Despite the downward trend in earnings at Cicor Technologies (VTX:CICN) the stock hikes 12%, bringing five-year gains to 28%

These days it's easy to simply buy an index fund, and your returns should (roughly) match the market. But the truth is, you can make significant gains if you buy good quality businesses at the right price. For example, the Cicor Technologies Ltd. (VTX:CICN) share price is up 19% in the last five years, slightly above the market return. Also positive is the 15% share price rise over the last year.

Since it's been a strong week for Cicor Technologies shareholders, let's have a look at trend of the longer term fundamentals.

Check out our latest analysis for Cicor Technologies

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

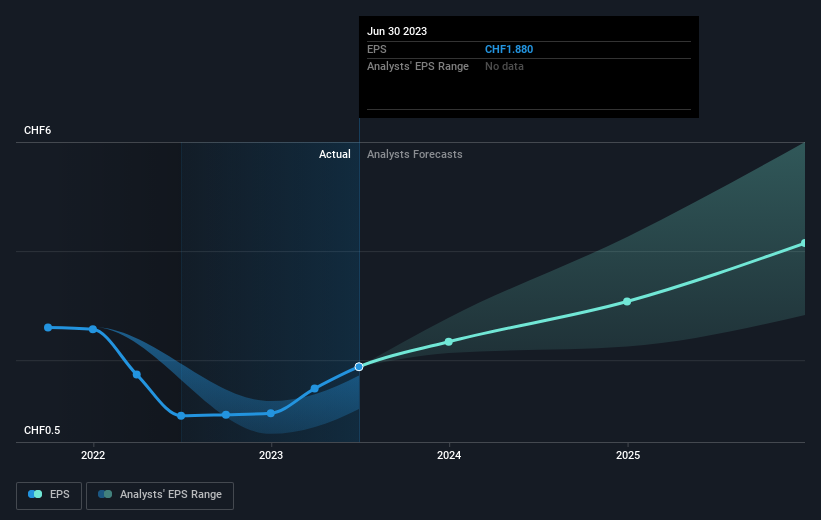

During five years of share price growth, Cicor Technologies actually saw its EPS drop 4.2% per year.

With EPS falling, but a modestly increasing share price, it seems that the market was probably too pessimistic about the stock in the past. In the long term, though, it will be hard for the share price rises to continue without improving EPS.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

We know that Cicor Technologies has improved its bottom line lately, but is it going to grow revenue? Check if analysts think Cicor Technologies will grow revenue in the future.

What About The Total Shareholder Return (TSR)?

We've already covered Cicor Technologies' share price action, but we should also mention its total shareholder return (TSR). Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Cicor Technologies' TSR of 28% for the 5 years exceeded its share price return, because it has paid dividends.

A Different Perspective

We're pleased to report that Cicor Technologies shareholders have received a total shareholder return of 15% over one year. Since the one-year TSR is better than the five-year TSR (the latter coming in at 5% per year), it would seem that the stock's performance has improved in recent times. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. It's always interesting to track share price performance over the longer term. But to understand Cicor Technologies better, we need to consider many other factors. Take risks, for example - Cicor Technologies has 1 warning sign we think you should be aware of.

But note: Cicor Technologies may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Swiss exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SWX:CICN

Cicor Technologies

Develops and manufactures electronic components, devices, and systems worldwide.

Very undervalued with reasonable growth potential.