- Switzerland

- /

- Electrical

- /

- SWX:PMN

Exploring Undiscovered Gems in Switzerland This October 2024

Reviewed by Simply Wall St

As the Swiss market navigates a period of marginal fluctuations, with the SMI index slightly down amid mixed economic signals such as rising unemployment and positive U.S. jobs data, investors are keenly observing small-cap opportunities that might offer resilience and growth potential. In this context, identifying stocks that can withstand broader market pressures while capitalizing on niche strengths becomes crucial for uncovering hidden gems in Switzerland's dynamic landscape.

Top 10 Undiscovered Gems With Strong Fundamentals In Switzerland

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| IVF Hartmann Holding | NA | 0.24% | 0.63% | ★★★★★★ |

| TX Group | 0.93% | -1.67% | 7.21% | ★★★★★★ |

| naturenergie holding | NA | 17.32% | 34.71% | ★★★★★★ |

| Datacolor | NA | 3.59% | 30.14% | ★★★★★★ |

| Elma Electronic | 36.60% | 3.13% | 3.10% | ★★★★★★ |

| Compagnie Financière Tradition | 47.15% | 1.91% | 11.44% | ★★★★★☆ |

| Vaudoise Assurances Holding | NA | 1.52% | 1.85% | ★★★★★☆ |

| Procimmo Group | 157.49% | 0.65% | 4.94% | ★★★★☆☆ |

| lastminute.com | 42.65% | 4.93% | 3.11% | ★★★★☆☆ |

| Bergbahnen Engelberg-Trübsee-Titlis | 3.00% | -10.81% | -16.31% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

naturenergie holding (SWX:NEAG)

Simply Wall St Value Rating: ★★★★★★

Overview: Naturenergie Holding AG, with a market cap of CHF1.28 billion, operates through its subsidiaries to produce, distribute, and sell electricity under the naturenergie brand in Switzerland and internationally.

Operations: Naturenergie generates revenue primarily from Customer-Oriented Energy Solutions (€1.15 billion) and Renewable Generation Infrastructure (€1.09 billion). The System Relevant Infrastructure segment contributes €403.50 million to the total revenue stream.

Naturenergie holding AG, a Swiss energy player, showcases robust financials with earnings growth of 40.5% over the past year, far outpacing the Electric Utilities industry at -1%. The company is debt-free and boasts high-quality earnings, reflecting stability. Despite sales dipping to €868.6 million from €972.5 million last year, net income climbed to €77.2 million from €68.5 million, suggesting operational efficiency improvements. Its price-to-earnings ratio of 11.7x signals potential undervaluation compared to the Swiss market average of 21.3x.

Phoenix Mecano (SWX:PMN)

Simply Wall St Value Rating: ★★★★★★

Overview: Phoenix Mecano AG, with a market cap of CHF452.69 million, manufactures and sells components for industrial customers globally through its various subsidiaries.

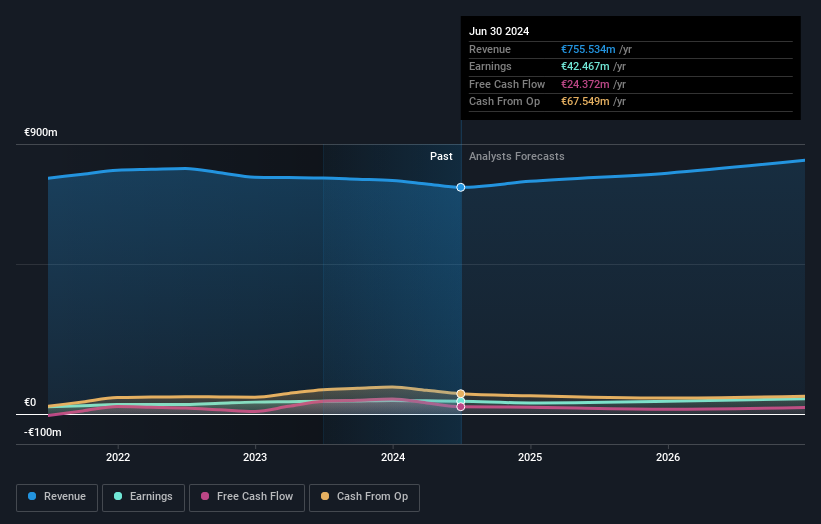

Operations: Phoenix Mecano AG generates revenue primarily through its Dewertokin Technology Group (€348.00 million), Enclosure Systems (€218.16 million), and Industrial Components (€197.28 million) segments.

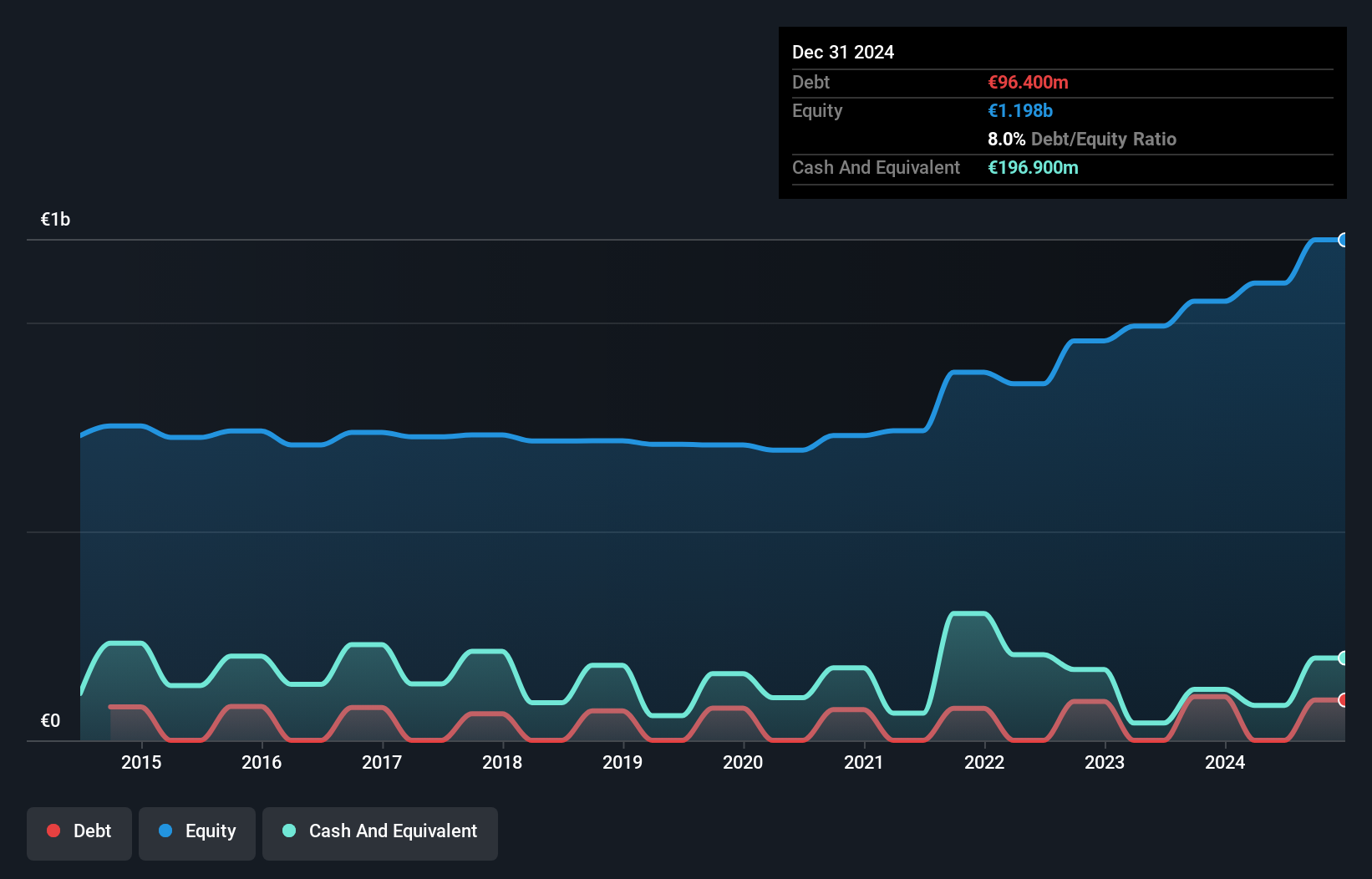

Phoenix Mecano, a noteworthy player in Switzerland's industrial landscape, showcases resilience despite recent challenges. Its earnings grew by 0.7% over the past year, outpacing the Electrical industry’s -11.1%. The firm’s debt to equity ratio has improved from 62.6% to 44.8% in five years, with interest payments well covered at 28.8x EBIT. While sales dipped to €382.8M from €405.7M last year, its P/E ratio of 11.3x suggests attractive valuation relative to the Swiss market average of 21.3x.

- Unlock comprehensive insights into our analysis of Phoenix Mecano stock in this health report.

Gain insights into Phoenix Mecano's historical performance by reviewing our past performance report.

TX Group (SWX:TXGN)

Simply Wall St Value Rating: ★★★★★★

Overview: TX Group AG operates a network of platforms and participations offering information, orientation, entertainment, and support services in Switzerland with a market cap of CHF1.51 billion.

Operations: TX Group AG's revenue is primarily derived from segments such as Tamedia (CHF 427 million) and Goldbach (CHF 299.10 million). The company also generates income from 20 Minutes, TX Markets, and Groups & Ventures. Notably, the net profit margin shows variability across reporting periods.

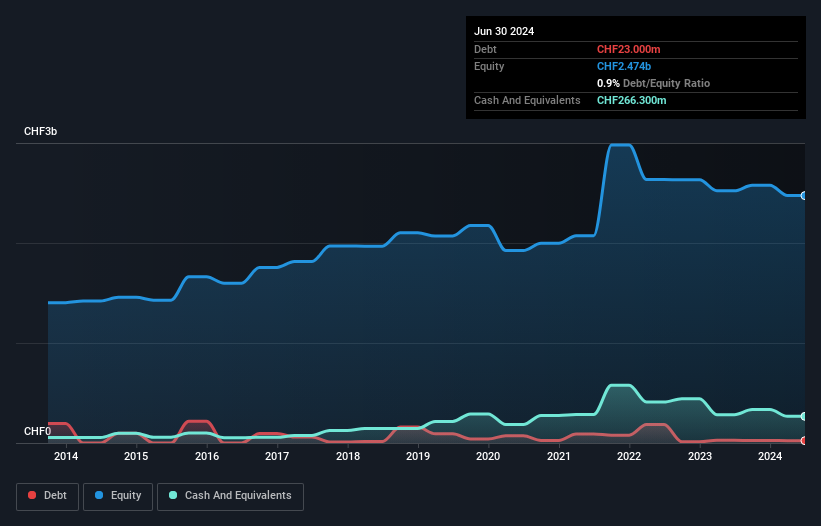

TX Group, a notable player in the Swiss market, has seen significant financial improvements recently. The company's debt to equity ratio dropped from 4.4% to 0.9% over five years, indicating stronger financial health. It reported a net income of CHF 9.6 million for the first half of 2024, compared to a loss of CHF 1.4 million last year, with earnings per share rising to CHF 0.9 from a loss per share of CHF 0.13 previously. Trading at about two-thirds below its estimated fair value and added to the S&P Global BMI Index in September, TX Group seems poised for continued profitability with forecasted earnings growth of over thirty percent annually.

- Navigate through the intricacies of TX Group with our comprehensive health report here.

Assess TX Group's past performance with our detailed historical performance reports.

Make It Happen

- Navigate through the entire inventory of 18 SIX Swiss Exchange Undiscovered Gems With Strong Fundamentals here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:PMN

Phoenix Mecano

Manufactures and sells components for industrial customers worldwide.

Flawless balance sheet with proven track record and pays a dividend.