Cicor Technologies Ltd.'s (VTX:CICN) Stock Is Going Strong: Is the Market Following Fundamentals?

Most readers would already be aware that Cicor Technologies' (VTX:CICN) stock increased significantly by 14% over the past three months. Given that the market rewards strong financials in the long-term, we wonder if that is the case in this instance. In this article, we decided to focus on Cicor Technologies' ROE.

Return on Equity or ROE is a test of how effectively a company is growing its value and managing investors’ money. Put another way, it reveals the company's success at turning shareholder investments into profits.

View our latest analysis for Cicor Technologies

How To Calculate Return On Equity?

The formula for return on equity is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Cicor Technologies is:

8.4% = CHF6.2m ÷ CHF74m (Based on the trailing twelve months to June 2020).

The 'return' is the income the business earned over the last year. That means that for every CHF1 worth of shareholders' equity, the company generated CHF0.08 in profit.

Why Is ROE Important For Earnings Growth?

We have already established that ROE serves as an efficient profit-generating gauge for a company's future earnings. Depending on how much of these profits the company reinvests or "retains", and how effectively it does so, we are then able to assess a company’s earnings growth potential. Assuming everything else remains unchanged, the higher the ROE and profit retention, the higher the growth rate of a company compared to companies that don't necessarily bear these characteristics.

Cicor Technologies' Earnings Growth And 8.4% ROE

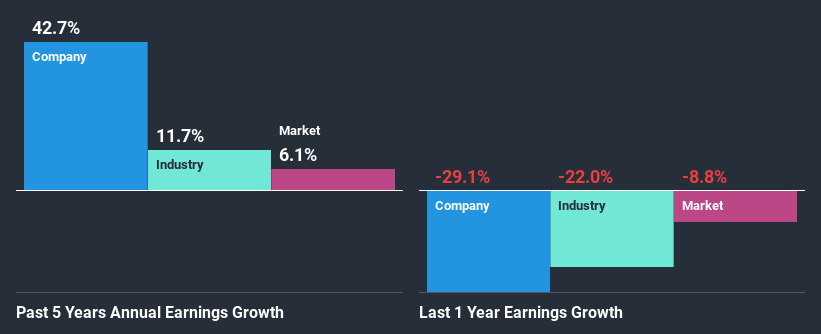

To start with, Cicor Technologies' ROE looks acceptable. Be that as it may, the company's ROE is still quite lower than the industry average of 11%. Still, we can see that Cicor Technologies has seen a remarkable net income growth of 43% over the past five years. We reckon that there could be other factors at play here. For example, it is possible that the company's management has made some good strategic decisions, or that the company has a low payout ratio. Bear in mind, the company does have a respectable ROE. It is just that the industry ROE is higher. So this also does lend some color to the high earnings growth seen by the company.

As a next step, we compared Cicor Technologies' net income growth with the industry, and pleasingly, we found that the growth seen by the company is higher than the average industry growth of 12%.

Earnings growth is an important metric to consider when valuing a stock. It’s important for an investor to know whether the market has priced in the company's expected earnings growth (or decline). Doing so will help them establish if the stock's future looks promising or ominous. One good indicator of expected earnings growth is the P/E ratio which determines the price the market is willing to pay for a stock based on its earnings prospects. So, you may want to check if Cicor Technologies is trading on a high P/E or a low P/E, relative to its industry.

Is Cicor Technologies Making Efficient Use Of Its Profits?

Cicor Technologies has a three-year median payout ratio of 31% (where it is retaining 69% of its income) which is not too low or not too high. By the looks of it, the dividend is well covered and Cicor Technologies is reinvesting its profits efficiently as evidenced by its exceptional growth which we discussed above.

Moreover, Cicor Technologies is determined to keep sharing its profits with shareholders which we infer from its long history of eight years of paying a dividend. Our latest analyst data shows that the future payout ratio of the company over the next three years is expected to be approximately 35%. Regardless, the future ROE for Cicor Technologies is predicted to rise to 10% despite there being not much change expected in its payout ratio.

Summary

In total, we are pretty happy with Cicor Technologies' performance. Particularly, we like that the company is reinvesting heavily into its business at a moderate rate of return. Unsurprisingly, this has led to an impressive earnings growth. If the company continues to grow its earnings the way it has, that could have a positive impact on its share price given how earnings per share influence long-term share prices. Not to forget, share price outcomes are also dependent on the potential risks a company may face. So it is important for investors to be aware of the risks involved in the business. Our risks dashboard would have the 2 risks we have identified for Cicor Technologies.

When trading Cicor Technologies or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SWX:CICN

Cicor Technologies

Develops, and manufactures electronic components, devices, and systems worldwide.

High growth potential with solid track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion