What Is Cicor Technologies Ltd.'s (VTX:CICN) Share Price Doing?

While Cicor Technologies Ltd. (VTX:CICN) might not be the most widely known stock at the moment, it saw a double-digit share price rise of over 10% in the past couple of months on the SWX. Less-covered, small caps sees more of an opportunity for mispricing due to the lack of information available to the public, which can be a good thing. So, could the stock still be trading at a low price relative to its actual value? Let’s examine Cicor Technologies’s valuation and outlook in more detail to determine if there’s still a bargain opportunity.

Check out our latest analysis for Cicor Technologies

What's the opportunity in Cicor Technologies?

Great news for investors – Cicor Technologies is still trading at a fairly cheap price according to my price multiple model, where I compare the company's price-to-earnings ratio to the industry average. I’ve used the price-to-earnings ratio in this instance because there’s not enough visibility to forecast its cash flows. The stock’s ratio of 22.02x is currently well-below the industry average of 41.07x, meaning that it is trading at a cheaper price relative to its peers. However, given that Cicor Technologies’s share is fairly volatile (i.e. its price movements are magnified relative to the rest of the market) this could mean the price can sink lower, giving us another chance to buy in the future. This is based on its high beta, which is a good indicator for share price volatility.

Can we expect growth from Cicor Technologies?

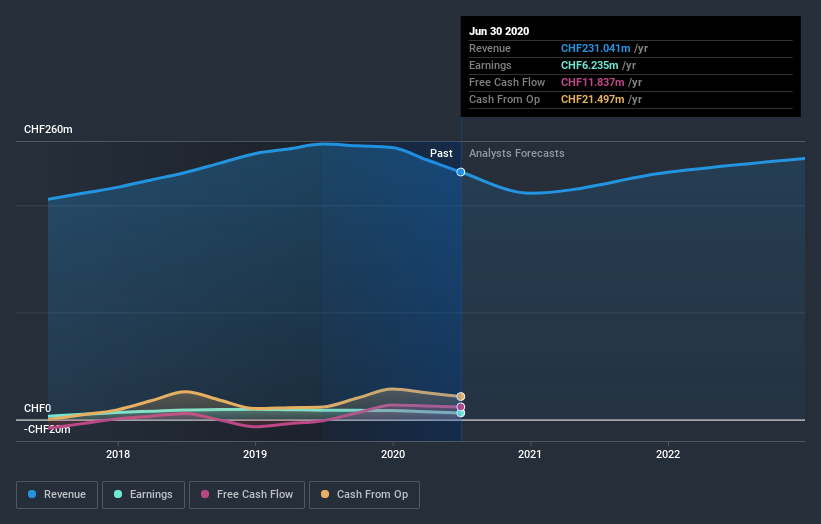

Future outlook is an important aspect when you’re looking at buying a stock, especially if you are an investor looking for growth in your portfolio. Although value investors would argue that it’s the intrinsic value relative to the price that matter the most, a more compelling investment thesis would be high growth potential at a cheap price. Though in the case of Cicor Technologies, it is expected to deliver a relatively unexciting top-line growth of 2.7% in the next few years, which doesn’t help build up its investment thesis. Growth doesn’t appear to be a main reason for a buy decision for the company, at least in the near term.

What this means for you:

Are you a shareholder? Even though growth is relatively muted, since CICN is currently trading below the industry PE ratio, it may be a great time to increase your holdings in the stock. However, there are also other factors such as capital structure to consider, which could explain the current price multiple.

Are you a potential investor? If you’ve been keeping an eye on CICN for a while, now might be the time to enter the stock. Its future outlook isn’t fully reflected in the current share price yet, which means it’s not too late to buy CICN. But before you make any investment decisions, consider other factors such as the strength of its balance sheet, in order to make a well-informed investment decision.

Keep in mind, when it comes to analysing a stock it's worth noting the risks involved. You'd be interested to know, that we found 2 warning signs for Cicor Technologies and you'll want to know about them.

If you are no longer interested in Cicor Technologies, you can use our free platform to see our list of over 50 other stocks with a high growth potential.

When trading Cicor Technologies or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SWX:CICN

Cicor Technologies

Develops, and manufactures electronic components, devices, and systems worldwide.

Undervalued with high growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion