- Switzerland

- /

- Consumer Durables

- /

- SWX:VZUG

3 Growth Companies On SIX Swiss Exchange With Insider Ownership Growing Earnings Up To 38%

Reviewed by Simply Wall St

The Swiss market recently experienced a slight downturn, with the SMI index closing marginally lower amid mixed economic signals, including a rise in unemployment rates and positive U.S. jobs data that helped cushion the decline. In such fluctuating conditions, companies on the SIX Swiss Exchange with strong insider ownership and robust earnings growth potential can offer investors insights into firms where management is confident about future prospects.

Top 10 Growth Companies With High Insider Ownership In Switzerland

| Name | Insider Ownership | Earnings Growth |

| Stadler Rail (SWX:SRAIL) | 14.5% | 24.1% |

| VAT Group (SWX:VACN) | 10.2% | 22.5% |

| Addex Therapeutics (SWX:ADXN) | 19% | 33.3% |

| Straumann Holding (SWX:STMN) | 32.7% | 21.8% |

| LEM Holding (SWX:LEHN) | 29.9% | 18.4% |

| Swissquote Group Holding (SWX:SQN) | 11.4% | 12.6% |

| Temenos (SWX:TEMN) | 21.8% | 14.4% |

| HOCHDORF Holding (SWX:HOCN) | 14.6% | 122.2% |

| Sensirion Holding (SWX:SENS) | 19.9% | 102.7% |

| Kudelski (SWX:KUD) | 37.5% | 121.7% |

Let's take a closer look at a couple of our picks from the screened companies.

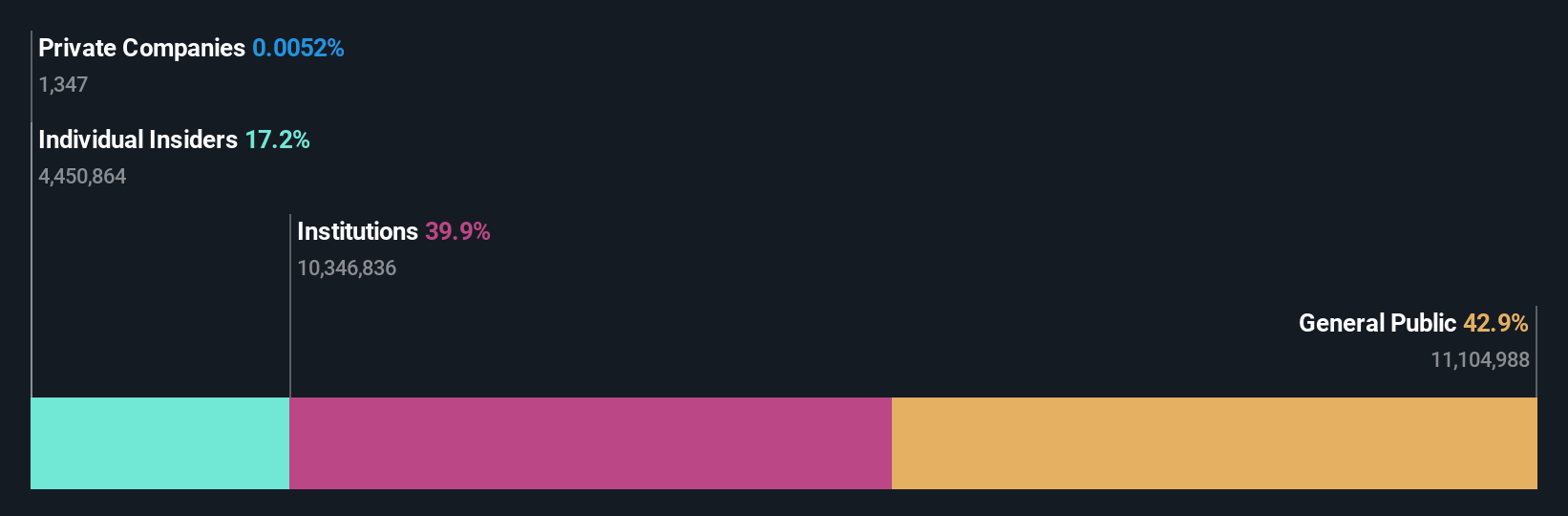

Partners Group Holding (SWX:PGHN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Partners Group Holding AG is a private equity firm that focuses on direct, secondary, and primary investments in private equity, real estate, infrastructure, and debt with a market cap of CHF33.25 billion.

Operations: The company's revenue is derived from segments including Private Equity at CHF1.19 billion, Infrastructure at CHF254.90 million, Private Credit at CHF218.90 million, and Real Estate at CHF190.90 million.

Insider Ownership: 17%

Earnings Growth Forecast: 14.5% p.a.

Partners Group Holding exhibits strong growth potential with earnings forecasted to grow at 14.5% annually, surpassing the Swiss market's 11.7%. Despite a high debt level, its return on equity is projected to be very high at 51.1% in three years. Recent participation in M&A discussions highlights strategic expansion efforts, although recent earnings showed a slight decline with net income of CHF 508 million for H1 2024. The dividend yield of 3.06% lacks robust coverage by earnings or cash flows.

- Click here to discover the nuances of Partners Group Holding with our detailed analytical future growth report.

- Our valuation report here indicates Partners Group Holding may be overvalued.

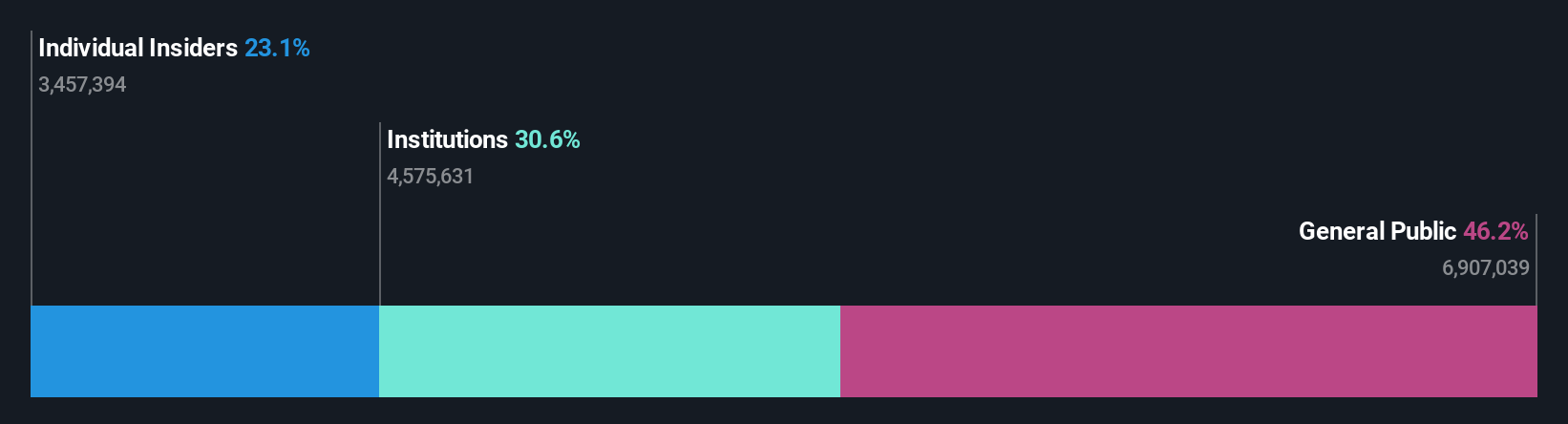

Swissquote Group Holding (SWX:SQN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Swissquote Group Holding Ltd offers a range of online financial services to retail, affluent, and professional investors globally, with a market cap of CHF4.51 billion.

Operations: The company generates revenue from two main segments: Leveraged Forex, contributing CHF93.28 million, and Securities Trading, accounting for CHF488.98 million.

Insider Ownership: 11.4%

Earnings Growth Forecast: 12.6% p.a.

Swissquote Group Holding demonstrates growth potential, trading significantly below its fair value estimate. Recent earnings show net income of CHF 144.56 million for H1 2024, up from CHF 106.53 million a year ago, with basic EPS rising to CHF 9.69. Although insider activity is limited in the past three months, the company’s earnings and revenue are expected to grow faster than the Swiss market at rates of 12.6% and 11.1% per year respectively.

- Delve into the full analysis future growth report here for a deeper understanding of Swissquote Group Holding.

- Upon reviewing our latest valuation report, Swissquote Group Holding's share price might be too pessimistic.

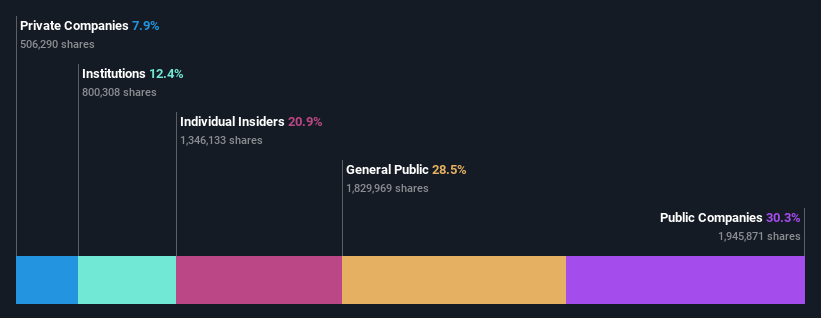

V-ZUG Holding (SWX:VZUG)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: V-ZUG Holding AG is involved in the development, manufacture, marketing, sale, and servicing of kitchen and laundry appliances for private households both in Switzerland and internationally, with a market cap of CHF348.43 million.

Operations: The company's revenue primarily comes from its Household Appliances segment, which generated CHF571.35 million.

Insider Ownership: 20.9%

Earnings Growth Forecast: 38.7% p.a.

V-ZUG Holding is trading significantly below its estimated fair value, with earnings expected to grow substantially at 38.7% annually over the next three years, outpacing the Swiss market's growth rate. While recent earnings for H1 2024 showed a rise in net income to CHF 8.73 million from CHF 4.33 million last year, sales decreased slightly to CHF 284.08 million. Despite low forecasted return on equity, V-ZUG's revenue growth is anticipated to exceed the market average modestly.

- Get an in-depth perspective on V-ZUG Holding's performance by reading our analyst estimates report here.

- Insights from our recent valuation report point to the potential undervaluation of V-ZUG Holding shares in the market.

Summing It All Up

- Click through to start exploring the rest of the 10 Fast Growing SIX Swiss Exchange Companies With High Insider Ownership now.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:VZUG

V-ZUG Holding

Engages in development, manufacture, marketing, sale, and services of kitchen and laundry appliances for private households in Switzerland and internationally.

Flawless balance sheet and good value.