Cicor Technologies Ltd. (VTX:CICN) Is Yielding 2.1% - But Is It A Buy?

Dividend paying stocks like Cicor Technologies Ltd. (VTX:CICN) tend to be popular with investors, and for good reason - some research suggests a significant amount of all stock market returns come from reinvested dividends. If you are hoping to live on your dividends, it's important to be more stringent with your investments than the average punter. Regular readers know we like to apply the same approach to each dividend stock, and we hope you'll find our analysis useful.

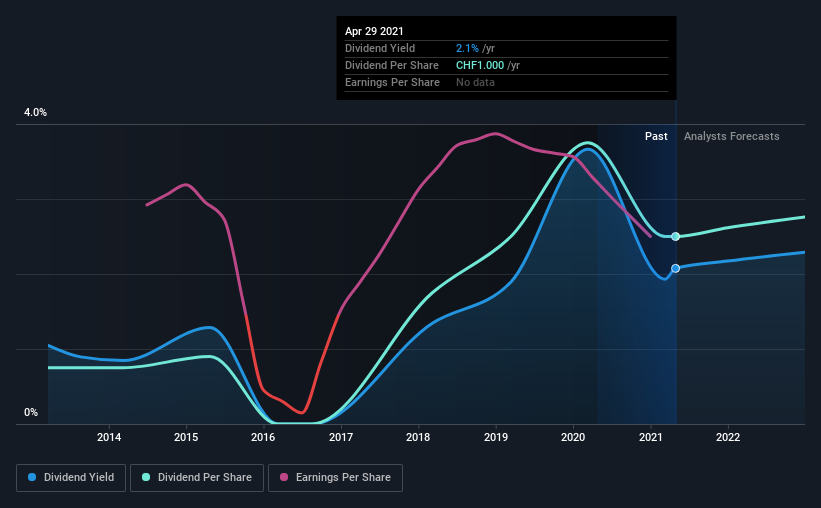

Investors might not know much about Cicor Technologies's dividend prospects, even though it has been paying dividends for the last eight years and offers a 2.1% yield. While the yield may not look too great, the relatively long payment history is interesting. There are a few simple ways to reduce the risks of buying Cicor Technologies for its dividend, and we'll go through these below.

Click the interactive chart for our full dividend analysis

Payout ratios

Companies (usually) pay dividends out of their earnings. If a company is paying more than it earns, the dividend might have to be cut. As a result, we should always investigate whether a company can afford its dividend, measured as a percentage of a company's net income after tax. In the last year, Cicor Technologies paid out 69% of its profit as dividends. This is a healthy payout ratio, and while it does limit the amount of earnings that can be reinvested in the business, there is also some room to lift the payout ratio over time.

Another important check we do is to see if the free cash flow generated is sufficient to pay the dividend. The company paid out 61% of its free cash flow, which is not bad per se, but does start to limit the amount of cash Cicor Technologies has available to meet other needs. It's encouraging to see that the dividend is covered by both profit and cash flow. This generally suggests the dividend is sustainable, as long as earnings don't drop precipitously.

We update our data on Cicor Technologies every 24 hours, so you can always get our latest analysis of its financial health, here.

Dividend Volatility

One of the major risks of relying on dividend income, is the potential for a company to struggle financially and cut its dividend. Not only is your income cut, but the value of your investment declines as well - nasty. Looking at the last decade of data, we can see that Cicor Technologies paid its first dividend at least eight years ago. Although it has been paying a dividend for several years now, the dividend has been cut at least once, and we're cautious about the consistency of its dividend across a full economic cycle. During the past eight-year period, the first annual payment was CHF0.3 in 2013, compared to CHF1.0 last year. Dividends per share have grown at approximately 16% per year over this time. The dividends haven't grown at precisely 16% every year, but this is a useful way to average out the historical rate of growth.

It's not great to see that the payment has been cut in the past. We're generally more wary of companies that have cut their dividend before, as they tend to perform worse in an economic downturn.

Dividend Growth Potential

With a relatively unstable dividend, it's even more important to evaluate if earnings per share (EPS) are growing - it's not worth taking the risk on a dividend getting cut, unless you might be rewarded with larger dividends in future. It's good to see Cicor Technologies has been growing its earnings per share at 39% a year over the past five years. Earnings per share are sharply up, but we wonder if paying out more than half its earnings (leaving less for reinvestment) is an implicit signal that Cicor Technologies' growth will be slower in the future.

Conclusion

To summarise, shareholders should always check that Cicor Technologies' dividends are affordable, that its dividend payments are relatively stable, and that it has decent prospects for growing its earnings and dividend. First, we think Cicor Technologies is paying out an acceptable percentage of its cashflow and profit. We were also glad to see it growing earnings, but it was concerning to see the dividend has been cut at least once in the past. Ultimately, Cicor Technologies comes up short on our dividend analysis. It's not that we think it is a bad company - just that there are likely more appealing dividend prospects out there on this analysis.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. For instance, we've picked out 3 warning signs for Cicor Technologies that investors should take into consideration.

We have also put together a list of global stocks with a market capitalisation above $1bn and yielding more 3%.

If you decide to trade Cicor Technologies, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SWX:CICN

Cicor Technologies

Develops, and manufactures electronic components, devices, and systems worldwide.

High growth potential with solid track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion