Renewable Generation Infrastructure (€1.09 billion). The company has a market cap of CHF 1.25 billion.

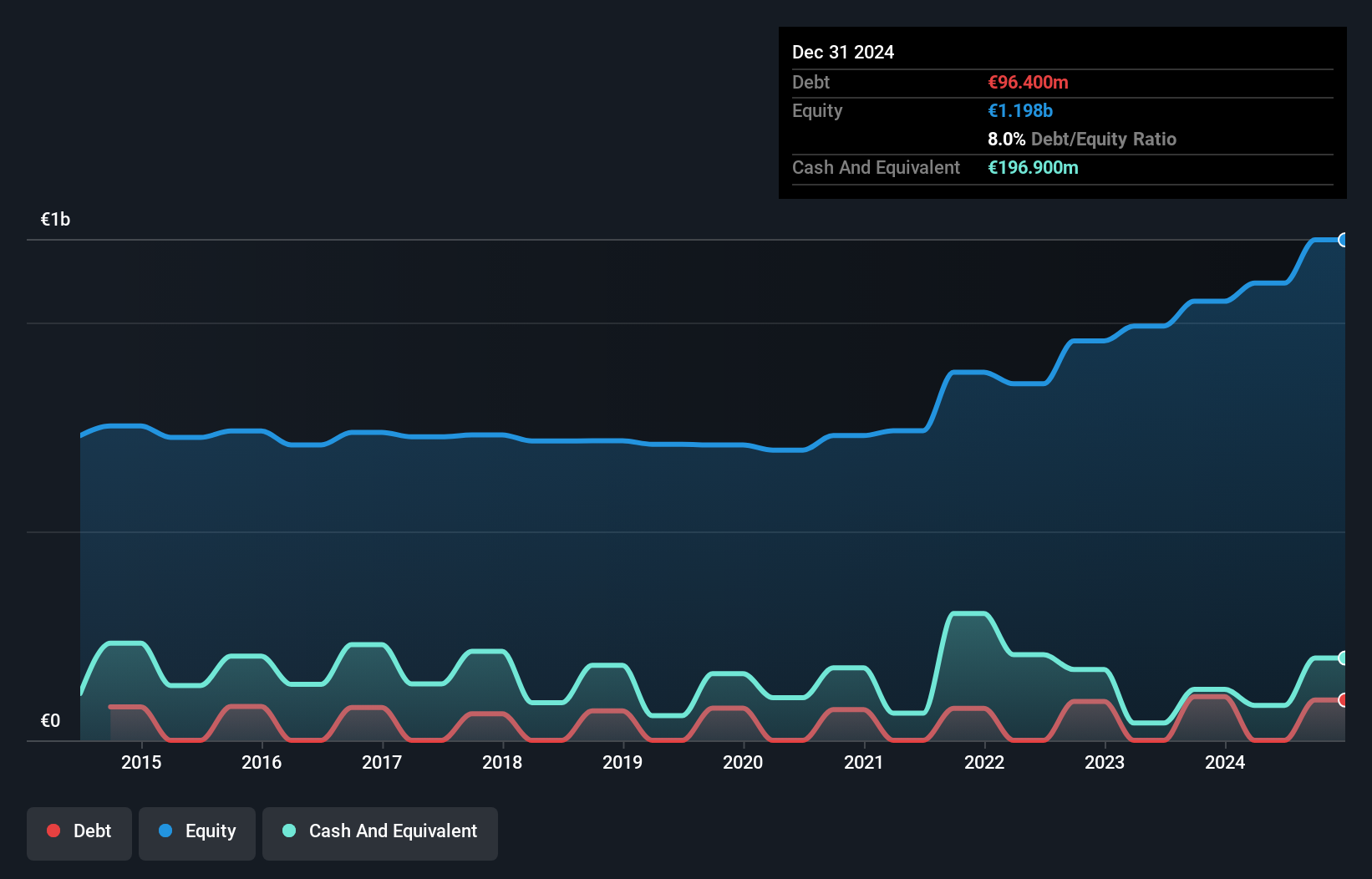

Naturenergie Holding, a small player in the Swiss energy sector, has shown impressive earnings growth of 40.5% over the past year, outpacing the Electric Utilities industry's -3.6%. With no debt on its books for five years and a P/E ratio of 11.5x compared to the Swiss market's 21.3x, it seems undervalued. The recent half-year results highlighted sales at €868.6 million and net income at €77.2 million, up from €68.5 million last year, reflecting robust profitability despite lower sales figures compared to €972.5 million previously reported.

- Take a closer look at naturenergie holding's potential here in our health report.

Explore historical data to track naturenergie holding's performance over time in our Past section.

V-ZUG Holding (SWX:VZUG)

Simply Wall St Value Rating: ★★★★★★

Overview: V-ZUG Holding AG is involved in the development, manufacture, marketing, sale, and servicing of kitchen and laundry appliances for private households both within Switzerland and internationally, with a market capitalization of CHF353.57 million.

Operations: V-ZUG generates revenue primarily from its Household Appliances segment, amounting to CHF571.35 million.

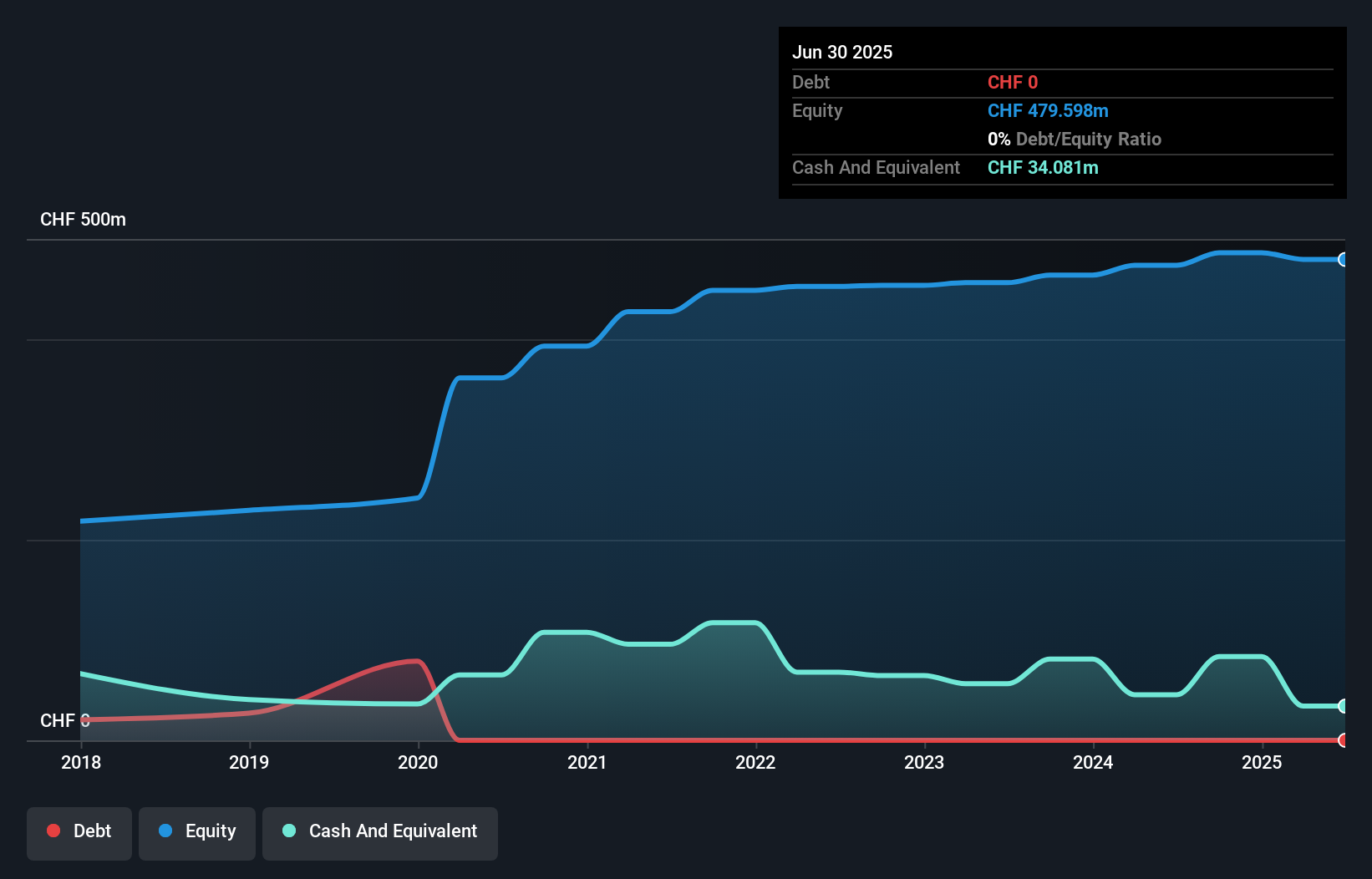

With a strong foothold in the Swiss market, V-ZUG has showcased impressive earnings growth of 89.2% over the past year, outpacing its Consumer Durables peers who saw a -2.7% shift. This debt-free company appears to offer high-quality earnings and trades at 82.1% below estimated fair value, suggesting potential undervaluation. Despite not being free cash flow positive recently, V-ZUG's lack of debt compared to five years ago when it had a 22.4% debt-to-equity ratio highlights financial prudence and positions it well for future growth prospects forecasted at 38.68% annually in an industry context that seems challenging for others.

- Click here to discover the nuances of V-ZUG Holding with our detailed analytical health report.

Gain insights into V-ZUG Holding's historical performance by reviewing our past performance report.

Key Takeaways

- Investigate our full lineup of 18 SIX Swiss Exchange Undiscovered Gems With Strong Fundamentals right here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:NEAG

naturenergie holding

Through its subsidiaries, engages in the production, distribution, and sale of electricity under the naturenergie brand in Switzerland and internationally.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives